|

|

|

|

|||||

|

|

Alibaba Group BABA recently reported its fourth-quarter fiscal 2025 financial results, showcasing resilience and strategic positioning that make it an attractive investment opportunity in the current market. (Read More: Alibaba Q4 Earnings Surpass Estimates, Revenues Increase Y/Y)

Despite missing revenue estimates slightly, the Chinese e-commerce and technology giant delivered strong earnings growth and demonstrated clear momentum across key business segments. With shares trading at significantly discounted valuations compared to industry peers, there are compelling reasons to consider BABA stock as a smart investment.

Alibaba reported non-GAAP earnings of $1.73 per ADS in the fourth quarter of fiscal 2025, beating analyst expectations by an impressive 16.89%. This represents a substantial 23% year-over-year increase in earnings, indicating strong operational efficiency and profitability despite challenging market conditions. While revenues of $32.6 billion (RMB 236.5 billion) grew 7% year over year, slightly missing estimates, the company's adjusted EBITA jumped 36% to RMB 32.6 billion ($4.5 billion).

The company's performance reflects successful execution of its dual growth strategy focusing on e-commerce and AI+Cloud, with all segments achieving year-over-year EBITA improvements this quarter. Management's "user first, AI-driven" approach has yielded meaningful results with accelerated growth across core businesses. This strategy positions Alibaba to leverage its technological strengths while maintaining leadership in its traditional e-commerce markets.

The Zacks Consensus Estimate for fiscal 2026 revenues is pegged at $143.48 billion, indicating 3.87% year-over-year growth. With the Zacks Consensus Estimate for fiscal 2026 earnings indicating an upward revision of 1.1% over the past 60 days to $10.95 per share, the market appears to be optimistic about Alibaba's growth trajectory.

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

See the Zacks Earnings Calendar to stay ahead of market-making news.

The accelerating performance of the company’s Cloud Intelligence Group is noteworthy. Cloud revenues grew 18% year over year, with AI-related product revenues maintaining triple-digit growth for the seventh consecutive quarter. This momentum positions Alibaba to capture significant market share in the rapidly expanding cloud computing and AI sectors.

The company has made substantial investments in AI infrastructure and advanced technologies, strengthening its global leadership position. The April release of its next-generation Qwen3 model as open source, which ranked among the top performers globally on multiple authoritative benchmarks, demonstrates Alibaba's commitment to innovation in this space.

Industry penetration of Alibaba's AI products continues to expand beyond traditional tech sectors into manufacturing, animal farming, and other traditional industries. This diversification of the customer base suggests substantial growth potential as AI adoption accelerates across the global economy. With AI expected to define technology trends for the next 10-20 years, Alibaba's early positioning and continued investment in this area represent a significant long-term growth driver.

Despite strong performance metrics and promising growth vectors, Alibaba trades at a significant discount to peers. The stock's forward 12-month Price/Earnings ratio of 11.07X is less than half the Zacks Internet-Commerce industry average of 22.29X, suggesting BABA shares are substantially undervalued relative to growth potential.

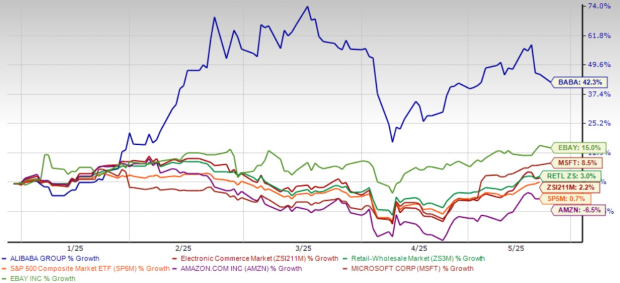

This valuation disconnect becomes even more apparent when considering Alibaba's performance against competitors. While shares have gained an impressive 42.3% year to date, outperforming the industry, the Zacks Retail-Wholesale sector and the S&P 500’s growth of 2.2%, 3% and 0.7%, respectively, the company still trades at a much lower multiple than comparable tech giants.

This performance stands in stark contrast to global e-commerce bigwigs like Amazon AMZN and eBay EBAY, highlighting Alibaba's relative strength. BABA also faces rising competition from the leading cloud players, namely Amazon, Microsoft MSFT and Google. Shares of Amazon have lost 6.5% year to date, while eBay and Microsoft have returned 15% and 8.5%, respectively.

Alibaba's commitment to shareholder returns further enhances its investment case. The company's board approved an annual dividend of $1.05 per ADS (a 5% increase) plus a special dividend of 95 cents per ADS, bringing total cash dividends to $2.00 per ADS ($4.6 billion). Combined with $11.9 billion in share repurchases, Alibaba returned a total of $16.5 billion to shareholders in fiscal 2025, affirming management's confidence in the company's long-term prospects.

With its core e-commerce business delivering solid performance, accelerating cloud and AI segments showing triple-digit growth, and international commerce operations expanding rapidly (22% revenue growth this quarter), Alibaba presents a compelling investment opportunity. The company's financial strength, with a strong net cash position of $50.5 billion, provides ample resources to fund strategic investments while continuing to reward shareholders.

While Alibaba faces competition from global e-commerce and cloud computing players, its discounted valuation, strong financial results, and strategic positioning in high-growth areas like AI make BABA stock a smart buy for investors seeking both value and growth potential in 2025. BABA stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 min | |

| 10 min | |

| 29 min | |

| 34 min | |

| 58 min | |

| 1 hour |

AI Stocks At Crossroads As Nvidia, Snowflake, CoreWeave, Salesforce Step Into Spotlight

MSFT AMZN

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow Rises Before Nvidia Earnings; First Solar Sinks On Weak Outlook (Live Coverage)

AMZN

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite