|

|

|

|

|||||

|

|

NIKE Inc. NKE stock slipped below its 50-day simple moving average (SMA) on May 23, 2025, indicating a short-term bearish sentiment. On May 23, the NKE stock closed at $60.02, pushing below the 50-day SMA of $60.89. The stock of this athletic apparel and footwear behemoth has been witnessing a significant downtrend in the past three months, which has resulted in a fall below the 50-day SMA on May 23, 2025. Before this, the NKE stock sloped below its 200-day moving average on Feb 28, 2025, and has been trading below the mark since then, indicating a possible long-term downward trend as well.

The 50-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as it is the first marker of an uptrend or a downtrend. SMA is an essential tool in technical analysis that helps investors evaluate price trends by smoothing out short-term fluctuations. This approach provides a clearer perspective on a stock's long-term direction.

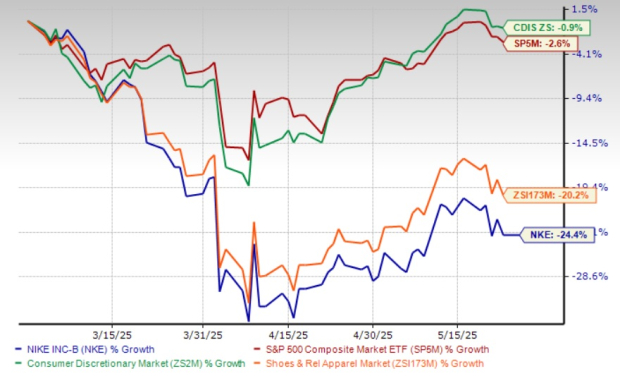

NIKE has shown a lackluster performance, with its shares losing 24.4% in the past three months compared with the Zacks Shoes and Retail Apparel industry’s decline of 20.2%. The NKE stock has also underperformed the broader Zacks Consumer Discretionary sector and the S&P 500's declines of 0.9% and 2.6%, respectively, in the same period.

NKE’s performance is notably weaker than that of its competitors, adidas AG ADDYY, Caleres CAL and Carter's Inc. CRI, which have recorded declines of 5.2%, 1.2% and 23.9%, respectively, in the past three months.

At its current price of $60.02, NIKE’s stock trades 38.8% below its 52-week high mark of $98.04 but stays 14.8% above its 52-week low of $52.28.

The recent price action is the result of the concerns surrounding NIKE’s growth prospects, including tough operating conditions, led by weakness in its lifestyle segment and a decline in digital sales, reflecting shifting consumer preferences. The company is also grappling with lower retail traffic and sell-through rates in Greater China, a key market in its global strategy. These factors have contributed to slower revenue growth and tighter profit margins.

Additionally, management’s cautious commentary regarding the potential impacts of evolving tariff dynamics, particularly tariff impositions on footwear and other merchandise, has contributed to the recent deceleration in share price momentum.

NKE faces mounting headwinds as it enters the fourth quarter of fiscal 2025 with a notably cautious outlook. The company warned of mid-teen revenue declines, albeit toward the lower end, pressured by shipment timing disruptions in North America, adverse foreign exchange rates and the looming effects of new tariffs on imports from China and Mexico.

Adding to the strain, NIKE anticipates a steep 400-500-basis-point contraction in the gross margin, reflecting the lingering impacts of prior-year restructuring charges and persistent margin pressures. While the company continues to focus on cost control, SG&A expenses are projected to grow in the low to mid-single digits, squeezing profitability. External risks, ranging from geopolitical instability and currency fluctuations to softening consumer sentiment, are amplifying the uncertainty, casting a shadow over NIKE’s short-term growth and earnings prospects.

The Zacks Consensus Estimate for NIKE’s fiscal 2025 EPS was unchanged in the last 30 days, while the same for the fiscal 2026 EPS moved down by a penny.

For fiscal 2025, the Zacks Consensus Estimate for NIKE’s revenues and EPS implies year-over-year declines of 10.7% and 45.6%, respectively. For fiscal 2026, the consensus mark for revenues and EPS indicates 1.4% and 9.8% year-over-year declines, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Is it the right time to stock up on shares, or should you book profits? Let us delve deeper into the company’s fundamentals.

NKE remains the global leader in athletic footwear and apparel, driven by unmatched brand equity, deep cultural relevance, and a powerful global distribution network. Despite near-term pressures from tariffs to inventory normalization, management is actively executing its “Win Now” strategy, focused on revitalizing growth through tighter inventory control, accelerated innovation and strengthened wholesale partnerships. These efforts aim to stabilize the company’s performance in fiscal 2025 and lay the groundwork for a stronger rebound in fiscal 2026.

Looking ahead, NIKE is doubling down on its sports-driven identity with faster product development via its new “Speed Lane” model, expansion into high-growth performance categories, and bold marketing to reinforce its cultural edge. Strategic retail enhancements and a shift toward full-price, digitally led sales are expected to support brand elevation and margin recovery. With strong brand fundamentals, decisive leadership and a clear roadmap, NIKE is well-positioned for long-term, profitable growth.

NIKE undoubtedly commands a high valuation for several compelling reasons, mainly rooted in its brand strength and long-term strategic execution. However, we believe that its valuation is too stretched at this time.

NKE is currently trading at a forward 12-month P/E multiple of 30.86X, exceeding the industry average of 24.21X and the S&P 500’s average of 21.36X.

At 30.86X P/E, NIKE is trading at a valuation much higher than its competitors. Its competitors, such as adidas, Caleres and Carter’s, are trading at lower multiples. adidas, Caleres and Carter’s have forward 12-month P/E ratios of 23.85X, 5.05X and 9.21X — all significantly lower than NIKE.

NIKE earns its premium valuation not just on legacy performance but on a foundation of innovation, execution and enduring brand relevance that positions it for sustained, long-term success. Initiatives like the “Win Now” strategy, digital transformation, and retail elevation demonstrate NKE’s ability to proactively address challenges and reinvest in growth. While success in these areas can strengthen its market leadership, failure can pose serious challenges for this athletic wear giant. At this moment, its current valuation seems unwarranted.

NIKE is a dominant force in the global athleticwear industry, backed by a legacy of innovation, strong brand equity and a clear strategic direction. Its long-term potential is underpinned by bold initiatives like the “Win Now” strategy, renewed focus on product innovation and an elevated retail experience. These efforts are designed to reignite growth and reinforce NIKE’s leadership as consumer preferences evolve.

However, near-term risks continue to weigh on the stock. NKE’s recent dip below its 50-day SMA, following a sustained slide below the 200-day SMA since February, reflects deteriorating technical momentum and subdued investor sentiment. The stock’s recent price decline, stagnant estimate revisions and a stretched forward P/E highlight market concerns over slowing growth, digital weakness, tariff pressures, margin contraction and the current macro backdrop.

While NIKE’s long-term prospects have been intact, near-term challenges may continue to pressure the stock. For now, a neutral stance appears warranted, with investors likely to await clearer signs of fundamental recovery and improved earnings visibility before turning more constructive. The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 6 hours | |

| 6 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 13 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 16 hours | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite