|

|

|

|

|||||

|

|

For years, Tesla TSLA has been the face of the electric vehicle (EV) revolution. Today, it’s still a giant, with a staggering $1 trillion market cap and a growing focus on technology — from robotaxis to artificial intelligence. But the road ahead isn’t as smooth as it once seemed. Rising competition, shifting political dynamics, and missed or delayed timelines have taken some shine off Tesla’s once-unshakable dominance.

On the other hand, there is NIO, Inc. NIO — often dubbed the “Tesla of China”— which has been on its own wild ride. The company’s market cap might be a fraction of Tesla’s, at just over some $8 billion, and it’s still not profitable. However, it operates in China, the world’s largest and most EV-friendly market. And while challenges remain, NIO seems to be inching forward with a clearer focus and renewed energy.

No doubt, Tesla is aiming big and positioning itself more like a tech powerhouse than just a carmaker. But NIO is also doubling down on the EV game in a supportive domestic environment. With U.S. President Trump’s tough stance on EVs and shifting investor expectations, the race is far from over.

Shares of both Tesla and NIO have declined year to date, underscoring the cautious mood around EV stocks.

Let’s delve into the key drivers and challenges to assess which stock deserves a spot in your portfolio now.

NIO may be a small player compared to global giant Tesla, but the Chinese EV maker is stepping up its game. Its growing vehicle lineup — including models like the ES6, ET5T, ES8, ET9 — is helping the company expand its footprint in the competitive electric vehicle landscape.

But NIO isn’t relying solely on its namesake brand to drive future growth. It has launched two sub-brands — ONVO, which targets the mainstream EV market, and Firefly, aimed at smaller premium vehicles. ONVO’s first model, the L60, is already on the roads and receiving positive feedback. Two more ONVO vehicles, the L90 and a yet-to-be-named model, are set to hit the market later this year, potentially widening NIO’s customer base. Firefly’s first model commenced deliveries last month.

In the first quarter of 2025, NIO delivered over 42,000 vehicles — a 40% jump year over year. Management aims to double deliveries in 2025, powered by new models and broader brand reach. The company’s signature battery swap technology remains a key differentiator, with more than 3,200 stations and a new partnership with battery giant CATL to expand the network further.

Vehicle margins are improving. The metric rose steadily through 2024, reaching 13.1% in the second half, and NIO is aiming for a 20% margin this year for its core brand. Still, challenges remain. NIO reported a net loss of more than $3 billion in 2024, and while management targets breakeven by the fourth quarter of this year, intense price competition in China and high operating costs pose a risk to that goal. Rising SG&A expenses and a stretched balance sheet—with shrinking cash reserves and high debt—add further pressure.

Despite these hurdles, NIO’s innovation, expanding portfolio, and access to China’s massive EV market offer compelling reasons to watch the stock closely.

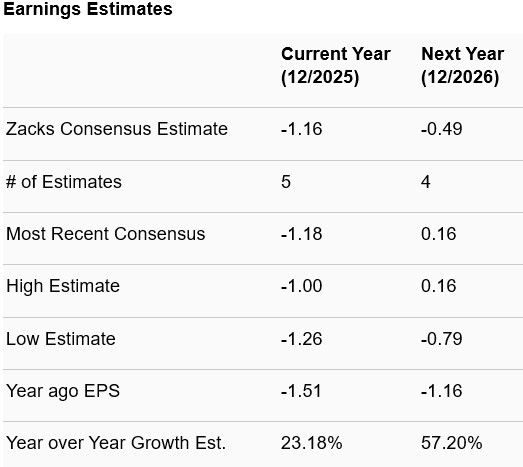

Take a look at the consensus estimates for NIO’s bottom line in 2025 and 2026.

Tesla’s journey from EV pioneer to tech powerhouse has hit a bumpy patch. Once the undisputed leader of the EV race, the company is now grappling with slowing growth in its core business. Deliveries are down, competition is fiercer than ever, and Tesla’s once-fresh lineup is beginning to show its age. In the first quarter of 2025, Tesla delivered 336,000 vehicles—a 13% year-over-year drop. Amid escalating global tariffs and rising uncertainty around its China operations, the company chose not to reaffirm its earlier forecast of modest growth for the year and said it would revisit its 2025 delivery targets in the second-quarter update.

Complicating matters is the growing discomfort around CEO Elon Musk’s political strides, which raised doubts about his focus on the company’s core operations. Nonetheless, its energy generation and storage segment, while still small, is gaining momentum and delivering higher margins than the EV business.

Financially, Tesla remains strong. It ended the first quarter of 2025 with a hefty $37 billion in cash and a low debt-to-capital ratio of just 7%, giving it room to fund future bets. And those bets are big.

Tesla is preparing to launch its first robotaxi service in Austin by next month—a move that could mark the company’s most meaningful step into full autonomy yet. It’s also building out the Cybercab, a two-seater self-driving vehicle expected in 2026, and continues to develop Optimus, its humanoid robot.

These ambitious projects could define Tesla’s next era. But they also come with high execution risk. For now, the company’s challenge is to steady its EV business while proving that its big ideas can turn into big results. Whether that comeback begins in 2025 is the question investors are asking.

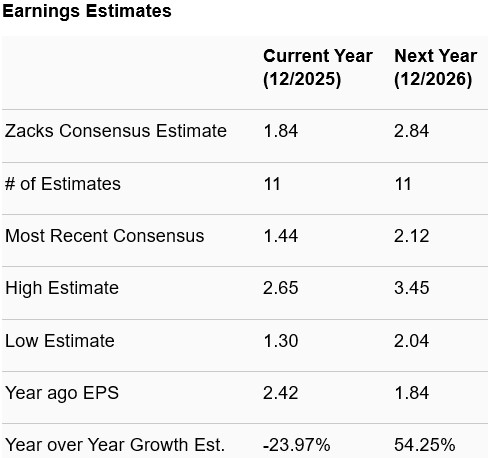

Take a look at the consensus estimates for TSLA’s bottom line in 2025 and 2026.

At this stage, neither NIO nor Tesla appears to be a compelling buy. But if you're choosing between the two, NIO looks like the better name to keep on your radar in the near term.

NIO shows some promise with improving vehicle margins and an expanding brand portfolio, though it remains unprofitable and faces stiff competition and financial constraints. Investors would be wise to wait for NIO’s upcoming quarterly results next week to assess whether it can maintain its delivery guidance and continue margin progress.

Tesla, meanwhile, is betting big on future tech with its robotaxi rollout. But with shares already up 35% in a month—reflecting much of the hype—this may be an opportune time for existing investors to book profits. It’s best to stay on the sidelines until Tesla’s robotaxi launch proves it can meet expectations.

Tesla currently carries a Zacks Rank #5 (Strong Sell), while NIO has a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 44 min | |

| 51 min |

Stock Market Today: Dow Wavers As Nasdaq Struggles; Cruise Line Sails Higher (Live Coverage)

TSLA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

TSLA

Investor's Business Daily

|

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite