|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

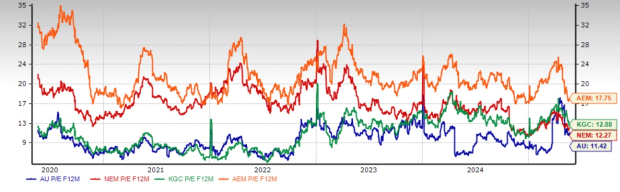

AngloGold Ashanti PLC AU stock is trading at a forward price/earnings of 11.42X, a roughly 16% discount to the Zacks Mining – Gold industry’s average of 14.27X. It also has a Value Score of B.

The stock also remains attractively priced compared with peers such as Newmont Corporation NEM, Agnico Eagle Mines Limited AEM and Kinross Gold Corporation KGC.

Is AU a smart buy based on its current valuation? Let’s dig deeper.

The AngloGold Ashanti stock has appreciated 85.9% year to date, outperforming the industry’s 39.1% gain. Meanwhile, the Basic Materials sector has risen 6.4% and the S&P 500 has edged up 0.7%. AU has also delivered stronger returns than Newmont, Agnico Eagle Mines and Kinross Gold Corporation, as illustrated in the chart below.

Solid Financial & Operational Results in Q1: The company reported first-quarter 2025 results on May 9. Earnings per share soared 529% year over year to 88 cents, driven by higher gold production, disciplined cost control and higher gold prices through the quarter.

Gold production increased by 22% to 720,000, marking its strongest first-quarter performance since 2020. This reflected the first full-quarter contribution of 117,000 ounces from the recently acquired Sukari mine, as well as upbeat performances at Siguiri, Tropicana, Cerro Vanguardia and Sunrise Dam.

The average realized gold price surged 39% year over year to $2,874 per ounce.

Adjusted EBITDA increased 158% year over year to $1.12 billion in the first quarter of 2025 from $434 million in the prior year quarter.

Total cash costs per ounce for the group, however, were up 4% to $1,223 per ounce. All-in-sustaining costs per ounce (AISC) increased 1% to $1,640 per ounce, mainly due to higher sustaining capital expenditure, which was partly offset by higher gold sold.

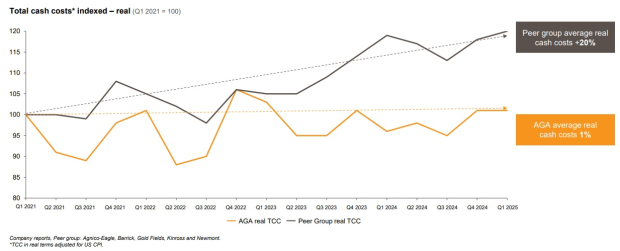

AngloGold Ashanti, meanwhile, remains focused on its Full Asset Potential program to offset the inflationary impacts. The company’s average real cash costs are up 1% over the first quarter 2021-first quarter 2025 timeframe compared to more than 20% for its peer group (Agnico-Eagle Mines, Barrick Mining, Gold Fields, Kinross and Newmont).

Significant Debt Reduction and Strong Liquidity: AU’s free cash flow increased almost seven-fold to $403 million in the first quarter, from $57 million in the year-ago quarter. It has managed to take down its adjusted net debt to $525 million, from the $1.322 billion at the year-ago quarter’s end. The adjusted net debt to adjusted EBITDA ratio improved to 0.15X in the first quarter compared to 0.86X in the first quarter of 2024.

AngloGold Ashanti ended the first quarter of 2025 with $3 billion in liquidity, including cash and cash equivalents of $1.5 billion.

FY25 Guidance Affirmed: AngloGold Ashanti expects 2025 gold production between 2.9 and 3.225 million ounces. Total cash cost per ounce is forecast to range between $1,125 and $1,225 per ounce, and AISC at $1,580-$1,705 per ounce.

Tailwinds From Rising Gold Prices: The metal has gained 23.5% year to date, riding on the escalating tariff tensions and geopolitical uncertainties. Gold is currently above $3,220 an ounce as lingering concerns over the U.S economic outlook and fiscal deficit continued to boost safe-haven demand.

Gold prices are likely to continue to gain in this uncertain environment, with increased purchases by central banks, hopes of interest rate cuts and geopolitical tensions. This creates a favorable backdrop for AU.

Strategic Growth Focus: AngloGold Ashanti is executing a clear strategy of organic and inorganic growth. In November 2024, it acquired Egyptian gold producer Centamin, adding the large-scale, long-life, world-class Tier 1 asset (Sukari) to its portfolio. It has the potential to produce 500,000 ounces annually. With this addition, the proportion of gold production from its Tier 1 assets has moved up from 62% to 67%. AU’s mineral reserves went up to 31.2 million ounces at the end of 2024.

It recently sold its interests in two gold projects in Côte d’Ivoire to Resolute Mining Limited to sharpen its focus on its operating assets and development projects in the United States.

Obuasi remains a significant pillar of its long-term strategy. The company’s focus this year is to continue the implementation of the underhand drift and fil UHDF mining method and make stoping improvements. This important orebody is expected to deliver around 400,000 ounces of annual production at competitive costs by 2028.

At Siguiri, efforts are underway to improve mining volumes through ongoing improvements to fleet availability and utilization, and to introduce gravity recovery in the processing plant to further improve metallurgical recovery.

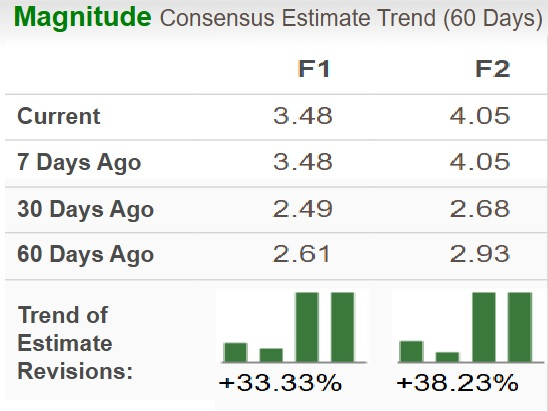

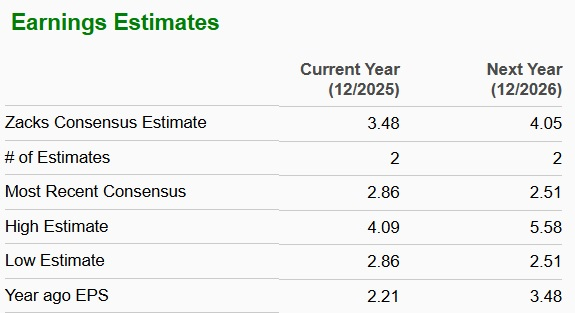

The EPS estimates for 2025 and 2026 have been trending north over the past 60 days, as seen in the chart below. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

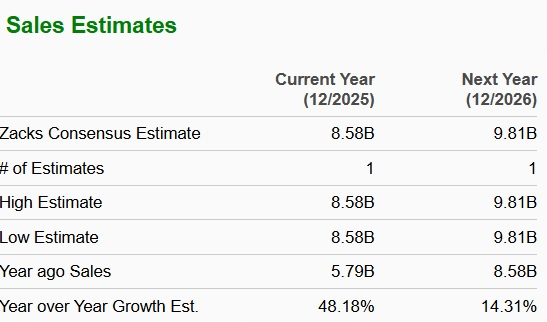

The Zacks Consensus Estimate for AU’s 2025 sales stands at $8.58 billion, suggesting 48.2% year-over-year growth. The consensus mark for the year’s earnings is at $3.48, indicating year-over-year growth of 57.4%. The Zacks Consensus Estimate for sales for 2026 suggests 14.3% year-over-year growth, and the same for earnings indicates growth of 16.4%.

Under its new dividend policy, AngloGold Ashanti aims to return 50% of its annual free cash flow, subject to maintaining an adjusted net debt to adjusted EBITDA ratio of 1.0 times. The dividend policy introduced an annual base dividend of 50 cents per share per year, payable in quarterly instalments of 12.50 cents per share.

If required, a “true-up” payment will be made in the final quarter of each year to ensure that the total dividends align with the 50% free cash flow payout target. This structure establishes a minimum return, offering stability to shareholders throughout commodity price cycles.

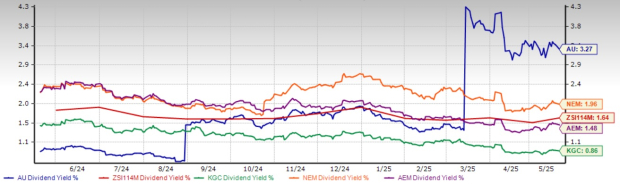

AngloGold Ashanti’s current 3.27% dividend yield is higher than the industry’s 1.64%. In comparison, Newmont, Agnico Eagle Mines and Kinross Gold Corporation have a lower dividend yield of 1.96%, 1.48% and 0.86%, respectively.

AngloGold’s strategic actions to boost production and financial health, combined with rising earnings estimates and an industry-leading dividend yield, present a compelling investment case. Surging gold prices should also boost its profitability and drive cash flow generation. Its disciplined cost management should help offset inflationary pressures.

With an attractive valuation, strong price performance relative to peers, and solid growth prospects, AU stands out as a promising opportunity. Adding this Zacks Rank #1 (Strong Buy) stock will be prudent for investors.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite