|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

PepsiCo Inc. PEP has been witnessing a downtrend in recent months, driven by strong but slowed sales performance, driven by challenges in its North America operations since the start of 2024, including reduced consumer demand and product recalls in the QFNA segment. Additionally, the company expects recent tariff-related headwinds to weigh on its performance in the quarters ahead. However, PEP’s current forward 12-month price-to-earnings (P/E) multiple of 16.26X reflects a discount relative to the Zacks Beverage – Soft Drinks industry’s average of 18.65X, making the stock attractive from a valuation perspective.

PepsiCo’s price-to-sales (P/S) ratio of 1.92X is also below the industry’s 4.44X, adding to investor expectations.

At 16.26X P/E, PepsiCo, which is a leading name in the Beverages – Soft Drinks industry, is trading at a valuation much lower than its competitors. Its competitors, such as The Coca-Cola Company KO, Monster Beverage MNST and Primo Brands Corporation PRMB, are delivering solid growth and trade at higher multiples. Coca-Cola, Monster Beverage and Primo Brands have forward 12-month P/E ratios of 23.48X, 32.7X and 19.79X — all significantly higher than PepsiCo.

Although PEP’s stock valuation is currently lower than that of its industry peers, this gap may not be as advantageous as it appears. The lower price can signal underlying issues rather than presenting a straightforward investment opportunity.

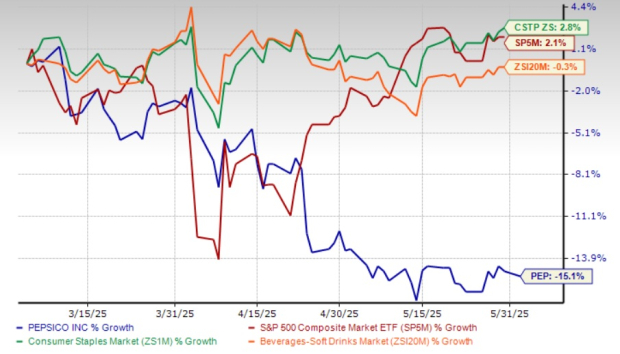

In the past three months, PepsiCo’s shares have lost 15.1% compared with the broader industry’s decline of 0.3%. The company has also underperformed the Zacks Consumer Staples sector’s growth of 2.8% and the S&P 500’s rise of 2.1%.

PEP’s performance is notably weaker than that of its competitors, Coca-Cola and Monster Beverage, which have gained 2.6% and 16.4%, respectively, in the past three months. Also, the stock has underperformed Primo Brands, which declined 3% in the same period.

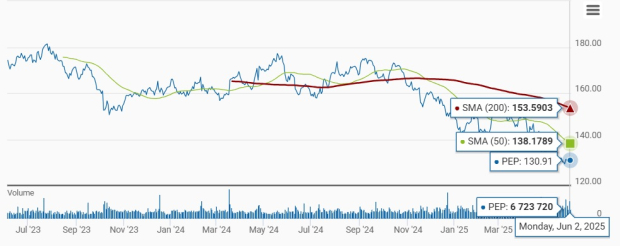

PEP’s current share price of $130.91 is 27.6% below its recent 52-week high mark of $180.91. Also, the stock trades 2.5% above its 52-week low of $127.75. PepsiCo trades below its 50 and 200-day moving averages, indicating a bearish sentiment.

With an attractive valuation and declining share price, it remains to be seen how much potential the stock holds at the current levels.

PEP stock has lost significant momentum in recent months, reflecting mounting investor concerns over persistent revenue softness, especially in North America, and an uninspiring start to 2025. The company reported just 1.2% organic revenue growth in first-quarter 2025, or 2% when adjusted for international calendar differences. Weakness in the PepsiCo Foods North America (“PFNA”) segment and a decline in Asia Pacific Foods weighed heavily. The core issue is that consumers remain price-sensitive amid inflationary strain, leading to reduced spending on discretionary items like snacks and hurting key brands such as Frito-Lay.

PepsiCo’s segment results were mixed, underscoring internal imbalances. PFNA saw a 2% organic revenue decline and a 7% drop in core operating profit, driven by fixed-cost deleverage and strategic investments. While Quaker Foods rebounded after last year’s recall, it could not fully offset the softness at Frito-Lay. On the brighter side, Beverages North America delivered improved sales and margin performance, and the international business continued to expand, though at a more moderate pace. These uneven results raise concerns about the company’s ability to generate consistent, broad-based growth, especially with North America — a key market — under pressure.

Margins also came under scrutiny. The core operating margin declined in the first quarter despite modest gains in the gross margin, as the benefits of PepsiCo’s productivity initiatives, such as automation and supply-chain efficiencies, have yet to fully materialize. Meanwhile, rising input costs and tariff exposure weigh on profitability. Global supply-chain disruptions and uncertain trade dynamics continue to challenge cost control and pricing flexibility, particularly in developed markets, wherein consumer spending remains tight.

These pressures have prompted PepsiCo to revise its 2025 earnings outlook downward. The company expects flat core EPS growth (in constant currency) versus the prior stated mid-single-digit gain. Organic sales are projected to rise only in the low-single-digit range. Given limited near-term operating leverage and constrained pricing power, PepsiCo’s growth outlook remains clouded. Unless the company can accelerate cost-savings or regain pricing leverage, the PEP stock may continue to struggle.

PepsiCo’s EPS estimates for 2025 and 2026 reflect downward revisions following the soft outlook. The Zacks Consensus Estimate for its 2025 and 2026 EPS declined 0.8% and 1.1%, respectively, in the last 30 days. The downward revision in earnings estimates indicates that analysts have been losing faith in the company’s growth potential.

The Zacks Consensus Estimate for PEP’s 2025 sales suggests year-over-year growth of 0.4% and that for EPS indicates a decline of 3.6%. For 2026, the Zacks Consensus Estimate for PepsiCo’s sales and EPS implies 3.3% and 5.4% year-over-year growth, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

In light of PEP’s declining fundamentals, mixed segment performance and a reset in earnings expectations, the stock’s recent underperformance appears more symptomatic than opportunistic. While its valuation multiples have fallen below those of industry peers, making it look attractive on the surface, this discount seems more reflective of the company’s weakening growth profile than a true bargain. The stock’s drop in price, coupled with downward revisions in sales and earnings estimates, underscores growing skepticism about its near-term potential.

Though long-term initiatives around productivity and global diversification offer strategic merit, their delayed impacts add to investor hesitation. Until PepsiCo demonstrates tangible improvement in execution, visibility into margin recovery and a return to more consistent top-line momentum, the valuation gap is unlikely to narrow convincingly.

For now, the cautious outlook, estimate revisions and lack of near-term catalysts support a more defensive stance. Investors may be better served by staying on the sidelines, awaiting clearer signs of stabilization before considering re-entry in this Zacks Rank #4 (Sell) stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite