|

|

|

|

|||||

|

|

Cal-Maine Foods, Inc. CALM has been delivering improved results and notable share price gains, riding on elevated egg prices and robust sales volumes. Prices surged as the highly pathogenic avian influenza (HPAI) impacted poultry farms across the United States, impacting supply. However, the latest Consumer Price Index (CPI) data from the U.S. Bureau of Labor Statistics paints a different picture, with egg prices dropping 12.7% in April. This was the first monthly decline since October 2024.

This shift raises important questions: Is this a brief reprieve or the start of a more sustained pullback? What does this mean for Cal-Maine’s outlook, and how should investors position themselves now?

According to the U.S. Department of Agriculture (USDA), HPAI outbreaks in U.S poultry led to the depopulation of 40.2 million birds in 2024, and another 32.9 million this year. This created a supply crunch, catapulting egg prices to record highs.

The USDA rolled out a $1-billion-dollar comprehensive strategy to curb HPAI, protect the U.S. poultry industry and normalize egg prices. Recently, the USDA noted fewer outbreaks at commercial poultry operations, suggesting that supply conditions may stabilize.

Per the U.S. Bureau of Labor Statistics report, the price of a dozen large white eggs was $5.12 in April. It was down from the record high of $6.23 in March 2025, but still 79% above the April 2024 average price of $2.86 in April 2024.

Meanwhile, the demand for eggs remains resilient and it has been a staple on consumers’ grocery lists. Valued as a source of high-quality protein and increasingly favored for healthy eating, eggs are likely to see sustained demand. While prices may ease from record highs, they are expected to stay elevated, supported by robust consumption, even as the effects of HPAI begin to stabilize.

Cal-Maine Foods has reported consistent increases in top and bottom-line results over the past few quarters, as shown in the charts below. This is attributed to the net average selling price of shell eggs and the increase in total dozens sold. The company’s focused approach to adding production capacity through acquisitions and organic growth has led to improved volumes.

In third-quarter fiscal 2025 (ended March 1, 2025), CALM reported earnings per share of $10.38, a significant improvement from earnings of $3.00 in the year-ago quarter. Sales skyrocketed 102% year over year to $1.42 billion due to increased net average selling price of shell eggs and higher total dozens sold. Also, farm production costs per dozen were down 5.7% year over year, reflecting favorable commodity pricing for key feed ingredients.

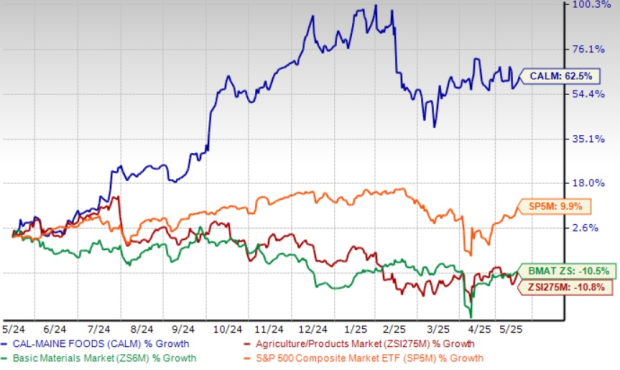

The company’s stock has surged 62.5% over the past year compared with the industry's 10.8% decline and the 10.2% drop witnessed by the Basic Materials sector. Meanwhile, the S&P 500 has gained 9.9%.

Cal-Maine Foods has also outpaced other stocks in the space like Vital Farms VITL, Performance Food Group Company PFGC and The Chef's Warehouse CHEF.

The Cal-Maine Foods stock is currently trading above the 50-day and 200-day simple moving averages, signaling strong upward momentum and price stability. This technical strength indicates positive market sentiment and confidence in the company’s financial health and prospects.

CALM is currently trading at a forward 12-month P/E of 14.45X compared with the industry’s 10.27X.

Vital Farms, Performance Food Group Company and The Chef's Warehouse are also trading at a premium to the industry average. In comparison, Cal-Maine Foods is a cheaper option than these stocks.

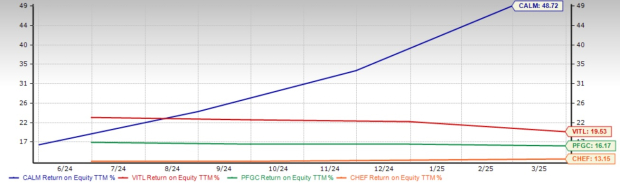

Cal-Maine Foods’ Return on equity, a profitability measure of how prudently the company is utilizing its shareholders’ funds, is 48.72%, way higher than the industry’s 11.98%. It also outpaced the sector’s average of 10.04% and the S&P 500’s 31.94%.

Cal-Maine Foods’ ROE is also higher than its peers, Vital Farms (19.53%), Performance Food Group Company (16.17%) and The Chef's Warehouse (13.15%).

The Zacks Consensus Estimate for the company’s 2025 and 2026 earnings has moved up 45.80% and 21.75% in the past 60 days, reflecting analyst optimism.

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

With customer demand shifting toward cage-free eggs and 10 U.S. states enacting legislation requiring cage-free compliance by 2030, Cal-Maine Foods is investing heavily in its cage-free capacity. The company is on track to complete $60 million in capital projects by the end of this year, which will add production capacity for 1.1 million cage-free layer hens and 250,000 pullets.

Recent acquisitions have bolstered capacity. In June 2024, Cal-Maine Foods acquired ISE America’s commercial shell egg production and processing assets. This increased cage-free capacity by 1 million cage-free laying hens. In February 2025, it acquired certain assets of Deal-Rite Feeds, Inc., including two feed mills, storage facilities, usable grain, vehicles, related equipment and retail feed sales business located in Statesville and Union Grove, NC. As feed is a primary cost component for the company, this move will help CALM lower production costs and drive efficiencies.

The company is also expanding its product portfolio to include value-added egg products. This is evident in its investment in Meadowcreek Foods for hard-cooked eggs and in Crepini Foods, a new venture offering egg products and prepared foods. Cal-Maine Foods expects to leverage the Crepini brand of quality products, including egg wraps and protein pancakes, to extend its reach to major retailers.

Cal-Maine Foods recently entered an agreement to acquire Burlington, WI-based Echo Lake Foods, which produces, packages, markets and distributes ready-to-eat egg products and breakfast foods. With this move, CALM will enter the large, growing and highly stable value-added food portion of the egg category.

While the recent decline in egg prices may cause some near-term uncertainty, prices will be supported by stable demand. Cal-Maine Food’s efforts to expand capacity, including cage-free and other specialty egg production, pose it for long-term growth. Efforts to diversify its product offerings will provide a distinct competitive advantage to the company.

Despite CALM’s premium valuation, you should buy this Zacks Rank #1 (Strong Buy) stock now for better returns. The company’s Value Score of A also instills confidence in the stock.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 9 hours | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite