|

|

|

|

|||||

|

|

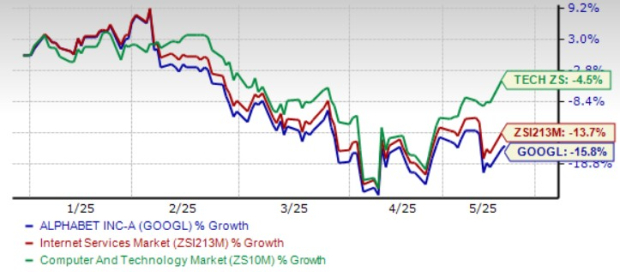

Alphabet GOOGL shares have dropped 15.8% year to date (YTD), underperforming the broader Zacks Computer & Technology sector’s fall of 4.5%. The decline can be attributed to challenging macroeconomic conditions, moderating cloud growth, higher investments in developing cloud infrastructure and increasing regulatory headwinds.

GOOGL is suffering from a lack of capacity, and until new capacity comes online this year, cloud revenues are expected to witness increased variability. The company expects to invest roughly $75 billion in capital expenditures in 2025, which is aimed at building up technical infrastructure, primarily for servers, followed by data centers and networking. Alphabet expects advertising revenue growth to be lower due to a challenging year-over-year comparison. The company enjoyed solid growth in the financial services vertical in 2024.

Regulatory headwinds like the lawsuit between the Department of Justice (DOJ) and GOOGL over Google Search are a concern. The DOJ argues that Google has inked anticompetitive deals with Apple and other companies for prime placement of its search engine and plans to break up Google to separate products like Chrome, Search, and Android. DOJ’s proposal doesn’t bode well for Alphabet, given growing competition from AI-powered products like ChatGPT, Grok, DeepSeek, Perplexity and Meta AI.

Nevertheless, Alphabet’s focus on leveraging artificial intelligence (AI) to drive growth is a key catalyst. AI is infused heavily across its offerings, including Search and Google Cloud, driving top-line growth. Will AI focus drive Alphabet’s prospects this year? Let’s dig deep to find out.

At its Cloud Next 2025 conference in Las Vegas, GOOGL unveiled Ironwood, its seventh-generation Tensor Processing Unit (TPU), expected to be available later this year. Google Cloud unveiled its Cloud Wide Area Network (Cloud WAN), giving enterprises access to its private global fiber network. Alphabet showcased Willow, its new quantum chip, while on the AI model front, Alphabet launched Gemini 2.5, its most advanced reasoning model, alongside Gemini 2.5 Flash, a low-latency, cost-efficient version tailored for developers.

Alphabet’s initiatives to infuse AI in Search are noteworthy. At the end of the first quarter of 2025, Circle to Search was available on 250 million devices, with usage increasing roughly 40% during the quarter. Since October 2024, monthly visual searches with lens have increased by 5 billion. AI Overview is currently used by more than 1.5 billion people monthly. The addition of AI mode expands AI Overview’s advanced reasoning, thinking and multimodal capabilities.

In Cloud, Alphabet is benefiting from its partnership with NVIDIA NVDA. Google Cloud was the first cloud provider to offer NVIDIA’s B200 and GB200 Blackwell GPUs and will be offering its next-generation Vera Rubin GPUs. Introduction of 2.5 flash, Imagen 3 and Veo 2 are noteworthy developments. Google Cloud is becoming a preferred choice for enterprises planning to deploy AI agents thanks to the Agent Development Kit and a low-code tool offering Agent Designer.

Meanwhile, the Google-Wiz combination offers security offerings that are supported on multi-cloud and are expected to tackle threats emerging from the advancement of AI, prevent breaches and help enterprises respond to breaches more efficiently. Wiz has a stellar clientele with its cloud security platform currently used by Amazon AMZN, Microsoft MSFT and Oracle.

The Wiz buyout reflects the growing importance of Google Cloud in the company’s growth plans. The addition of Wiz to Google Cloud will boost competitive prowess against the likes of Amazon and Microsoft in the cloud computing space. Per Synergy Research Group data, Amazon’s share in the worldwide cloud infrastructure market amounted to 29% in the first quarter of 2025, ahead of Microsoft’s Azure platform at 22% and Google Cloud at 12%.

The Zacks Consensus Estimate for second-quarter 2025 earnings is pegged at $2.12 per share, up a couple of cents over the past 30 days, indicating 12.17% year-over-year growth.

The consensus mark for 2025 earnings is pegged at $9.43 per share, up 7% over the past 30 days, suggesting 17.29% year-over-year growth.

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Alphabet’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 14.64%.

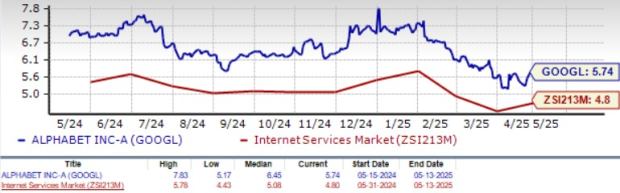

The Value Score of C suggests a stretched valuation for Alphabet at this moment.

Alphabet stock is trading at a premium, with a forward 12-month Price/Sales of 5.74X compared with the Zacks Internet Services industry’s 4.8X.

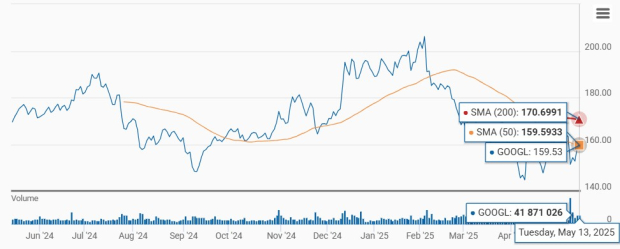

GOOGL shares are trading below the 50-day and the 200-day moving averages, indicating a bearish trend.

Alphabet’s growing GenAI capabilities and significant investments in cloud computing present a potential catalyst for the future amid stiff competition in the cloud space and increasing regulatory headwinds. GOOGL’s dominant position in the search engine market and strong position in the cloud are long-term drivers.

Alphabet currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 min | |

| 10 min | |

| 12 min | |

| 19 min | |

| 22 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours |

Dow Jones Futures Fall; Nvidia Hits AI Stocks, But S&P 500 Holds Key Support

NVDA -5.46%

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite