|

|

|

|

|||||

|

|

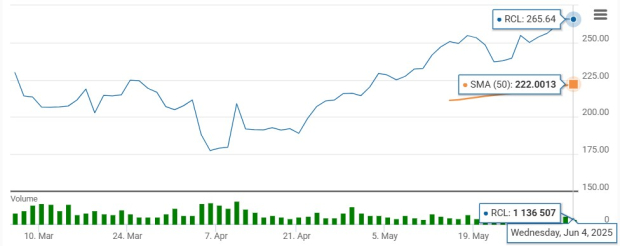

Shares of Royal Caribbean Cruises Ltd. RCL have rallied 17.8% in the past month compared with the Zacks Leisure and Recreation Services industry’s 10.1% rise. Over the same timeframe, the stock has outperformed the S&P 500’s growth of 6.3%.

Royal Caribbean’s recent stock surge has been fueled by reaffirmed confidence in resilient cruise demand and continued strength in consumer spending behavior. While some investors remain cautious due to perceived post-COVID value erosion and pricing concerns, management has emphasized that booking trends for the latter half of 2025 and into 2026 remain strong.

Investor sentiment was further lifted by long-term growth drivers like Perfect Day Mexico and expansion into premium river cruises. With an investment-grade rating and disciplined capital returns, RCL remains well-positioned for continued momentum.

So, the million-dollar question: Should investors jump aboard now or wait for calmer seas? Let’s unpack what’s powering RCL’s growth and whether there’s still time to catch this ship before it sails higher.

Royal Caribbean’s growth trajectory continues to benefit from robust demand for cruise vacations, as evidenced by record-breaking bookings during the 2025 WAVE season. Consumers are demonstrating a strong willingness to spend on leisure travel, particularly when it offers high value, and Royal Caribbean is well-positioned to capture this trend. With bookings for 2025 already outpacing the prior year and higher average per diems supporting yield expansion, the company is capitalizing on its compelling vacation offerings to drive revenue growth.

Fleet expansion is another major catalyst, with Royal Caribbean introducing new, high-performing ships such as Icon of the Seas, Utopia, and the soon-to-launch Star of the Seas and Celebrity Xcel. These vessels are delivering premium pricing and enhanced guest satisfaction due to innovative design and amenities. The deployment of these ships, along with increased capacity across popular markets like the Caribbean and Europe, positions the company to attract new guests and encourage repeat bookings, fueling both occupancy and onboard spending.

Operational efficiency is also playing a critical role in the company’s growth. Royal Caribbean’s ability to tightly manage costs while scaling operations has led to significant margin improvements. In the first quarter of 2025, net cruise costs excluding fuel were nearly flat, and the company reported a 35% EBITDA margin, reflecting a 360-basis-point improvement year over year. This disciplined cost structure, combined with better-than-expected revenue performance, supports continued earnings growth and strong cash flow generation.

Royal Caribbean’s strategic investments in digital innovation and exclusive private destinations are strengthening its competitive edge. Enhanced loyalty programs and app-based engagement are increasing guest retention and pre-cruise spending. Additionally, destination projects like the Royal Beach Club in Paradise Island are designed to offer differentiated experiences that command higher pricing. These initiatives, along with a growing global sourcing strategy, provide a durable foundation for long-term growth.

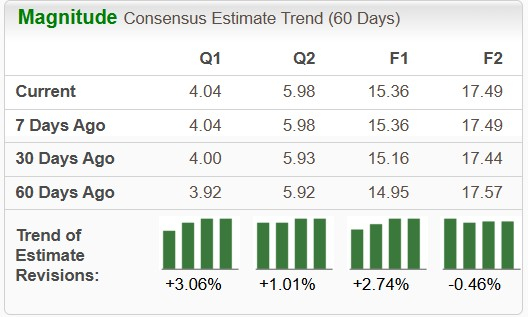

Royal Caribbean’s 2025 earnings per share estimates have been revised upward, increasing from $14.95 to $15.36 over the past 60 days. This upward trend reflects strengthened analyst confidence in the stock’s near-term prospects.

The 60-day earnings estimate growth trend for RCL remains higher for 2025 compared with other industry players, including Carnival Corporation & plc CCL, Norwegian Cruise Line Holdings Ltd. NCLH, and OneSpaWorld Holdings Limited OSW. Over the past 60 days, earnings estimates for 2025 for CCL, NCLH, and OSW have declined 0.5%, 1.9% and 1%, respectively.

Royal Caribbean continues to face a complex set of challenges despite strong demand and brand momentum. The company operates in an environment of heightened macroeconomic uncertainty, with concerns about consumer spending behavior and the overall economy lingering in the background. While cruise bookings remain resilient and the company reports encouraging trends in onboard spending, management remains cautious, expanding guidance ranges to account for potential shifts in consumer sentiment.

Operationally, RCL faces transitional pressures from fleet expansion and new ship rollouts, which are expected to temporarily dampen yield performance in the latter half of the year. The delayed revenue contributions from ships like Star of the Seas, which enter service late in the quarter, create a short-term mismatch between capacity growth and revenue realization. Additionally, cost pressures from ramping up destination investments, such as the Royal Beach Club in Nassau, and retrofitting older ships for higher occupancy present execution risks. While these initiatives are expected to enhance guest experience and long-term competitiveness, they demand precise cost management to protect margins in an uncertain climate.

Royal Caribbean stock is currently trading at a discount. RCL is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 16.33X, below the industry average of 18.16X, reflecting an attractive investment opportunity. Other industry players, such as Carnival, Norwegian Cruise and OneSpaWorld, have P/E ratios of 12.07X, 8.33X and 18.56X, respectively.

From a technical perspective, RCL is currently trading above its 50-day moving average, indicating solid upward momentum and price stability.

While Royal Caribbean’s recent rally, strong bookings, and disciplined cost management highlight its solid execution and growth potential, near-term challenges from macroeconomic uncertainty, rising capital expenditures, and the delayed impact of new ship deployments warrant a cautious approach.

Investors should closely watch Royal Caribbean’s ability to sustain yield growth, manage cost pressures, and execute its fleet expansion and destination strategies without margin erosion. We recommend waiting for a clearer entry point, especially if market volatility presents a more attractive valuation. For current shareholders, maintaining a position in this Zacks Rank #3 (Hold) stock appears reasonable given its long-term growth outlook and strategic positioning.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite