|

|

|

|

|||||

|

|

Dollar Tree, Inc. DLTR is likely to register a decline in its top and bottom lines when it reports first-quarter fiscal 2025 results on May 3 before the market opens. The Zacks Consensus Estimate for revenues is pegged at $4.5 billion, indicating a drop of 40.5% from the prior-year quarter’s figure.

The consensus estimate for earnings is pegged at $1.20 per share, indicating a decrease of 16.1% from the year-ago period’s figure. The consensus mark has been increased by 2 cents in the past 30 days.

Dollar Tree, Inc. price-consensus-eps-surprise-chart | Dollar Tree, Inc. Quote

The company has a trailing four-quarter negative earnings surprise of 8.4%, on average. In the last reported quarter, this Chesapeake, VA-based company’s earnings missed the Zacks Consensus Estimate by 3.2%.

Dollar Tree’s first-quarter fiscal 2025 results are expected to reflect continued pressures from soft demand for discretionary items owing to reduced spending trends among low-income consumers. Additionally, the company has been facing headwinds related to inflationary pressures and increased interest rates. Adverse foreign currency translations also continue to act as deterrents.

The company has been actively evaluating and adjusting its sourcing strategies to address the risk associated with the additional tariffs. This includes diversifying its supplier base, exploring alternative manufacturing locations outside the impacted regions, and leveraging long-term supplier partnerships to negotiate better terms. It is also enhancing its supply chain agility to quickly adapt to shifting trade policies. However, these adjustments may lead to transitional inefficiencies and added short-term costs, which could impact first-quarter results.

The company has been witnessing higher selling, general and administrative (SG&A) expenses for a while, owing to elevated operating costs. These factors are expected to have collectively marred the top and bottom lines in the fiscal first quarter.

On the last reported quarter’s earnings call, management had expected consolidated net sales to be in the band of $4.5-$4.6 billion, down from $7.6 billion seen in the year-ago quarter and adjusted EPS between $1.10 and $1.25, reflecting the full burden of shared services costs without any offsetting TSA reimbursements.

Earnings are expected to include a negative impact of 30-35 cents per share due to shared service costs tied to the Family Dollar sale, mostly concentrated in the first two quarters of fiscal 2025. While these costs will be incurred throughout 2025, the company will only receive reimbursement in the second half under a Transition Services Agreement (“TSA”), anticipated to begin upon the sale closing in June 2025.

On the positive front, DLTR is expected to have displayed continued progress on its restructuring and expansion initiatives, driven by steady store openings and the improvement of distribution centers, which is likely to have partly cushioned revenues. The company’s progress on optimizing its store portfolio through store openings, renovations, re-banners and closings bodes well.

For the fiscal first quarter, management predicted comps growth of 3-5%. Our model predicts a 4.7% year-over-year increase in comps for the Dollar Tree banner.

Our proven model predicts a likely earnings beat for Dollar Tree this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is exactly the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Dollar Tree has an Earnings ESP of +7.86% and a Zacks Rank of 3.

From a valuation perspective, Dollar Tree shares present an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 16.47X, below the five-year median of 17.86X and the Retail-Discount Stores industry’s average of 33.28X, the company’s shares offer compelling value for investors seeking exposure to the sector. Additionally, the stock currently has a Value Score of A, further validating its appeal.

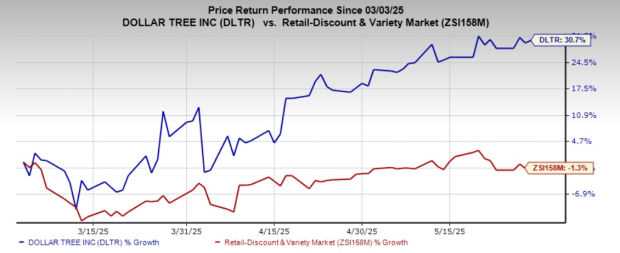

Recent market movements show that Dollar Tree’s shares have gained 230.7% in the past three months against the industry’s 1.3% decline.

Dollar General Corporation DG currently has an Earnings ESP of +3.15% and a Zacks Rank #3. The Zacks Consensus Estimate for first-quarter fiscal 2025 earnings per share is pegged at $1.47, implying a 10.9% year-over-year decline. Dollar General’s top line is expected to rise year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for quarterly revenues is pegged at $10.28 billion, which indicates an increase of 3.7% from the figure reported in the prior-year quarter. DG delivered a trailing four-quarter earnings surprise of 1.2%, on average.

The Kroger Co. KR currently has an Earnings ESP of +0.38% and a Zacks Rank of 3. KR’s top line is anticipated to advance year over year when it reports first-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $45.38 billion, which indicates a 0.3% rise from the figure reported in the year-ago quarter.

The company is expected to register an increase in the bottom line. The consensus estimate for Kroger’s first-quarter earnings is pegged at $1.44 per share, up 1% from the year-ago quarter. KR delivered a trailing four-quarter earnings surprise of 2%, on average.

Victoria's Secret & Co. VSCO currently has an Earnings ESP of +54.55% and a Zacks Rank #3. The Zacks Consensus Estimate for current-quarter earnings per share is pegged at 4 cents, down from 12 cents registered in the year-ago period.

Victoria's Secret's quarterly revenues are pegged at $1.33 billion, which indicates a decline of 2.1% from the prior-year quarter. VSCO delivered a trailing four-quarter earnings surprise of 12.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite