|

|

|

|

|||||

|

|

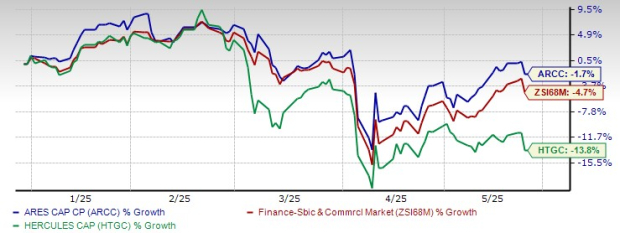

Ares Capital Corporation ARCC and Hercules Capital, Inc. HTGC are two leading Business Development Companies (BDCs) that provide debt financing to private companies. While ARCC focuses on middle-market firms across various industries, HTGC carves out a niche in venture debt, targeting high-growth technology and life sciences sectors.

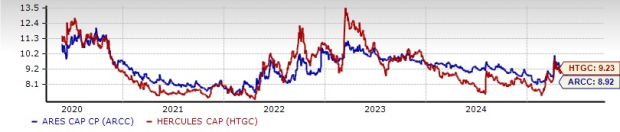

In today’s environment of elevated interest rates, sluggish economic activity and ongoing ambiguity surrounding potential Trump-era tariffs, BDCs face mounting headwinds. Subdued refinancing demand and slower transactional activity are likely to weigh on total investment income, while elevated rates and geopolitical risks pose a threat to asset quality as borrowers face increased debt-servicing pressure. As such, ARCC and HTGC have experienced stock declines.

YTD Price Performance

Against this backdrop, a question arises: which BDC stock is better positioned, Ares Capital with its broad exposure and scale or Hercules Capital with its tech-focused growth strategy? Let’s dive into their fundamentals, financial performance and growth outlook to find out which one presents a more compelling opportunity right now.

Ares Capital's investments in corporate borrowers generally range from $30 million to $500 million, while its investments in power generation projects are between $10 million and $200 million. It offers customized financing solutions, ranging from senior debt instruments to equity capital, with a focus on senior secured debt.

In the first quarter of 2025, ARCC reported 4.4% year-over-year growth in total investment income. This was largely driven by an increase in interest income from investments, capital structuring service fees and other income. However, the company recorded lower portfolio exits and gross commitments. As such, the company’s top and bottom-line numbers lagged the Zacks Consensus Estimate.

In the last five years, Ares Capital’s total investment income witnessed a CAGR of 14.4%, driven by higher demand for personalized financing solutions, leading to increased investment commitments. Also, the company originated $15.1 billion, $6 billion, $9.9 billion, $15.6 billion, $6.7 billion and $7.3 billion in 2024, 2023, 2022, 2021, 2020 and 2019, respectively, in gross investment commitments to new and existing portfolio companies.

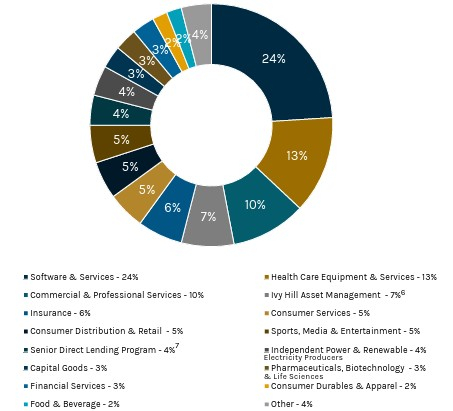

As of March 31, 2025, ARCC had a diversified investment portfolio of $27.1 billion across 566 portfolio companies. It had 24% of its investments in software & services and 13% in healthcare equipment & services. Other major investment areas were financial services, which include investment in Ivy Hill Asset Management (10%), commercial & professional services (10%) and insurance services (6%). While this reduces concentration risk and enhances the sustainability of total investment income, many of these industries are expected to face headwinds because of Trump’s tariffs.

Ares Capital’s Investment Portfolio (by Industry)

Hence, ARCC’s total investment income growth will likely be hampered in the near term due to relatively high interest rates, subdued demand for customized financing and delays in investment commitments amid an uncertain operating backdrop.

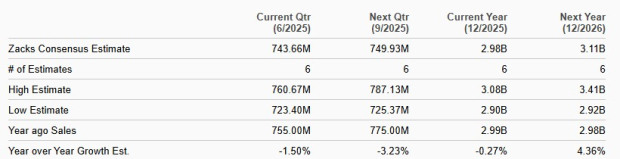

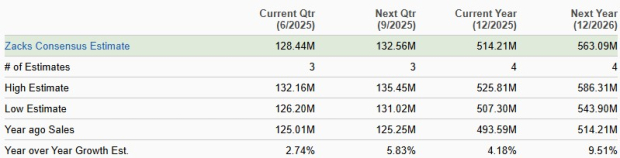

Sales Estimates

Hercules Capital's investments generally fall between $15 million and $40 million. It offers customized financing solutions ranging from senior debt to equity capital, with a focus on structured debt with warrants. It invests in companies that have been in business for at least six months to one year before the date of investment and expects these investments to generate revenues within at least two to four years.

In the first quarter of 2025, HTGC witnessed a 2% fall in total investment income due to a lower total fee income. Nonetheless, the company recorded a rise in gross new debt and equity commitments during the quarter.

In the last decade, Hercules Capital’s total investment income witnessed a CAGR of 12.1%. Additionally, the company closed $2.6 billion, $3.1 billion, $2.2 billion and $2.7 billion in new debt and equity commitments in 2021, 2022, 2023 and 2024, respectively. Driven by the rise in demand for customized financing and a robust deal pipeline, total new commitments are expected to keep rising.

Total Investment Income

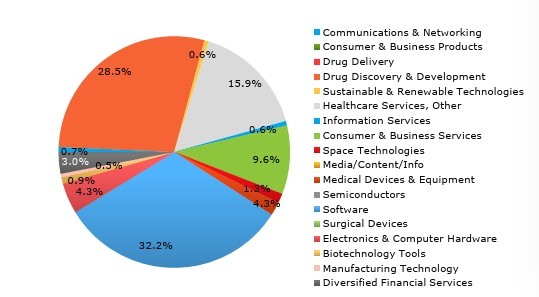

As of March 31, 2025, HTGC had an investment portfolio of $3.9 billion. It had 32% of its portfolio investments (at fair value) in software companies and 29% in drug discovery & development companies. Other major investment areas were other healthcare services (16%) and consumer & business services (10%). With a focus mainly on the technology and life science sectors, HTGC is better placed to counter tariffs.

HTGC’s Investment Portfolio (by Industry)

Despite several near-term headwinds, Hercules Capital is well-placed to record a rise in total investment income and commitments going forward.

Sales Estimates

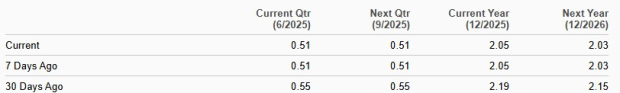

The Zacks Consensus Estimate for ARCC’s 2025 and 2026 earnings indicates a 12% and 0.9% decline for 2025 and 2026, respectively. Over the past month, earnings estimates for 2025 and 2026 have been revised lower. This indicates analysts’ bearish sentiments.

Earnings Trend

On the contrary, analysts are more optimistic about HTGC’s prospects. While the consensus mark for 2025 earnings suggests a 4% decline, for 2026, it is expected to grow 5.9%. Also, over the past 30 days, earnings estimates for 2025 have been revised lower, while it has been marginally revised north for 2026.

Earnings Trend

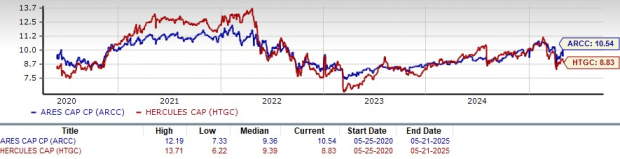

Valuation-wise, ARCC is currently trading at a 12-month forward price-to-earnings (P/E) of 10.54X, higher than its five-year median of 9.36X. The HTGC stock, on the other hand, is currently trading at a 12-month forward P/E of 8.83X, which is lower than its five-year median of 9.39X.

P/E F12M

Therefore, Hercules Capital is inexpensive compared to Ares Capital.

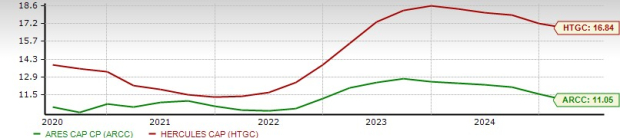

Additionally, HTGC’s return on equity (ROE) of 16.84% is way above ARCC’s 11.05%. HTGC also outscores the industry ROE of 11.20%. This reflects Hercules Capital’s efficient use of shareholder funds to generate profits.

ROE

Further, HTGC’s dividend yield of 9.23% is slightly higher than ARCC’s 8.92%. Nonetheless, both are lower than the industry average dividend yield of 10.27%.

Dividend Yield

Despite macroeconomic headwinds, Hercules Capital is better positioned for long-term growth than Ares Capital. HTGC’s focus on venture debt in high-growth tech and life sciences sectors gives it an edge, along with a strong return on equity of 16.84%—well above ARCC’s and the industry average. Its rising investment commitments and projected earnings growth for 2026 signal strong momentum. HTGC also trades below its five-year median P/E, offering an attractive valuation.

In contrast, ARCC's broader industry exposure makes it more vulnerable to tariff-related risks. Its earnings estimates have been revised downward, and its premium valuation limits near-term upside. While ARCC offers income stability through its diversified portfolio and strong dividends, HTGC’s sector focus, higher efficiency and better earnings trajectory make it a more compelling choice for investors seeking solid long-term returns.

At present, HTGC carries a Zacks Rank of 3 (Hold), while Ares Capital has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-08 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite