|

|

|

|

|||||

|

|

Qualcomm Technologies Inc. QCOM and Broadcom Inc. AVGO are leading semiconductor companies specializing in wireless communication technologies, including 5G connectivity and mobile processors. Qualcomm’s offering includes high-performance, low-power chip designs for mobile devices, PCs, XR (Extended Reality), automotive, wearable, robotics, connectivity and AI (Artificial Intelligence) use cases. The company boasts a comprehensive intellectual property portfolio comprising 3G, 4G, 5G and other technologies.

Broadcom primarily focuses on complex digital and mixed-signal complementary metal oxide semiconductor-based devices and analog III-V-based products. Its semiconductor solutions are used in end products such as enterprise and data center networking, home connectivity, set-top boxes, broadband access, telecommunication equipment, smartphones and base stations, data center servers and storage systems, factory automation, power generation and alternative energy systems and electronic displays.

With growing AI proliferation in PCs, smartphone, automotive and IoT applications, both Qualcomm and Broadcom have the wherewithal to cater to the evolving demands of business enterprises. Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

Qualcomm is well-positioned to meet its long-term revenue targets driven by solid 5G traction, greater visibility and a diversified revenue stream. The company is increasingly focusing on the seamless transition from a wireless communications firm for the mobile industry to a connected processor company for the intelligent edge. It recently introduced Qualcomm X85 5G Modem-RF, powered by Qualcomm’s 5G AI Processor. The solution is designed to deliver the fastest, battery efficient and most consistent 5G connectivity to Android users. The solution is already gaining market traction from the world’s leading network operators.

The company is strengthening its foothold in the mobile chipsets market with innovative product launches. It had extended its Snapdragon G Series portfolio with the addition of next-generation gaming chipsets, Snapdragon G3 Gen 3, Snapdragon G2 Gen 2 and Snapdragon G1 Gen 2 chips. Samsung, one of the major smartphone manufacturers, has deployed the Snapdragon 8 Elite Mobile Platform for its premium S25, S25 Plus and S25 Ultra devices. It is also placing strong emphasis on developing advanced chipsets for the emerging market of AI PCs. The company has inked agreements to acquire MovianAI to augment its efforts in fundamental AI research.

Despite efforts to ramp up its AI initiatives, Qualcomm has been facing tough competition from Intel Corporation INTC in the AI PC market. Shift in the share among OEMs at the premium tier has reduced Qualcomm's near-term opportunity to sell integrated chipsets from the Snapdragon platform. The company is also facing stiff competition from Samsung’s Exynos processors in the premium smartphone market, while MediaTek is gaining market share in the mid-range and budget smartphone market. Competition is also likely to come from formidable rivals like Broadcom and NVIDIA Corporation NVDA. Qualcomm’s extensive operations in China are further likely to be significantly affected by the U.S.-China trade hostilities.

Broadcom is benefiting from a strong demand for its networking products and custom AI accelerators (XPUs). XPUs are necessary to train Generative AI (GenAI) models, requiring complex integration of compute, memory and I/O capabilities to achieve the necessary performance at lower power consumption and cost. Its next-generation XPUs are in 3 nanometers and will be the first of the kind to market in that process node. Broadcom remains on track for volume shipment of these XPUs to its hyperscale customers in the second half of fiscal 2025. The company envisions massive opportunities in the AI space as specific hyperscalers have started to develop their XPUs.

In addition, Broadcom has been aggressively pursuing strategic acquisitions to diversify end markets beyond semiconductors and has been looking to strengthen its presence in the infrastructure software vertical. Acquisitions of CA and Symantec’s enterprise security business have expanded its addressable market. The acquisition of LSI Corporation has helped it to diversify its existing business line from wired infrastructure, wireless and industrial businesses into the storage chip market. The addition of Brocade has enabled Broadcom to penetrate the FC SAN market and garner competitive prowess, while the acquisition of VMware has benefited Infrastructure software solutions.

However, the company faces significant competition in most of its operating markets, leading to intense pricing pressure that adversely impacts margins. In the FBAR technology market, the company faces significant competition from Skyworks surface acoustic wave (SAW) filters, while the acquisition of Brocade makes it a direct competitor of Cisco in the FC SAN market. Broadcom’s frequent acquisitions have further escalated integration risks.

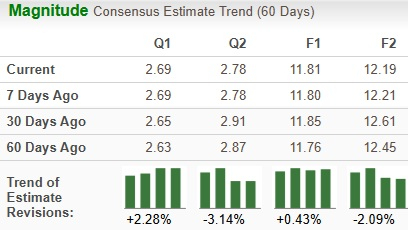

The Zacks Consensus Estimate for Qualcomm’s 2025 sales and EPS implies year-over-year growth of 11.8% and 15.6%, respectively. The EPS estimates have been trending northward on average over the past 60 days.

The Zacks Consensus Estimate for Broadcom’s 2025 sales suggests year-over-year growth of 21%, while that for EPS implies a rise of 35.9%. The EPS estimates have been trending northward over the past 60 days.

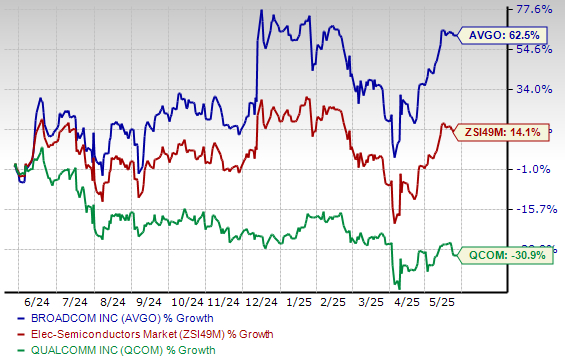

Over the past year, Qualcomm has declined 30.9% against the industry’s growth of 14.1%. Broadcom has gained 62.5% over the same period.

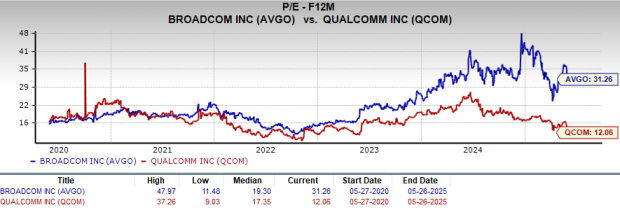

Qualcomm looks more attractive than Broadcom from a valuation standpoint. Going by the price/earnings ratio, Qualcomm’s shares currently trade at 12.06 forward earnings, significantly lower than 31.26 for Broadcom.

Both Qualcomm and Broadcom carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both companies expect their sales and profits to improve in 2025. Broadcom has shown steady revenue and EPS growth for years, while Qualcomm has been facing a bumpy road. However, with a better price performance and healthy long-term earnings growth expectations of 19.1%, Broadcom is relatively better placed than Qualcomm (long-term earnings growth expectations of 9.1%), although the former is a bit expensive in terms of valuation metrics. Consequently, Broadcom seems to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 35 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite