|

|

|

|

|||||

|

|

Over the past year, Mastercard Incorporated MA has pushed forward a major shift in how people pay online across Europe. It is working toward eliminating manual card entry entirely and moving to 100% tokenized transactions by 2030. So far, it has made strong progress. Nearly 50% of all Mastercard e-commerce transactions in Europe are now tokenized. These payments, including digital wallets, Secure Card on File (SCOF), and Click to Pay, have grown more than 33% year over year.

Moreover, Click to Pay is now active in 26 markets in Europe, with enrollments more than doubling. SCOF is now live in 45 countries and territories. Mastercard has also begun rolling out passkeys, letting users authenticate payments with biometrics like facial recognition instead of passwords.

This transition matters because it directly addresses two major pain points in online shopping. Security threats, like card fraud, are reduced through tokenization, which replaces card numbers with encrypted data specific to each merchant. Also, checkout frustration is eased. Mastercard found that 82% of users feel frustrated by complex online payment processes, and 54% dislike being forced to create accounts during checkout.

This digital push has strong potential to boost Mastercard’s financial performance long term. Higher approval rates from tokenized transactions can drive transaction volumes, meaning more revenue from processing fees. Lower fraud rates reduce costs and make Mastercard more attractive to merchants and financial institutions. By partnering with major players like Santander, PayU, N26, and Delivery Hero, Mastercard is strengthening its position in the European digital payments ecosystem.

In short, Mastercard is building a deeper moat, increasing stickiness with merchants, improving customer experience, and solidifying its lead in the transition to digital-first payments. This positions the company for sustainable growth.

These moves are also expected to boost Mastercard’s Value-Added Services, providing revenue diversification benefits. Revenue from Value-Added Services grew 17.7% in 2023, 16.8% in 2024 and 16% in the first quarter of 2025, indicating an impressive momentum. The company continues to make strategic acquisitions and strike partnerships to further expand its service business and strengthen its cybersecurity capabilities.

Mastercard's strong cash generation ability supports these inorganic growth moves, financial stability and enables substantial share buybacks and dividend payouts. Mastercard generated cash flows from operations of $2.4 billion in the first quarter of 2025, which advanced from the prior-year period’s $1.7 billion.It bought back 4.7 million shares for $2.5 billion in the first quarter and paid out dividends worth $694 million.

The Zacks Consensus Estimate for Mastercard’s EPS indicates growth of 9.4% in 2025 and 16.8% in 2026. Revenues are expected to rise 13.1% and 12%, respectively. The stock has seen two upward earnings estimate revisions over the past month, against no movement in the opposite direction. Mastercard has also beaten earnings estimates in each of the last four quarters, with an average surprise of 3.7%.

Mastercard Incorporated price-eps-surprise | Mastercard Incorporated Quote

Mastercard stock has gained 10.6% over the year-to-date period, outperforming the industry’s 6.4% growth. Competitors like Visa Inc. V jumped 15.8% during this time while American Express AXP grew 0.2%. Meanwhile, the S&P 500 has increased 0.4% in the same period.

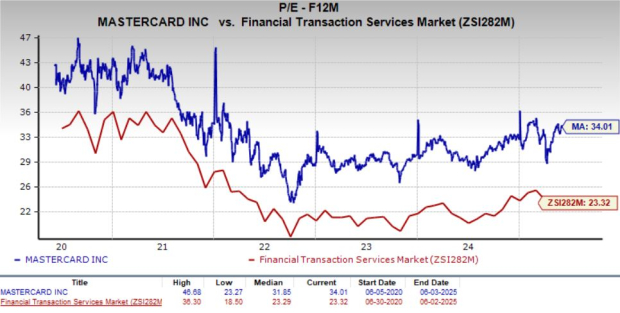

From a valuation standpoint, Mastercard is trading at a forward P/E ratio of 34.01X, higher than its five-year median of 31.85X and well above the industry average of 23.32X. In comparison, Visa trades at 29.70X and American Express at 18.48X. Mastercard’s high valuation raises overvaluation concerns, especially as it trades near its 52-week high of $588.45. MA carries a Value Score of F.

While Mastercard continues to expand its Value-Added Services and strengthen its digital payments strategy, there are several key risks investors should monitor:

Rising costs remain a concern. Adjusted operating expenses have climbed steadily year over year: up 10.7% in 2022, 10.5% in 2023, 11% in 2024, and 12.7% in the first quarter of 2025. At the same time, rebates and incentives, which reduce revenues, rose 16.1% in 2024 and 11.7% in the first quarter of 2025, creating pressure on net revenue growth.

Legal and regulatory headwinds are intensifying. In December 2024, Mastercard settled a major London lawsuit over card fees. It also resolved a workplace pay bias case in early 2025, committing to internal audits. Meanwhile, in the U.S., the Department of Justice has accused both Mastercard and Visa of using their dominant market positions to impose excessive fees on merchants. The Credit Card Competition Act of 2023, if enforced, could increase competitive pressures and limit fee-based revenue streams.

European regulators are also stepping in. Both the European Commission and the U.K.’s Payment Systems Regulator are investigating the recent spike in fees charged by Mastercard and Visa. These inquiries could lead to new rules or fee caps, posing an additional risk to revenue growth in the region.

Mastercard’s digital initiatives, like tokenization, Click to Pay, and passkeys, are driving long-term growth, supported by strong Value-Added Services and rising transaction volumes. Solid cash flows and consistent earnings beats further strengthen its fundamentals. However, rising operating costs, higher rebates, and mounting regulatory pressures in both the United States and Europe pose meaningful risks. Additionally, the stock’s current valuation appears stretched, trading above its historical average and industry peers.

While Mastercard’s outlook remains positive, near-term headwinds and a rich valuation warrant caution. Therefore, with a balanced risk-reward profile, Mastercard currently has a Zacks Rank #3 (Hold), suggesting that investors should stay put for now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 21 min | |

| 3 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite