|

|

|

|

|||||

|

|

Dollar Tree, Inc. DLTR saw its shares rise 6.3% following the release of its first-quarter fiscal 2025 results on June 4. This performance outperformed the Zacks Retail - Discount Stores industry and the Zacks Retail and Wholesale sector, which slipped 3.6% and 1.3%, respectively, in the same time frame. However, the S&P 500 advanced 0.9% during the same period.

Dollar Tree has delivered relatively strong stock performance compared to some other major players in the discount retail sector, such as Dollar General Corporation DG, The TJX Companies, Inc. TJX and Costco Wholesale Corporation COST. During the same period, Dollar General Corp., The TJX Companies and Costco Wholesale Corp. posted declines of 0.3%, 2.7% and 5.2%, respectively.

This upswing was fueled by strong quarterly performance, with earnings and sales exceeding analyst expectations and reflecting solid year-over-year growth. The company’s strategic initiatives, including its ongoing store conversions and expansions, have successfully boosted same-store sales by attracting more customers and increasing average spending.

Despite this encouraging momentum, caution remains warranted as Dollar Tree faces near-term challenges. Its outlook for the upcoming quarter anticipates margin pressures stemming from tariff-related costs and transitional expenses linked to the sale of its Family Dollar unit. These factors could temporarily weigh on profitability, suggesting that the recent stock rally may reflect optimism tempered by awareness of short-term hurdles.

This alignment between strong earnings performance and stock price strength raises a critical question for investors: Is the rally a short-term overvaluation or a sustainable growth signal?

Dollar Tree’s strong sales growth was driven by its successful store conversions to the multi-price format and expansion efforts, which attracted more shoppers and encouraged higher spending per visit. This resulted in a robust 11.3% increase in net sales to $4.64 billion, excluding Family Dollar. Same-store sales (comps) grew 5.4%, supported by a 2.5% rise in store traffic and a 2.8% increase in average ticket size.

On the margin side, improved freight efficiency and better occupancy cost leverage helped gross profit rise. However, these gains were partially offset by higher distribution expenses, increased inventory shrinkage, rising wages and store investments. As a result, gross profit increased 11.7% to $1.6 billion with a 20-basis-point expansion in gross margin to 35.6%.

Financially, Dollar Tree remains well-positioned, with a strong liquidity profile and active share repurchase programs underscoring management’s commitment to shareholder value. The impending completion of the Family Dollar sale is expected to streamline operations further and provide additional capital flexibility to support future growth initiatives.

On its last earnings call, Dollar Tree reiterated its fiscal 2025 sales guidance on a continuing operations basis, which includes the Dollar Tree segment, corporate support and other functions. The company’s outlook assumes that the level of tariffs in place as of June 4, 2025, is in effect for the rest of the fiscal year. It is likely to mitigate the majority of the incremental margin pressures from increased tariffs and other input costs. The company revised the adjusted EPS view.

Dollar Tree still projects net sales from continuing operations of $18.5-$19.1 billion, supported by comps growth of 3-5%. Adjusted EPS from continuing operations is projected to be $5.15-$5.65, including the year-to-date share repurchase impacts. Additional share repurchases are not reflected in the revised outlook. It had earlier envisioned the metric to be $5-$5.50.

Dollar Tree appears well-poised for long-term growth, supported by strategic transformation, solid execution and financial resilience. A key driver of momentum is the company's shift to a multi-price strategy, known internally as the “3.0” format. These stores consistently outperform legacy formats, benefiting from broader assortments and higher discretionary sales. The average unit retail remains low at $1.35, and 85% of items are still priced under $2, maintaining the value proposition while adding flexibility in sourcing and pricing. The ongoing rollout of these stores is expected to further support traffic, ticket growth and customer loyalty.

The pending divestiture of Family Dollar is a strategic milestone. It will enable Dollar Tree to sharpen its operational focus, significantly improve cash flow and strengthen the balance sheet. Proceeds from the sale, along with transition service agreements, are expected to enhance liquidity and fund growth initiatives, such as new store openings and store remodels. Additionally, the company has robust strategies in place to offset inflation and tariff-related pressures. These include negotiating with suppliers, shifting country of origin, product redesign and leveraging the expanded price ladder. While second-quarter earnings will face short-term pressure from elevated costs, the company expects to recover in the second half of the year.

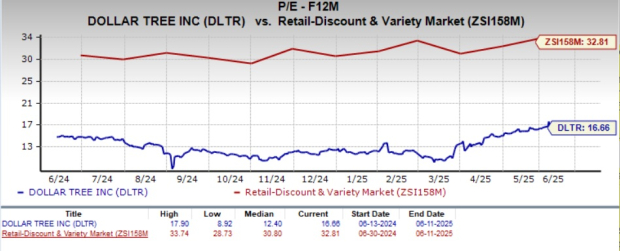

Dollar Tree is currently trading at a notable discount compared to its industry peers, making it an appealing option for value-focused investors. As of now, the company trades at a forward 12-month price-to-earnings (P/E) ratio of 16.66X, which is significantly lower than the industry average of 32.81X. While its valuation is lower than that of Costco Wholesale Corp., which trades at a significantly higher 51.14X, it also remains below other discount retail peers such as Dollar General Corp. and The TJX Companies, which have P/E ratios of 19.01X and 26.90X, respectively.

This lower valuation is not due to a lack of performance or strategic clarity. On the contrary, Dollar Tree is undergoing a meaningful transformation through its multi-price strategy, enhanced store formats and the strategic divestiture of Family Dollar. These moves are positioning the company for margin expansion, stronger customer engagement and long-term earnings growth.

Given this backdrop, Dollar Tree's lower multiple appears less a reflection of risk and more an underappreciation of its future earnings power and improving business model.

Dollar Tree is also trading well above its 50-day and 200-day moving averages, an important bullish technical indicator. This breakout is not just technical but reflects growing market confidence in its growth story.

Reflecting optimism around Dollar Tree, analysts have revised their EPS estimates upward. Over the past 30 days, EPS estimates for the current quarter and fiscal year have increased 3.3% and 3% each to $5.39 and $6.12, respectively. These estimates suggest growth rates of 5.7% and 13.5% year over year, respectively.

Following the post-earnings increase, Dollar Tree presents a promising outlook for investors. The company delivered strong first-quarter results, fueled by continued progress in store conversions to the multi-price format, successful expansion efforts, and robust same-store sales growth driven by increased customer traffic and higher average spending. Despite near-term headwinds such as tariff-related costs and transitional expenses linked to the Family Dollar divestiture, Dollar Tree remains fundamentally sound.

Its shares trade at an attractive valuation compared to industry peers, suggesting upside potential as its strategic initiatives continue to take hold. Analysts have recently revised their earnings estimates upward, indicating growing confidence in the company’s trajectory. While the stock currently carries a Zacks Rank #3 (Hold), reflecting a neutral stance in the near term, Dollar Tree’s long-term fundamentals and transformation efforts make it a compelling name to watch and potentially hold through market fluctuations.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 8 hours | |

| 9 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite