|

|

|

|

|||||

|

|

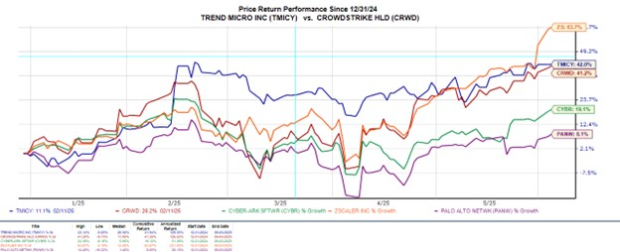

Trend Micro TMICY has joined the growing number of cybersecurity stocks that have gained traction, including CrowdStrike CRWD, CyberArk Software CYBR, Palo Alto Networks PANW, and Zscaler ZS.

Outside of Zscaler, Trend Micro has outperformed most of its popular cybersecurity peers this year and is sitting on gains of over +40%. Offering endpoint, messaging, and web security software, what further separates Trend Micro is its more reasonable valuation, although the growth of these popular cybersecurity firms is starting to justify their premiums to the broader market.

That said, Trend Micro's strong financial results and strategic growth initiatives are very compelling, with TMICY sporting a Zacks Rank #1 (Strong Buy) and landing the Bull of the Day.

At the forefront of Trend Micro’s expansion is its Vision One unified cybersecurity platform, which is designed to provide advanced threat detection, risk management, and security automation across multiple environments for the enterprise.

Simplifying security operations for businesses while providing proactive risk management, Trend Micro serves over 10,000 large enterprise customers worldwide, with Vision One being widely adopted by financial institutions, healthcare organizations, and government agencies.

Highlighted as a leading XDR platform (Extended Detection and Response), enterprises have flocked to Trend Vision One because of the platform's ability to adapt to AI-driven threats, using machine learning to detect and respond to sophisticated cyberattacks. It’s also noteworthy that Vision One protects cloud-native applications and digital workloads, putting Trend Micro in a prime position to compete with Palo Alto Networks, Zscaler, and other cloud security leaders.

Also contributing to Trend Micro’s expansion is that it has multiple partnerships across various industries, including with cloud providers, other cybersecurity firms, and managed service providers:

Microsoft MSFT – Integrates Trend Micro’s security solutions with Azure for enhanced cloud protection.

Amazon’s AMZN AWS – Collaborates on cloud security and threat intelligence for AWS customers.

Alphabet’s GOOGL Google Cloud – Works together on AI-driven cybersecurity and cloud-native security solutions.

Cisco Systems CSCO – Partners on network security and endpoint protection.

VMware – Provides virtualization security for VMware environments.

Outside of traditional cybersecurity for the enterprise, Trend Micro’s Scam Check Tool had 16,000 active users during Q1, boosting its consumer revenue by 14% from the prior year quarter. Based on Zacks' estimates, Trend Micro’s total sales are expected to be up 10% in fiscal 2025 and are projected to rise another 6% in FY26 to $2.11 billion.

Notably, FY26 sales projections would represent 22% growth over the last five years, with Trend Micro’s top line more than doubling over the last decade in correlation with the need to combat the rising number of cyber threats.

Most suggestive of more upside in Trend Micro stock is that FY25 and FY26 EPS estimates are up over 3% and 7% in the last 30 days, respectively. Trend Micro’s annual earnings are now expected to spike 30% this year to $2.05 per share, versus EPS of $1.57 in 2024. Plus, FY26 EPS is projected to rise another 16%.

Making the positive EPS revisions very enticing is that TMICY trades at 37.4X forward earnings, with the next cheapest P/E valuation among its afore-noted cybersecurity peers being Zscaler at 95.5X. In terms of price to sales, Trend Micro also stands out with a forward P/S ratio of 5.4X, which is near the S&P 500 with CrowdStrike, CyberArk, Palo Alto, and Zscaler all trading at a least 14X or more.

While many cybersecurity stocks are intriguing at the moment, investors who may be keeping their risk tolerance in mind could be more comfortable selecting Trend Micro. With its consumer business expansion supporting the growth of the popular Trend Vision One platform, more upside for TMICY looks justified at current levels when considering the premium investors are paying for cybersecurity stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 22 min | |

| 25 min | |

| 36 min | |

| 45 min | |

| 47 min | |

| 48 min | |

| 50 min |

Palo Alto Networks Stock Drops After Earnings; CEO Questions AI Fears

PANW -6.21%

The Wall Street Journal

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite