|

|

|

|

|||||

|

|

Costco Wholesale Corporation’s COST May sales results offer fresh insight into the retail giant’s current performance. Known for its steady growth and strong position in the warehouse club space, Costco continues to appeal to long-term investors. However, the latest figures could have a meaningful impact on the stock’s near-term trajectory. Let’s take a closer look at the data to determine whether Costco stock is a buy, hold, or sell after May sales results.

Costco's membership-driven model remains a key driver, with high renewal rates providing a reliable revenue stream. Its efficient supply chain and bulk purchasing power support competitive pricing and market position. The combination of strong customer loyalty and operational efficiency helps Costco maintain an edge in the competitive retail landscape.

For the four weeks ended June 1, 2025, comparable sales in the United States, Canada and Other International markets grew 4.1%, 3.3% and 6.6%, respectively. Total company comparable sales rose 4.3%. This follows gains of 4.4% in April and 6.4% in March, signaling consistent momentum. E-commerce also remained a bright spot, with comparable sales surging 11.6%. (Read: Costco Sales Surge in May: E-Commerce Leads the Way With a 12% Jump)

As a result, Costco's net sales for May increased 6.8% to $20.97 billion, up from $19.64 billion in the same period last year. This follows sales improvements of 7% and 8.6% reported in April and March, respectively, reflecting a strong and consistent sales performance over the past few months.

Costco continues to impress with its stellar revenue performance, showcasing its ability to navigate shifting economic dynamics. The consistent growth in membership fee income, coupled with a high renewal rate of 92.7% in key markets like the United States and Canada, underscores the company’s effective customer retention strategies and strong member engagement.

With a substantial base of paid household members and increasing executive memberships, Costco ensures a steady flow of high-margin recurring revenues. At the end of the third quarter of fiscal 2025, the retailer had 79.6 million paid household members, up 6.8% year over year. Executive memberships, a more profitable segment, grew 9% to 37.6 million, now making up 47.3% of paid members and contributing to 73.1% of global sales.

By steadily enhancing its e-commerce capabilities and investing in fulfillment infrastructure, Costco is creating a more integrated omnichannel shopping experience. Its e-commerce comparable sales rose 14.8% in the third quarter. Notably, Costco Logistics deliveries surged 31%, driven by increasing volumes of large and bulky items. The launch of a Buy Now Pay Later program in partnership with Affirm has offered members greater purchasing flexibility, especially for higher-priced items.

The company takes a measured approach to expanding its global warehouse footprint. During the third quarter, Costco opened nine warehouses — including seven in the United States, one in Japan, and a relocation in Australia — and plans to open 10 more in the final quarter, including its second warehouse in Sweden and 20th in Korea. For fiscal 2025, the company expects 27 total openings (24 net new), bringing its global warehouse count to 914.

Meanwhile, Costco’s disciplined focus on cost control, product mix optimization, and growing penetration of its private-label brand, Kirkland Signature, continues to support margin expansion. Kirkland Signature sales outpaced overall company growth in the third quarter, with penetration rising 50 basis points year over year. The company continues to shift more Kirkland Signature sourcing to the regions where items are sold, helping reduce costs and mitigate tariff impacts.

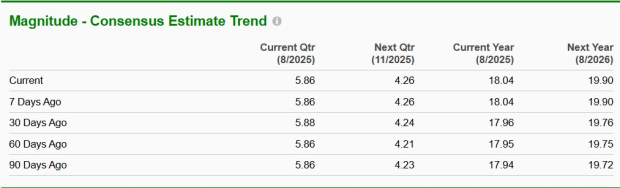

Over the past 30 days, analysts have raised their estimates for the current fiscal year by 8 cents to $18.04. For the next fiscal year, the Zacks Consensus Estimate has increased by 14 cents to $19.90. These estimates suggest year-over-year growth rates of 12% and 10.3%, respectively.

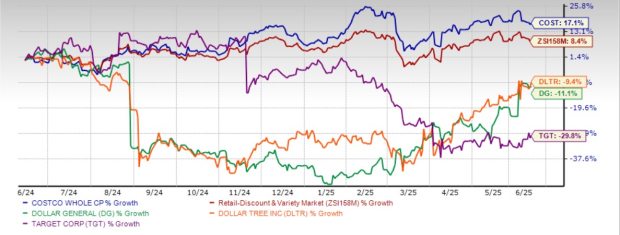

Costco stock has been a standout performer, with shares rallying 17.1% over the past year, outpacing the industry's rise of 8.4%. This impressive growth underscores investor confidence in Costco’s business model.

Costco has even outperformed its peers, such as Dollar General Corporation DG, Dollar Tree, Inc. DLTR and Target Corporation TGT. Shares of Dollar Tree, Dollar General and Target have declined 9.4%, 11.1%, and 29.8%, respectively, in the past year.

However, Costco is trading at a significant premium to its industry peers. Costco's forward 12-month price-to-earnings ratio stands at 51.44, higher than the industry’s ratio of 32.81 and the S&P 500's ratio of 22.02. The stock is also trading above its median P/E level of 50.77, observed over the past year.

Costco is trading at a premium to Dollar General (with a forward 12-month P/E ratio of 19.07), Dollar Tree (16.99) and Target (12.88).

Now, the question arises whether Costco’s current price is warranted or overvalued in today’s market.

Costco’s high valuation shows that investors have strong faith in the company’s steady growth, loyal customer base, and solid business model. This premium may be deserved, given Costco’s consistent performance, but it also means the stock has less room for error. At this level, some of the future growth may already be priced in, making it harder to justify further upside.

Costco's May sales results reaffirm its position as a dependable stock in the retail sector, backed by strong membership growth, consistent comparable sales improvement and solid financial fundamentals. While the stock trades at a premium valuation, this appears justified given its operational resilience, expanding global footprint, and loyal customer base. For long-term investors willing to pay up for quality and stability, Costco remains a compelling choice. However, for value-conscious buyers, the elevated valuation may warrant patience for a more attractive entry point. Costco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 14 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite