|

|

|

|

|||||

|

|

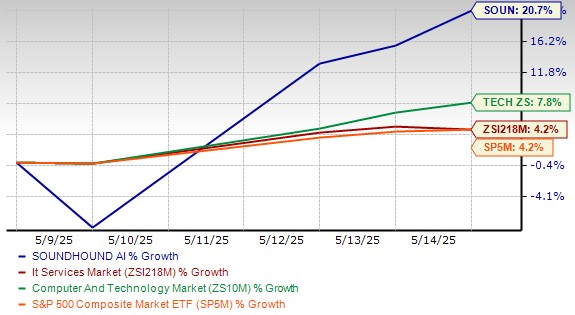

SoundHound AI Inc. SOUN has experienced a remarkable 20.7% surge in its stock price since reporting its first-quarter 2025 earnings last week on May 8, outperforming the broader Zacks Computer & Technology sector’s rise of 7.8% and the Zacks Computers - IT Services industry’s increase of 4.2%. This uptick reflects growing investor confidence in the company's trajectory within the voice AI sector.

SOUN’s Post Q1 Share Performance

If we look into the maker of artificial intelligence (AI) tools for computer interpretation of voice commands’ recent quarterly results, its revenues of $29.1 million marked a staggering 151% increase year over year. This growth underscores the company's expanding footprint in the voice AI domain. However, it's noteworthy that this figure fell slightly short of analysts' expectations, which anticipated $30 million in revenues. On the earnings front, SoundHound posted an adjusted loss of 6 cents per share, outperforming the Zacks Consensus Estimate of a loss of 7 cents per share. This narrower loss indicates improved operational efficiency and cost management. Yet, adjusted EBITDA was a loss of $22.2 million, widening from a loss of $15.4 million, reflecting continued investment in growth and R&D.

The company reaffirmed its 2025 revenue guidance of $157 to $177 million, reflecting continued confidence in demand for its voice AI solutions. If achieved, this would represent a growth rate of approximately 85–109% over 2024 levels. The reaffirmation suggests management’s visibility into its sales pipeline and execution capacity remains strong despite macroeconomic headwinds.

However, despite strong revenue growth, SoundHound’s margins declined, with GAAP gross margin falling to 36.5% from 59.7% and non-GAAP margin declining to 50.8% from 65.5%, reflecting elevated costs tied to acquisitions and scaling. This suggests operational efficiencies have not yet caught up with top-line expansion.

Let's delve deeper into the company's prospects to determine whether SOUN stock is a prudent addition to your portfolio now.

SoundHound’s stand-out quarterly revenue growth reflects the momentum behind the company’s enterprise AI solutions and its expanding industry footprint. A key highlight is the diversification of its customer base, with no single customer accounting for more than 10% of total revenues, underscoring broader market adoption of SoundHound’s voice AI technologies across sectors such as automotive, healthcare, financial services, and restaurants.

SoundHound’s Polaris multilingual AI foundation model underpinned its competitive edge, with superior latency, accuracy, and multi-language capabilities enabling traction across international markets. The company activated more than 1,000 restaurant locations during the first quarter, nearly 10 times its pace a year ago, and its AI now handles around 10 million interactions per quarter across 13,000 restaurants.

The company’s collaborations with major players such as NVIDIA NVDA, Perplexity, Lucid Group, Inc. LCID and LG, along with restaurant industry partners, are key tailwinds. These partnerships underscore SoundHound’s leadership in creating transformative voice solutions. SoundHound has expanded its collaboration with NVIDIA by integrating NVIDIA AI Enterprise tools to enhance its voice AI capabilities. This partnership enables faster, low-latency processing, real-time retrieval-augmented generation, and scalable AI model optimization. The integration is already being used in automotive applications, such as Lucid Motors' voice assistant, to improve response times and user interactions. SoundHound AI plans to broaden the use of NVIDIA AI software in more modules to further advance automotive voice technology.

The company’s standout first-quarter performance was fueled by rapid expansion across core verticals—restaurants, automotive, and enterprise. SoundHound is amplifying its go-to-market capabilities through high-impact partnerships. These include tie-ups with Acrelec (restaurant tech), PowerConnect.AI (energy), and Pindrop (security), along with renewals from global IT, telecom, and hospitality players. In the automotive sector, SoundHound partnered with Tencent’s TCEHY Tencent Intelligent Mobility—part of Tencent’s Cloud and Smart Industries Group—to integrate its advanced conversational AI into intelligent cockpit systems for global automobile brands. A new alliance with Tencent and growing adoption of its voice commerce solution further amplified automotive traction. Additionally, new partnerships in the energy and utility sectors, such as with Power Connect AI, indicate strategic market diversification.

These alliances not only diversify revenue streams but also help scale the company’s platform into new domains with low incremental cost.

Recent acquisitions—SYNQ3, Amelia, and Allset—contributed meaningfully in the quarter. These integrations enhanced upsell opportunities, cross-functional capabilities, and technological breadth. Amelia 7.0, powered by SoundHound’s new Agentic Plus framework, allows deployment of autonomous AI agents for voice-driven transactions and customer support, ushering in real-time commercial applications of agentic AI.

While revenue surged, SoundHound grappled with margin pressure due to low-margin acquired contracts and call center operations, which it plans to optimize over the next 18–24 months.

R&D, Sales & Marketing, and General and Administrative costs increased significantly (up 66%, 117%, and 79% year over year, respectively), driven largely by acquisitions and investments in talent, infrastructure, and go-to-market capabilities. While these investments are necessary to build scale, they weigh on near-term profitability.

Automotive volumes were impacted by geopolitical uncertainty, though higher AI-driven ASPs offered some relief. Additionally, a customer transition also delayed $2 million in expected first-quarter revenue to later in 2025.

Over the past 60 days, the Zacks Consensus Estimate for SOUN’s 2025 loss per share has remained unchanged at 16 cents per share. Nonetheless, the estimated figure reflects an improvement from the year-ago loss of $1.04 per share.

SOUN shares are currently overvalued, as suggested by its Value Score of F. In terms of its forward 12-month price-to-sales (P/S) ratio, SOUN is trading at 25.66, higher than the Zacks Computers - IT Services industry’s 19.63.

SoundHound’s impressive 21% rally following its first-quarter results underscores investor optimism in its long-term AI growth story, particularly within voice-enabled enterprise solutions. The company is scaling rapidly, as evidenced by 151% revenue growth and significant traction across core verticals, including restaurants, automotive, and smart devices. Strategic partnerships with tech giants like NVIDIA and Tencent, combined with recent acquisitions, are expanding SoundHound’s ecosystem and revenue streams.

However, margin compression, elevated operating costs, and continued EBITDA losses highlight the trade-off between growth and near-term profitability. Despite a robust 2025 revenue outlook of up to $177 million, valuation remains stretched, with SOUN trading at a rich forward P/S multiple. Given the mixed picture—high growth potential tempered by operational challenges and a premium valuation—the Zacks Rank of #3 (Hold) is appropriate. Investors may consider holding SOUN to participate in its AI-driven upside while waiting for clearer profitability signals before committing further capital. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 min | |

| 1 hour | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite