|

|

|

|

|||||

|

|

Estee Lauder, the flagship brand of The Estee Lauder Companies Inc. EL, has officially launched its storefront on the Amazon.ca Premium Beauty Store. This move brings the brand’s high-performance skincare, makeup and fragrances to customers across Canada through one of the country’s most trusted e-commerce platforms.

The launch follows Estee Lauder’s debut in the Amazon.com Premium Beauty store in Fall 2024 and marks a significant step in broadening its digital presence in North America.

With the launch, Estee Lauder is offering a curated selection of its best-known products, including the Advanced Night Repair Serum, Double Wear Stay-In-Place Foundation, Revitalizing Supreme+, Re-Nutriv and Futurist Hydra Rescue Moisturizing Foundation. These items are now available for direct purchase through Amazon.ca, making it easier for shoppers from Canada to explore and buy the brand’s high-performance formulas from a trusted online platform.

The storefront is designed to offer a convenient and informative shopping experience, helping customers discover and learn about these iconic products.

Estee Lauder’s arrival on Amazon.ca Premium Beauty adds a new level of convenience for Canada’s beauty shoppers. Prime members can enjoy fast, free delivery, making it easier than ever to receive their favorite products. The collaboration aims to combine Amazon’s trusted service with Estee Lauder’s signature luxury, offering a seamless and elevated online shopping experience.

Estee Lauder is focusing on regaining growth momentum through its Beauty Reimagined strategy, which emphasizes expanding consumer reach, accelerating innovation and boosting brand presence across digital platforms like Amazon and TikTok Shop. The company reported share gains in key markets, including Southeast Asia, the United States, the United Kingdom and Canada, supported by strong performances from brands like Clinique, La Mer, The Ordinary and TOM FORD. These efforts are aimed at strengthening the brand’s global footprint while meeting evolving customer preferences.

The company is advancing its Profit Recovery and Growth Plan (“PRGP”) to support long-term performance and restore sustainable sales growth. As of the third quarter of fiscal 2025, the company approved more than 2,600 net position reductions, streamlining middle management by 20% and cutting executive expenses by 30% through a flatter leadership structure. Procurement and outsourcing initiatives, introduced under the expanded PRGP in February 2025, are also progressing well. These efforts aim to strengthen profitability and build long-term resilience.

In the past month, EL’s shares have gained 9.8% compared with the industry and the S&P 500’s growth of 14.8% and 2.4%, respectively.

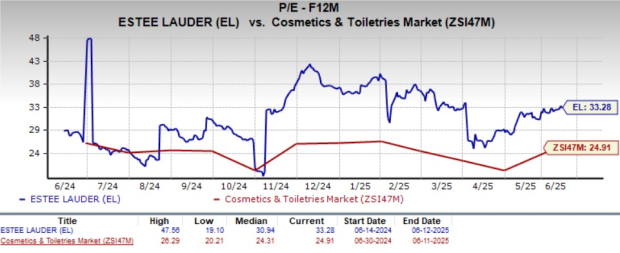

While EL stock has delivered a strong performance, its valuation remains a key factor for consideration. The stock is currently trading at a premium compared with the industry average, with a forward 12-month price-to-earnings ratio of 33.28, well above the industry’s average of 24.91.

For long-term investors, holding onto this Zacks Rank #3 (Hold) stock might still be a viable option. However, prospective investors may want to wait for a more favorable entry point given the stock's current higher valuation.

European Wax Center, Inc. EWCZ operates as the franchisor and operator of out-of-home waxing services. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for European Wax Center’s current fiscal-year earnings indicates growth of 35.6% from the prior-year reported levels. EWCZ delivered a trailing four-quarter earnings surprise of 186.9%, on average.

Urban Outfitters Inc. URBN is a lifestyle specialty retailer that offers fashion apparel and accessories, footwear, home decor and gift products. It currently sports a Zacks Rank #1. URBN delivered a trailing four-quarter average earnings surprise of 29%.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year sales and earnings implies growth of 8.1% and 21.2%, respectively, from the year-ago actuals.

Canada Goose GOOS designs, manufactures and sells performance luxury outerwear, apparel, footwear and accessories for men, women, youth, children and babies. It carries a Zacks Rank #2 (Buy) at present. GOOS delivered a trailing four-quarter average earnings surprise of 57.2%.

The Zacks Consensus Estimate for Canada Goose’s current fiscal-year sales and earnings indicates growth of 2.9% and 10%, respectively, from the year-ago actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 |

Estée Lauder Files Lawsuit Against Walmart Alleging Sales of Counterfeit Products

EL

The Wall Street Journal

|

| Feb-10 |

Estee Lauder Files Lawsuit Against Walmart Alleging Sales of Counterfeit Products

EL

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite