|

|

|

|

|||||

|

|

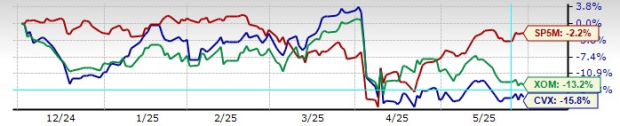

Chevron Corporation CVX has seen its stock drop roughly 16% over the past six months, falling behind both the S&P 500 and large-cap energy peers like ExxonMobil XOM. For a company known for its scale, dividend reliability and global footprint, this sharp underperformance has left many investors wondering what’s gone wrong and whether it’s time to re-evaluate the stock’s near-term investment appeal.

In this article, we break down the mounting challenges that explain Chevron’s recent slide. From geopolitical setbacks in Venezuela to legal wrangling over its Hess Corporation HES acquisition and earnings underperformance, the energy giant is facing pressure on multiple fronts. Let’s examine why the stock’s recent decline may not be a buying opportunity, but a warning sign.

One major factor behind Chevron’s declining fundamentals is the abrupt halt to its Venezuelan operations. Following the expiration of its U.S. license on May 27, 2025, the company is now barred from exporting oil or generating revenue from its joint ventures in the country, operations that previously produced around 150,000 barrels per day of hydrocarbons. At $60 oil, that’s a hit worth roughly $3 billion annually.

These weren’t just large volumes of oil — they were low-cost, high-margin barrels that didn’t need much reinvestment. Losing them takes away a key source of steady cash flow for Chevron, right when oil prices are shaky and margins are under pressure. Replacing that with more expensive U.S. shale isn’t easy, since those wells need ongoing spending just to keep production steady.

Chevron’s proposed $53 billion acquisition of Hess Corporation (HES) was intended to offset some of that lost volume — but the deal has only deepened investor uncertainty. First, there’s dilution: the stock-and-share deal will increase Chevron’s share count by up to 20%, putting immediate pressure on earnings per share. That’s already a concern in a weak-margin environment.

Second, and perhaps more damaging, is the legal dispute now underway. ExxonMobil has challenged the deal, arguing that it has the right of first refusal on Hess’s 30% stake in the lucrative Stabroek block offshore Guyana. The outcome, expected in Q3 2025, could determine whether Chevron can move forward with the acquisition at all. A ruling against Chevron would gut the deal’s strategic rationale and could lead to an abrupt loss of long-term growth assumptions already priced into the stock.

Muted sales growth has also been a driving force behind the poor share performance over recent years. Sales of $47.6 billion in its latest period fell 2.3% year over year, which followed negative growth rates in some of the prior periods of the recent past. Meanwhile, pre-tax profit plunged 30% to $5.6 billion in Q1 due to a 3% rise in total costs. As a result, pre-tax margins narrowed significantly. This is especially concerning as Chevron shifts toward shorter-cycle, reinvestment-heavy shale projects to maintain production.

Investors hoping for a rebound won’t find comfort in Wall Street’s forecast revisions. Chevron’s 2025 EPS estimate has fallen from $10.34 to $6.85 over the past 60 days — a 34% drop. Next year’s projections are similarly down, from $12.30 to $8.74. That kind of downgrade implies not only lower earnings power but also falling investor conviction in the company’s ability to execute.

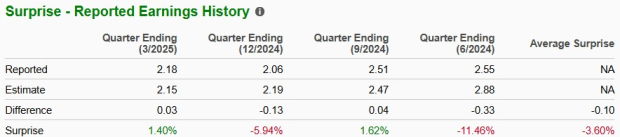

These revisions have been reinforced by poor earnings execution. Chevron has missed the Zacks Consensus EPS estimate by an average of 3.6% across the last four quarters. This consistent underperformance has further eroded confidence and helped fuel the stock’s downward momentum.

Despite the growing list of headwinds, Chevron remains expensive relative to its peers. Its forward 12-month P/E multiple stands near 18X, exceeding ExxonMobil’s 15.63X. This premium is difficult to justify given the margin pressures, Venezuela loss and unresolved Hess litigation. The company has a Zacks Value Score of D, a sign that the stock offers little in the way of valuation comfort amid deteriorating fundamentals.

Chevron’s dividend yield above 5% is still attractive at face value. However, sustaining meaningful dividend growth may become harder going forward. The reasons are straightforward: the loss of free cash flow from Venezuela, rising reinvestment demands in shale, and the added capital strain from the Hess transaction. With a narrower cash buffer and greater operational complexity, Chevron may have to balance future payouts more cautiously.

Chevron stock’s decline over the past six months looks more like a signal than a blip. The company faces a complex mix of operational setbacks, legal entanglements, declining margins, and weakening earnings power. What’s more, Wall Street has taken note, slashing growth expectations and lowering estimates across the board. The stock’s premium valuation only adds to the case for caution.

Chevron is currently a Zacks Rank #5 (Strong Sell), reflecting negative estimate revisions, soft execution, and an unfavorable outlook within the broader oil/energy industry. For now, it’s best to stay away from Chevron stock for now rather than betting on a turnaround that remains far from certain.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Stock Market Today: Dow Rises Ahead Of Fed Minutes; Nvidia Jumps On Meta Deal (Live Coverage)

CVX

Investor's Business Daily

|

| Feb-18 | |

| Feb-17 |

Warren Buffett's company invests in The New York Times 6 years after he sold all his newspapers

CVX

Associated Press Finance

|

| Feb-17 |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

CVX

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite