|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

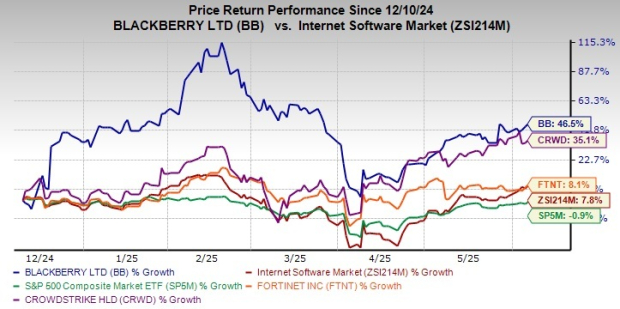

BlackBerry Limited’s BB shares have rallied 46.5% in the past six months, outperforming the Internet Software industry’s growth of 7.8% and the S&P 500 composite’s decline of 0.9%, thereby attracting investors' interest. BB stock inched up 1.5% and closed the session at $4.13, still down 33.8% from its recent 52-week high of $6.24.

Once known for smartphones, BB has made a pivot to cybersecurity and Internet of Things (IoT), focusing on enterprise security, embedded software and auto technology.

BlackBerry has also outperformed peers within the cybersecurity space, such as Fortinet FTNT and CrowdStrike Holdings, Inc. CRWD. Fortinet and CrowdStrike have gained 8.1% and 35.1%, respectively, over the same time frame. FTNT is a provider of network security appliances and Unified Threat Management network security solutions, while CRWD is a leader in next-generation endpoint protection, threat intelligence and cyberattack response services.

Now, the question arises: Does BB’s rally still have room to run, or was the surge a temporary pop driven by speculation? Let’s explore the catalysts behind the surge, the fundamentals, and whether you should hold on or fold.

The renamed QNX division (formerly IoT unit) is being positioned as the strategic core going forward. BlackBerry’s QNX business is gaining from strength in the automotive segment, particularly strong demand for its solutions across the advanced driver assistance systems market and digital cockpit domain. The rapid adoption of the QNX platform in the General Embedded markets is a positive factor. The increasing adoption of the next-generation version of the QNX operating system, SDP 8.0, in the Auto and General Embedded market and the release of the QNX General Embedded Development Platform are positive factors.

Earlier in the year, QNX and Microsoft MSFT partnered to aid automakers in building, validating and refining software within the cloud to power the evolution of SDVs. The partnership will bring the QNX Software Development Platform 8.0 to Microsoft Azure, offering automakers a comprehensive cloud-based environment to accelerate innovation while reducing development risks. Also, QNX and Microsoft plan to extend their collaboration to include the QNX Hypervisor and the QNX Cabin.

Growing momentum in QNX Cabin with multi-year deal wins from the top 10 global auto OEMs further cushions its prospects. Despite delays in automotive software development, QNX’s royalty backlog grew year over year to about $865 million. This shows that QNX is adding future royalty revenues faster than it’s being recognized, which BlackBerry sees as a strong sign of the business’s long-term health.

BlackBerry Limited price-consensus-eps-surprise-chart | BlackBerry Limited Quote

BlackBerry has offloaded its underperforming Cylance unit to Arctic Wolf. The transaction with Arctic Wolf unlocked $80 million in initial cash proceeds and 5.5 million shares, while preserving BlackBerry’s AI/ML patent assets and tax losses. BB expects these tax losses to provide a shield for future profits generated by its U.S. entities.

Momentum in the Secure Communication division, driven by solid operational execution and cost-saving efforts, is working in favor of BlackBerry. Fiscal fourth-quarter revenues of $67.3 million beat the high limit of the company’s forecast ($62-$66 million), driven by strong AtHoc revenues and renewals in the core German market.

Healthy momentum in UEM stemmed from rising deal wins from government agencies, top banks and law firms. Expansion of the deal with the Malaysian government bolsters both the contract length and the number of licenses. The Malaysian government is a great example of successfully using its full Secure Communications portfolio, and it is working to replicate this model in other regions. Management highlights this division to be a key contributor to BlackBerry’s overall EBITDA and cash flow.

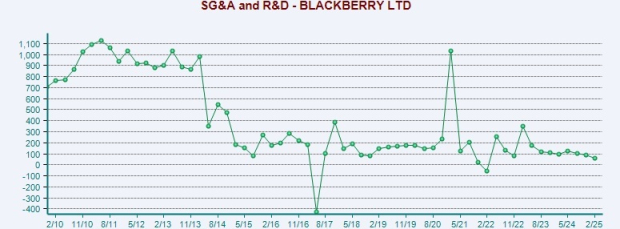

BlackBerry's total adjusted EBITDA for fiscal 2025 was $39.3 million, including Cylance. This is a $54 million improvement from last year after adjusting for the patent sale in early fiscal 2024. Cost-cutting and restructuring measures are driving up profitability for BlackBerry. It has successfully achieved its initial target of cutting back roughly $150 million from its run rate.

Management expects an additional $75 million of cash to be added in fiscal 2026, including the second Cylance payment of $40 million, positioning the company to reinvest or return capital opportunistically.

Due to recent tariff changes, especially on automotive goods, BlackBerry is currently unsure how this will affect its business. While it does not expect a direct impact on products and services, there may be indirect effects on its customers, such as supply chain disruptions and changes in demand. Given the current uncertainty, BlackBerry is maintaining the upper end of the revenue guidance ($260-$270 million) shared at Investor Day in October but widening the lower end. It now expects QNX revenues to fall within the range of $250 million to $270 million.

BB’s QNX backlog may look robust, but the realization of the same may be delayed owing to the ongoing weakness in global auto production, and with several OEMs facing supply chain disruptions and demand uncertainty.

BlackBerry is also taking a cautious stance on the Secure Communications division due to ongoing turmoil in its core government markets. The potential impact of DOGE and other shifts within the U.S. administration, as well as political changes in Canada, Germany and other regions, is likely to create a challenging and unstable environment. While significant effects are yet to be seen, the situation remains unpredictable. These developments could lead to short-term disruptions for the business.

BlackBerry faces increasing competitive pressures in both IoT and cybersecurity businesses.

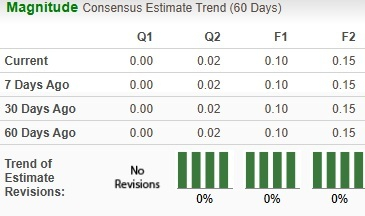

Given the factors, analysts remain cautious, as evidenced by unchanged estimates in the past 60 days.

Though the company's strategic pivot toward high-margin areas, such as IoT and Secure Communications, augurs well, there are several risks that could put downward pressure on the stock price. Its heavy reliance on cost-cutting measures to drive EBITDA, exposure to volatile markets like automotive, and stiff competition in the cybersecurity space remain concerns.

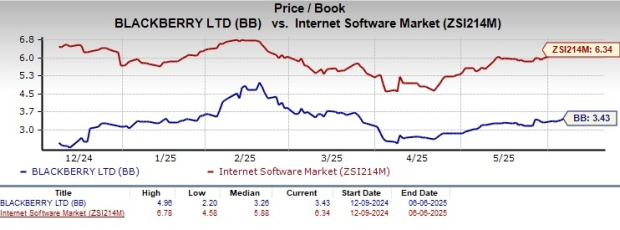

Though BB stock is trading at a discount with a trailing 12-month price/book multiple of 3.43 compared with the industry’s multiple of 6.34, this could mean more risk than opportunity.

Given these factors, investors should exercise caution and wait for a more favorable entry point. Investors holding BB stock should closely monitor how BlackBerry executes its strategic priorities in the coming quarters.

BB currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 21 min | |

| 22 min | |

| 23 min | |

| 1 hour |

Anthropic Jolts Cybersecurity Stocks, JFrog After Finance, Health Care, Legal Drama

CRWD -10.08%

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite