|

|

|

|

|||||

|

|

Amgen’s AMGN stock has declined 10.4% in the past three months. A lot of this price decline is related to the broader macroeconomic uncertainty.

Stocks have been on a roller-coaster ride since President Trump unveiled sky-high tariffs in early April and China came up with retaliatory tariffs. Last week, China and the United States struck a deal that eased trade tensions and resulted in a stock market recovery. Though the massive tariffs imposed by the United States and retaliatory tariffs by China and some other countries are now on a pause, it is only a temporary suspension, and no one knows what will happen after the 90-day tariff suspension ends. The uncertainty around tariffs and trade production measures remains, which has muted economic growth.

Although pharmaceuticals have been exempted from tariffs in the first round, they could be Trump’s target in the next round, considering the President’s goal to shift pharmaceutical production back to the United States, primarily from European and Asian countries.

Trump and the Republican government also continue to stress on the control of drug prices with the latest attempt being his “most favored nations’ policy.”

Let’s understand AMGN’s strengths and weaknesses to better analyze how to play the stock in the uncertain macro environment.

Amgen’s revenues grew 9% year over year in the first quarter of 2025, driven by growing patient demand for its innovative medicines.

Amgen is seeing declining revenues from oncology biosimilars and some legacy established products like Enbrel. Pricing headwinds and competitive pressure are hurting sales of many products. Sales of some key brands, like Otezla and Lumakras, have been lukewarm. However, revenues from key older medicines like Prolia, Repatha and Blincyto and new drugs like Tavneos and Tezspire are driving the top line. Rare disease drugs like Tepezza, Krystexxa and Uplizna, added from last year’s acquisition of Horizon Therapeutics, are also boosting top-line growth.

Amgen is also evaluating Kyprolis, Otezla, Nplate, Repatha, Lumakras, Tezspire, Uplizna and Blincyto for additional indications. Approval for the expanded use of these drugs can potentially drive further top-line growth. Uplizna was approved for IgG4-related disease in the United States in April 2025.

Amgen’s regulatory application for Uplizna in myasthenia gravis is under review in the United States, with an FDA decision expected on Dec. 14, 2025. Tezspire is under review in the United States for chronic rhinosinusitis with nasal polyps, with an FDA decision expected on Oct. 19, 2025.

Amgen has invested several billion dollars in M&A deals over the last decade, which has bolstered its product portfolio and diversified its pipeline.

Amgen is developing MariTide, a GIPR/GLP-1 receptor, as a single dose in a convenient autoinjector device with a monthly and, possibly, less frequent dosing. This key feature differentiates it from Eli Lilly’s LLY and Novo Nordisk’s NVO popular GLP-1-based obesity drugs, Zepbound and Wegovy, which are weekly injections.

In clinical studies, it has shown predictable and sustained weight loss and a meaningful impact on cardiometabolic parameters.

In March, Amgen initiated two phase III studies on MariTide in obesity as part of its comprehensive MARITIME phase III program. Separate phase III studies on MariTide in obesity, with or without type II diabetes, are currently enrolling patients. Additional MARITIME phase III studies on MariTide in specific obesity-related conditions are expected to be launched throughout 2025. Separate phase II studies on obesity and type II diabetes are also ongoing, with data readouts expected in the second half.

An interesting BiTE drug, Imdelltra (tarlatamab), was approved for pre-treated advanced small cell lung cancer (ES-SCLC) in May 2024. Several phase III studies are currently ongoing on tarlatamab in earlier-line settings across extensive-stage and limited-stage SCLC. Imdelltra is believed to have blockbuster potential, as there are limited treatment options in late-line SCLC. Another important candidate, rocatinlimab, is being evaluated in phase III studies for atopic dermatitis and prurigo nodularis.

Several data readouts are expected over the next six to 12 months, which could be important catalysts for the stock.

Amgen has successfully launched some new biosimilar products this year, which generated impressive sales in the first quarter. In January, Amgen launched Wezlana, the first biosimilar version of J&J’s JNJ blockbuster drug, Stelara. Wezlana generated sales of $150 million in the quarter. Wezlana was approved by the FDA in 2023 but was not launched until January 2025, as per a settlement with J&J.

Amgen launched the first biosimilar version of Regeneron’s Eylea, Pavblu, in the fourth quarter of 2024, which generated sales of $99 million in the first quarter of 2025. Another key biosimilar product, Bekemv, a biosimilar version of AstraZeneca’s Soliris, was approved in the United States in May 2024 and was launched in the second quarter of 2025.

In the first quarter of 2025, Amgen’s biosimilar products generated impressive sales of $735 million, which rose 35% year over year. Amgen’s new biosimilar launches will play a key role in mitigating the impact of Amgen’s upcoming loss of exclusivity (LOE) over the next few years.

Phase III studies are ongoing to evaluate biosimilar versions of Bristol-Myers’ Opdivo (ABP 206), Merck’s Keytruda (ABP 234) and Roche’s Ocrevus (ABP 692).

Patents for RANKL antibodies (including sequences) for Prolia and Xgeva expired in February 2025 in the United States and will expire in November 2025 in some European countries. Sales of these best-selling drugs are expected to erode significantly in 2025, mainly in the second half, due to patent erosion.

Sales of Amgen’s rare disease drugs, mainly Tepezza, have slowed down, which is a concern.

The Medicare Part D redesign is expected to hurt sales of some of Amgen’s drugs in future quarters. Enbrel and Otezla have been selected by the Centers for Medicare & Medicaid Services for Medicare Part D price setting beginning in 2026 and 2027, respectively.

Pricing headwinds and competitive pressure are hurting sales of many products. Weakness in some key brands like Otezla and Lumakras creates potential revenue headwinds.

Amgen’s stock has risen 7.3% so far this year against a decrease of 3.1% for the industry. The stock has also outperformed the sector and S&P 500 index, as seen in the chart below.

From a valuation standpoint, Amgen is reasonably priced. Going by the price/earnings ratio, the company’s shares currently trade at 13.12 forward earnings, which is lower than 14.74 for the industry. The stock is also trading below its five-year mean of 13.80.

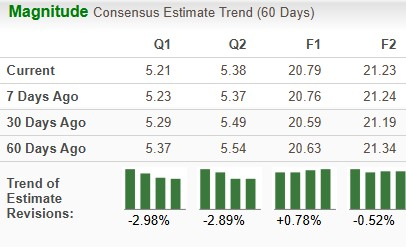

The Zacks Consensus Estimate for earnings has risen from $20.59 to $20.79 per share for 2025 over the past 30 days. For 2026, the consensus mark for earnings has risen from $21.19 to $21.23 per share over the same timeframe.

After analyzing the factors discussed above, we believe the company is well placed to maintain long-term revenue growth, driven by continued strong volume growth of key drugs, Repatha, Evenity and Prolia and increasing contribution from new innovative medicines like Tezspire, Tavneos and Imdelltra. It is expected to see continued clinical success from its mid- to late-stage pipeline. Though the initial data from MariTide studies were below expectations, MariTide has the potential to be a game-changer for Amgen.

Along with all these factors, Amgen’s consistently rising estimates, reasonable valuation and decent stock price appreciation are good enough reasons for those who own this Zacks Rank #3 (Hold) stock to stay invested for now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours |

Novo Nordisk Licenses Vivtex Tech for Up to $2.1 Billion to Deepen Obesity Push

NVO

The Wall Street Journal

|

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite