|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

In the fiercely competitive world of energy drinks, two industry giants are locked in a high-stakes battle for dominance. On one side stands PepsiCo Inc. PEP, a global powerhouse leveraging its vast distribution network and brand muscle. On the other is Monster Beverage Corporation MNST, the edgy disruptor that built an empire on adrenaline, attitude and loyal fans.

What was once a niche market has exploded into a multi-billion-dollar arena, and both players are racing to lead the charge. But as consumer preferences evolve and the energy category diversifies, the question remains: Will Monster’s focused intensity keep it on top, or will PepsiCo’s strategic depth and global reach tip the scales?

This face-off dives deep into their strategies, product lines, market performance and the shifting consumer trends that can crown the next ruler of the energy drink world. Is Monster still the king of buzz, or is PepsiCo's powerful distribution muscle and brand synergy giving it the upper hand? Buckle up; this battle is anything but tame.

Let us step into the ring and see who has the edge.

As one of the most formidable players in the global soft drinks industry, PEP brings unmatched scale, brand strength and executional muscle to any category it enters. With iconic brands like Pepsi, Mountain Dew and Gatorade, as well as a vast presence across retail, foodservice and international markets, PepsiCo is well-equipped to scale innovation and capture emerging consumer trends.

The company is increasingly asserting itself in the energy drinks space, leveraging its powerful distribution network and expanding into adjacent functional beverage categories. Its recent acquisition of Poppi, a fast-growing prebiotic soda brand, underscores its intent to tap into health-focused and multi-cultural segments that overlap with energy drink consumers.

In first-quarter 2025, PepsiCo reinforced its focus on high-growth, high-margin segments such as zero sugar, functional hydration and sports nutrition — categories that align closely with shifting consumer preferences. Gatorade Zero gained a share in sports drinks, while Propel posted solid revenue growth, highlighting the company’s growing relevance in energy-adjacent spaces. Together, these moves position PepsiCo not just to compete but to steadily increase its share in the evolving energy drinks market by offering products that meet the demand for both performance and wellness.

However, PepsiCo continues to face several headwinds, particularly persistent soft top-line trends and lingering challenges in its North America operations, which have been evident since early 2024. The company noted that consumer sentiment remains cautious, with heightened value-consciousness influencing purchasing behavior, especially in North America, where inflationary pressures are straining household budgets. This has led to more price-sensitive choices and reduced discretionary spending, particularly in categories like snacks. Looking to 2025, PepsiCo is expected to navigate a difficult cost environment, led by rising supply-chain expenses and greater exposure to tariffs on globally sourced inputs.

Monster remains a dominant force in the global energy drinks market, with a well-diversified and fast-evolving portfolio that includes flagship Monster Energy, Reign, Bang and NOS brands. Despite macroeconomic headwinds and foreign exchange pressures, Monster’s core energy drinks segment delivered 2.2% sales growth on a currency-adjusted basis in first-quarter 2025. The company maintains a strong market share across several key geographies and continues to benefit from rising household penetration and global demand for energy drinks.

Innovation remains central to Monster’s strategy. Recent launches like Monster Energy Ultra Blue Hawaiian, which has quickly become a top seller in the U.S. market, highlight the success of its fast-moving pipeline. From high-performance options like Reign Total Body Fuel to wellness-oriented Reign Storm and flavorful formats like Java and Juice Monster, the brand continues to meet a wide range of consumer preferences, sustaining its category leadership through constant brand refreshment.

Monster is strategically expanding its affordable energy offerings, such as Predator and Fury, in multiple international markets. These brands cater to emerging markets, wherein cost-sensitive consumers are fueling volume growth. International adjusted net sales accounted for roughly 40% of total revenues in first-quarter 2025, underscoring the company’s global momentum and diversified growth strategy.

Despite short-term sales volatility due to distributor ordering patterns and macroeconomic uncertainty, Monster delivered solid profitability and improved margins in first-quarter 2025. With minimal debt, significant cash reserves and a $500-million repurchase authorization still available, Monster is well-capitalized to invest in innovation, global expansion and shareholder returns. Its focused model, strong brand equity and operational discipline make MNST a compelling long-term investment in the energy beverage space.

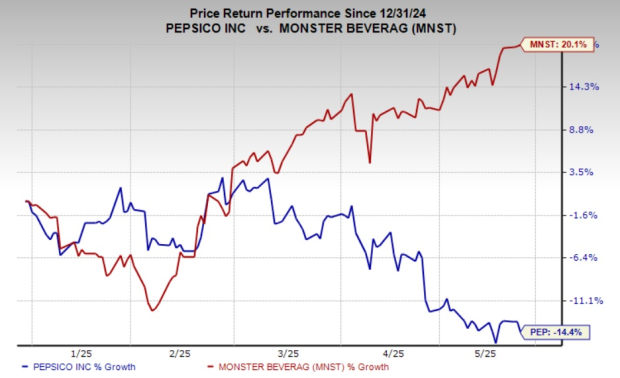

Shares of PepsiCo show a declining trend in the year-to-date period due to the ongoing challenges related to subdued category demand in its North America convenient food business and speculations about the rising supply-chain expenses and increased exposure to tariffs on global inputs. Meanwhile, Monster’s shares have demonstrated steady growth in the year-to-date period, driven by resilient business trends. Year to date, PEP shares have declined 14.4%, whereas the MNST stock has rallied 20.1%.

From a valuation perspective, PepsiCo currently trades at a more modest forward price-to-earnings (P/E) multiple of 16.16X, significantly lower than Monster Beverage’s 32.44X. On the surface, this may suggest that PepsiCo is more attractively priced.

However, a lower valuation does not automatically signal a buying opportunity; it can also reflect underlying concerns about growth prospects or operational challenges. The key question for investors is whether this discount represents untapped value or signals potential headwinds ahead for the stock.

Then again, Monster’s valuation appears rich, but for good reason. Its premium multiple reflects strong brand equity, a solid financial foundation, a consistent record of innovation and significant international growth potential. These strengths position Monster as a resilient, high-growth player for long-term investors. If the company continues to execute effectively and capitalize on global energy drink demand, its elevated valuation may be well justified.

PepsiCo’s EPS estimates for 2025 and 2026 moved down 0.3% and 0.2%, respectively, in the last seven days. PEP’s 2025 revenues are projected to rise 0.4% year over year to $92.2 billion, and EPS is expected to decline 3.6% year over year to $787.

Monster’s EPS estimates for 2025 and 2026 have moved up 1.6% and 2%, respectively, in the past 30 days. MNST’s 2025 revenues and EPS are expected to increase 5.9% and 14.8% year over year, respectively, to $7.9 billion and $1.86 per share.

In the battle for dominance in the energy drinks market, both PepsiCo and Monster Beverage bring distinct strengths to the table. PepsiCo leverages its massive distribution reach, diversified portfolio, and strategic investments in emerging brands to steadily expand its presence in the space. However, when it comes to pure-play energy momentum, Monster continues to lead. With a focused brand strategy, robust innovation pipeline and expanding international footprint, Monster not only delivers category leadership but also inspires investor confidence.

Year to date, MNST has outperformed PEP in terms of stock returns, reflecting market enthusiasm for its growth trajectory. Moreover, recent upward revisions in Monster’s earnings estimates suggest growing investor optimism about its future performance. If current trends hold, Monster appears well-positioned to retain its edge and remain the top contender in the fast-growing energy drinks arena. Monster currently carries a Zacks Rank #3 (Hold), while PEP has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite