|

|

|

|

|||||

|

|

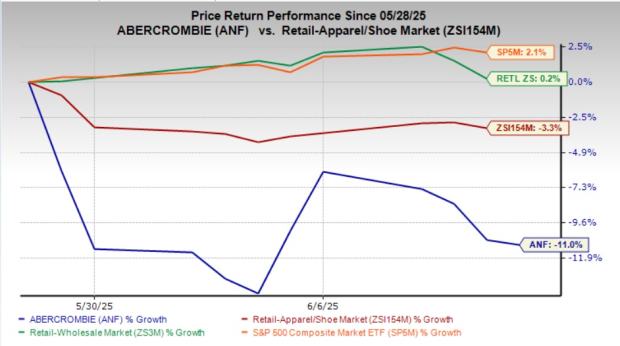

Abercrombie & Fitch Co. ANF saw its shares drop 11% following the release of its first-quarter fiscal 2025 results on May 28. This marks a notable underperformance compared to the Zacks Retail - Discount Stores industry and the Zacks Retail and Wholesale sector, which slipped 3.3% and 0.2%, respectively, during the same time frame. However, the broader S&P 500 advanced 2.1% in the same period.

The company surprised the market with an upbeat first-quarter fiscal 2025 performance, delivering an earnings beat, reporting EPS of $1.59, above the Zacks Consensus Estimate of $1.35. It also posted record sales of $1.1 billion, up 8% year over year. These strong results initially sent the stock soaring 14.7% on the day of the release. However, this post-earnings rally was short-lived.

Abercrombie has delivered a lower stock performance compared with major retail players, like Dollar General Corporation DG, Dollar Tree Inc. DLTR and Costco Wholesale Corporation COST. Since May 28, 2025, Dollar General and Dollar Tree have posted gains of 14.3% and 7.5%, respectively, while Costco has posted a decline of 1.1%.

While first-quarter results were largely positive, the market's reaction points to underlying caution. One key issue was the year-over-year decline in earnings, with EPS dropping 25.7% compared with $2.14 in the year-ago quarter. Additionally, the company's gross margin contracted 440 basis points (bps) to 62%, impacted by inflationary pressures and higher selling expenses. The deterioration in profitability, despite strong revenue growth, raised red flags about ANF’s ability to maintain margins.

Another contributing factor to investor concern is the underperformance of the Abercrombie brand. While the Hollister brand delivered impressive 22% growth and 23% comp sales gains, the Abercrombie brand saw sales decline by 4% and comps drop 10%. Since the flagship brand still makes up nearly 50% of the company’s total sales, its weakness poses a strategic risk and adds to near-term uncertainty.

Additionally, management's revised guidance for fiscal 2025 was a mixed bag. While sales growth expectations were raised to 3-6%, reflecting confidence in top-line momentum, the EPS guidance was lowered to $9.50-$10.50 from the prior range of $10.40-$11.40. Operating margin expectations were also revised downward to 12.5%-13.5%, primarily due to an estimated 100 bps impact from tariffs. This guidance cut, despite a strong fiscal first quarter performance, suggests that these headwinds could weigh on profitability in the second half of fiscal 2025.

Abercrombie is strategically positioning itself for sustainable long-term growth by focusing on brand evolution, international expansion and omni-channel capabilities. A key pillar of its long-term strategy is the modernization of its store fleet and digital ecosystem to meet the expectations of younger, digitally native consumers. The company’s plan to open 60 new stores, remodel 40 and close 20 in fiscal 2025 reflects its commitment to optimizing its physical presence while enhancing customer experience. Its global footprint is expanding, with double-digit sales growth in EMEA and continued gains in APAC, pointing to rising international brand relevance.

At the heart of ANF’s strength lies its brand portfolio, particularly the revitalization of Hollister, which continues to outperform with eight consecutive quarters of growth. Hollister’s strong performance in key categories like denim, fleece and casual wear, combined with improved cross-channel engagement, shows the brand’s ability to resonate across both genders and age groups. Although the Abercrombie brand experienced short-term weakness, it remains a critical part of the company’s identity and growth potential. ANF’s strategic focus on brand storytelling, product innovation and targeted marketing is designed to rebuild momentum and secure a loyal consumer base, positioning it to thrive over the long term.

ANF is currently trading at a forward 12-month P/E ratio of 7.57X, below the industry average of 17.85X and the S&P 500’s average of 22.02X.

ANF shares also trade at a discount to its competitors, including Dollar General, Dollar Tree and Costco, with higher P/E multiples of 19.07x, 16.99x and 51.44x, respectively.

While the lower valuation might initially suggest an attractive entry point, it may also reflect investor concerns or potential underlying challenges within the business.

Reflecting cautious sentiment around Abercrombie, the Zacks Consensus Estimate for EPS has seen downward revisions. In the past 30 days, the consensus EPS estimate has declined 6.2% to $10.28 for fiscal 2025 and declined 6% to $10.78 for fiscal 2026. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Following its post-earnings decline, Abercrombie presents a mixed picture for investors. The company delivered strong first-quarter results, including record sales driven by broad-based growth across regions and exceptional momentum at its Hollister brand. These results highlight the success of its brand strategy, international expansion and omni-channel investments. However, external headwinds, including inflationary pressures, rising labor costs, tariffs and currency volatility, are expected to continue weighing on margins in the near term.

Moreover, recent downward revisions in earnings estimates and the company's fiscal 2025 guidance have contributed to growing investor caution. While ANF trades at a significant discount to peers, reflecting these concerns, its long-term strategic initiatives could support a rebound once macroeconomic pressures ease. For now, investors may choose to remain on the sidelines until clearer signs of margin stability and brand recovery emerge for this Zacks Rank #4 (Sell) stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite