|

|

|

|

|||||

|

|

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

An Underwhelming Retail Sector Earnings Performance

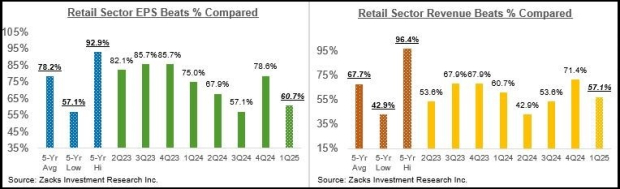

Total Q1 earnings for the 28 of the 33 Retail sector companies in the S&P 500 index that have reported already are up +11.2% from the same period last year on +5.0% higher revenues, with 60.7% beating EPS estimates and 57.1% beating revenue estimates.

Regular users of Zacks Research know that we have a stand-alone economic sector for the Retail sector, unlike the ‘official’ Standard & Poor’s classification that places retailers in the Consumer Discretionary and Consumer Staples sectors. The Zacks Retail sector includes online vendors like Amazon AMZN, restaurant operators like McDonald's MCD, and conventional retailers like Walmart WMT and Target TGT.

The comparison charts below show the Q1 EPS and revenue beats percentages for these companies in the context of what we had seen from the same group of 28 Retail sector companies in other recent periods.

As you can see above, these Retail sector companies have been struggling to beat EPS and revenue estimates.

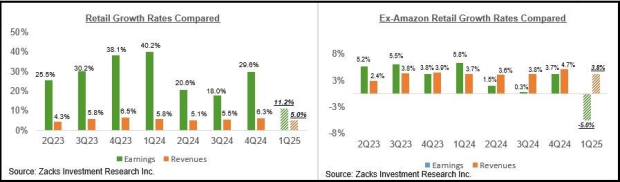

The comparison charts below show this group’s earnings and revenue growth rates in a historical context. The right-hand chart shows the group’s earnings and revenue growth pace on an ex-Amazon basis.

As you can see below, the group’s +11.2% earnings growth drops to a decline of -5.0% once Amazon’s substantial contribution is excluded from the numbers.

If we look at Retail sector earnings on an annual basis, the expectation is for +4.1% earnings growth this year, which follows +22.7% growth in 2024. But as we saw with the Q1 earnings results, all of that growth is coming from Amazon, with this year’s +4.1% earnings growth dropping to -0.6% and last year’s +22.7% dropping to +1.8% once Amazon’s contribution is excluded from the sector’s numbers.

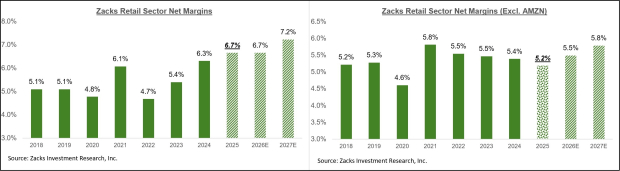

A significant part of the sector’s earnings challenge is a result of margin pressures, with the logistics associated with e-commerce sales forcing retailers to spend heavily on fulfillment and deliveries.

You can see this in the chart below that shows the sector’s net margins on an annual basis. The left-hand side showing the sector as a whole and the right-hand side showing the sector’s margins excluding Amazon.

As you can see above, Retail sector margins outside of Amazon have been on a downtrend since 2021, with this year’s margins expected to serve as a bottom and start recovering going forward.

Evolving Expectations for 2024 Q2 and Beyond

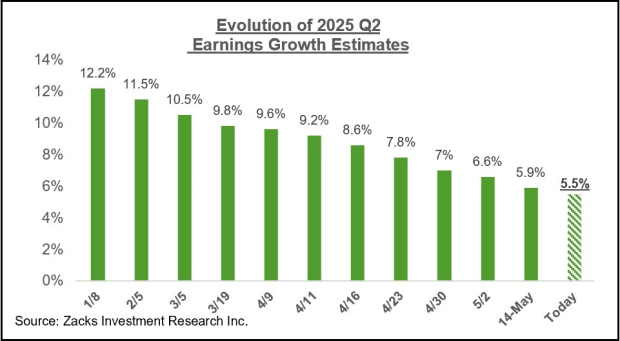

The start of Q2 coincided with heightened tariff uncertainty following the punitive April 2nd tariff announcements. While the onset of the announced levies was eventually delayed for three months, the issue has understandably weighed heavily on estimates for the current and coming quarters.

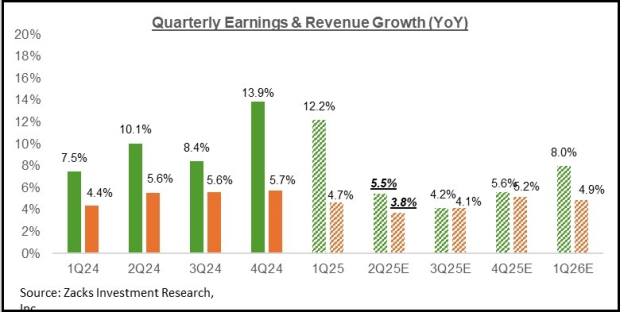

The expectation at present is for Q2 earnings for the S&P 500 index to increase by +5.5% from the same period last year on +3.8% higher revenues. The chart below shows how Q2 earnings growth expectations have evolved since the start of the year.

While it is not unusual for estimates to be adjusted lower, the magnitude and breadth of Q2 estimate cuts are greater than we have seen in the comparable periods of other recent quarters.

Since the start of the quarter, estimates have come down for 15 of the 16 Zacks sectors, with the biggest declines for the Transportation, Autos, Energy, Construction, and Basic Materials sectors. The only sector experiencing favorable revisions in this period is Aerospace.

Estimates for the two largest earnings contributors to the index – Tech & Finance – have also declined since the quarter began.

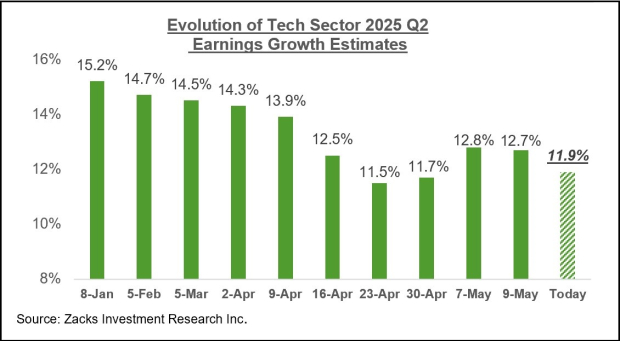

Tech sector earnings are expected to be up +11.9% in Q2 on +9.9% higher revenues. While these earnings growth expectations are materially below where they stood at the start of April, the revisions trend appears to have notably stabilized lately, as we have been flagging in recent weeks. You can see this in the sector’s revisions trend in the chart below.

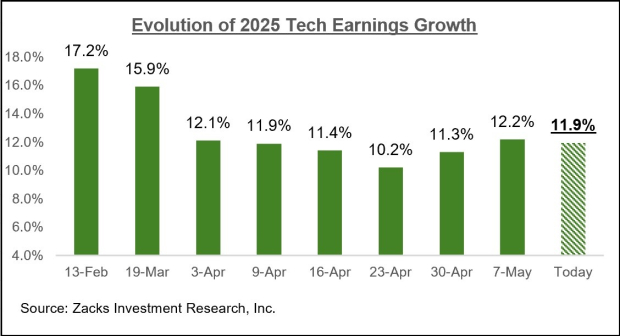

This stabilizing turn in the Tech sector’s revisions trend can be seen in expectations for full-year 2025 as well, as the chart below shows.

The above two charts show that estimates for the Tech sector have stabilized and are no longer under the type of downward pressure that we were experiencing earlier. The Tech sector is much more than just any another sector, as it alone accounts for almost a third of all S&P 500 earnings.

The Earnings Big Picture

The chart below shows expectations for 2025 Q1 in terms of what was achieved in the preceding four periods and what is currently expected for the next four quarters.

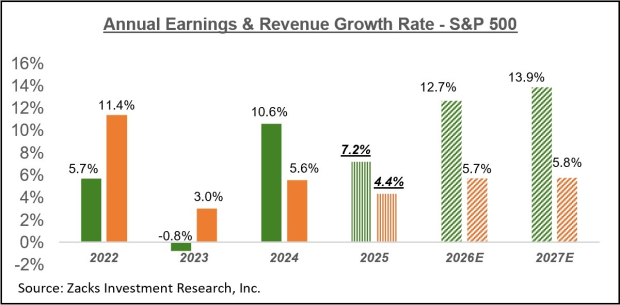

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

While estimates for this year have been under pressure lately, there haven’t been a lot of changes to estimates for the next two years at this stage.

Stocks have recouped their tariff-centric losses, although the issue has only been deferred for now. While some of the more dire economic projections have eased lately, there is still plenty of macro uncertainty that will likely continue to weigh on earnings estimates in the days ahead, particularly as we gain visibility on the tariffs question.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 min | |

| 41 min | |

| 57 min | |

| 57 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

Retail sales unchanged in December from November, closing out year on a lackluster tone

AMZN WMT

Associated Press Finance

|

| 2 hours |

AI Stocks Turn Choppy As Investors Look For Safe Havens From Disruption

AMZN

Investor's Business Daily

|

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite