|

|

|

|

|||||

|

|

Mission Produce Inc. AVO is likely to witness top and bottom-line declines when it reports second-quarter fiscal 2025 results on June 5, after market close. The Zacks Consensus Estimate for fiscal second-quarter sales is pegged at $282.1 million, indicating a 5.2% decrease from the year-ago quarter's reported figure.

The consensus estimate for the company's fiscal second-quarter earnings is pegged at 3 cents per share, suggesting a 78.6% decline from the year-ago quarter’s actual. Earnings estimates have been unchanged in the past 30 days. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

The Oxnard, CA-based company has been reporting steady earnings outcomes, as evident from its top and bottom-line surprise trends in the trailing three quarters. Mission Produce delivered an earnings surprise of 900% in the last reported quarter. Given its positive record, the question is, can AVO maintain the momentum?

Our proven model does not conclusively predict an earnings beat for AVO this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Mission Produce has an Earnings ESP of 0.00% and a Zacks Rank of 3. You can see the complete list of today's Zacks #1 Rank stocks here.

Mission Produce is expected to have sustained its growth momentum in second-quarter fiscal 2025, underpinned by resilient global demand, strategic diversification and strong operational agility. The rise in avocado consumption, fueled by health-conscious consumer trends and growing popularity in emerging markets, is expected to continue supporting AVO’s international farming model. Additionally, optimized distribution channels position it to capitalize on these enduring tailwinds.

While short-term challenges, such as supply shifts in Mexico, may create volatility, Mission Produce’s proactive diversification, operational discipline and strategic foresight offer a strong foundation for sustained growth and profitability. This is expected to have bolstered the second-quarter fiscal 2025 top line and volumes.

Mission Produce, Inc. price-eps-surprise | Mission Produce, Inc. Quote

On the last reported quarter’s earnings call, the company projected the avocado industry volumes to remain consistent year over year, with Mexican supply tapering due to a lighter-than-expected harvest. However, this is likely to be offset by a faster-than-usual ramp-up in California and Peru’s crop, aided by favorable weather. This dynamic is expected to support a 5% year-over-year increase in average avocado pricing in the fiscal second quarter, signaling robust demand despite inflationary headwinds.

The Blueberry segment is also on track for a strong performance, with total harvest volumes projected to rise 35-40% in second-quarter fiscal 2025, driven by expanded acreage and improved yields. Approximately 20% of the Peruvian crop is expected to be sold in the quarter, aligning with last year’s seasonal cycle. While average prices may decline sequentially, they are projected to remain in line with second-quarter fiscal 2024, reflecting a normalized supply-demand environment and healthy production momentum.

Additionally, Mission Produce’s ongoing investments in vertical integration, digital innovation and geographic diversification are expected to improve operational efficiency and asset utilization, particularly in its International Farming segment. This sets the stage for longer-term margin recovery despite near-term cost pressures and tariff uncertainties.

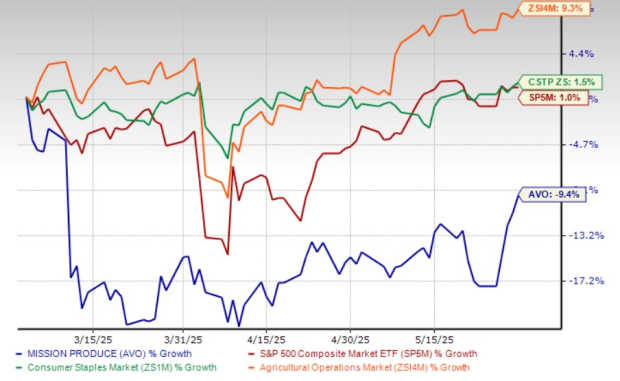

Mission Produce’s shares have exhibited a downtrend in the past three months, losing 9.4% against the industry’s growth of 1.5%. Meanwhile, the company has underperformed the Zacks Consumer Staples sector and the S&P 500’s growth of 9.3% and 1%, respectively.

AVO stock has also underperformed industry peers, including Archer Daniels Midland Company ADM, Corteva Inc. CTVA and Calavo Growers CVGW, which rallied 3.7%, 17.3% and 21%, respectively, in the past three months.

At its current price of $11.18, the AVO stock trades 17.2% above its 52-week low of $6.54. Moreover, Mission Produce’s current stock price stands 26.7% below its 52-week high of $15.25.

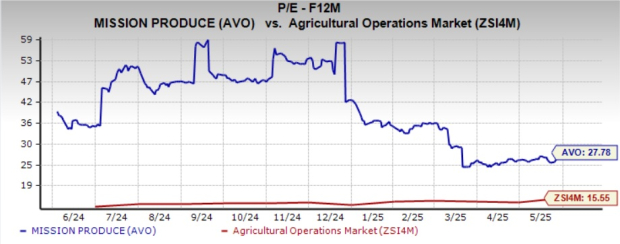

From the valuation standpoint, the company trades at a forward 12-month P/E multiple of 27.78X, exceeding the industry average of 15.55X and the S&P 500’s average of 21.71X.

The premium valuation suggests that investors have strong expectations for Mission Produce’s future performance and growth potential. However, the stock currently seems somewhat overvalued. As a result, investors may be hesitant to buy at these elevated levels and prefer to wait for a more favorable entry point.

Image Source: Zacks Investment Research

Mission Produce continues to cement its position as a global leader in the avocado industry, attracting investor interest with its scale, strategic clarity and consistent execution. AVO leans on a vertically integrated, global footprint with a sharp focus on operational efficiency and international sourcing. With sourcing operations across Mexico, Peru, Colombia and Guatemala, AVO commands a meaningful share of the global avocado supply and is steadily expanding into complementary high-growth categories like blueberries and mangoes.

However, tariff uncertainties remain a variable, especially given Mexico’s central role in sourcing. Temporary tariffs earlier this year created margin pressure and underscored the value of Mission Produce’s global diversification. With alternative sourcing regions like Peru, Colombia and others, and a resilient supply network, the company is well-equipped to absorb geopolitical shocks, strengthening its case as a long-term growth player in the global produce sector.

Regardless of how Mission Produce's stock responds to its second-quarter fiscal 2025 results, the company’s long-term growth narrative remains compelling. The company’s vertically integrated model, diversified sourcing and expanding multi-category portfolio, anchored by health-forward staples, position it well to benefit from enduring consumer demand trends. While near-term headwinds like inflation, high interest rates and tariff uncertainties may weigh on margins, these pressures appear cyclical rather than structural.

On the financial front, AVO is delivering disciplined, profitable growth, with improvements in adjusted earnings and EBITDA, driven by strong asset utilization and expanding farming operations. Investments in digital innovation are further streamlining logistics and supply-chain efficiency. While some investors may wait for a more attractive valuation, long-term holders can remain confident. The company’s strategic execution and innovation are well-aligned to deliver sustained value over time.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite