|

|

|

|

|||||

|

|

Target Corporation TGT, a leading general merchandise retailer, is currently trading at a compelling discount relative to its industry and broader market benchmarks. TGT stock trades at a forward 12-month price-to-earnings (P/E) ratio of 12.36, lower than the industry’s average of 32.47.

This valuation looks compelling when compared to other discount stores such as Dollar General Corporation DG, Dollar Tree, Inc. DLTR and Costco Wholesale Corporation COST. Dollar General, Dollar Tree, and Costco are all trading at higher forward P/E ratios of 18.72, 16.81, and 50.74, respectively.

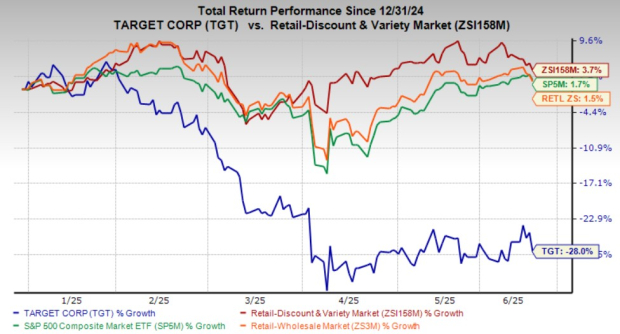

While Target’s valuation appears attractive, much of that discount stems from the stock’s decline in 2025. Shares of TGT are down 28% year to date, while the industry and the S&P 500 have posted a modest gain of 3.7% and 1.7%, respectively. Target has even underperformed the broader Retail and Wholesale sector’s growth of 1.5%. In comparison, peers like Dollar General, Dollar Tree, and Costco have posted robust gains of 49.4%, 27%, and 8.3%, respectively.

Closing yesterday’s trading session at $97.37, TGT stands about 41.8% below its 52-week high of $167.40, reached on Aug. 21. The stock also trades well below its 200-day simple moving average of $126.37, signaling continued downward momentum. This technical setup reflects cautious investor sentiment and a lack of near-term catalysts.

Target reported lower-than-expected first-quarter fiscal 2025 earnings, leading to a substantial cut in full-year guidance. Adjusted earnings per share (EPS) came in at $1.30, down from $2.03 in the prior-year period, while total revenues declined 2.8% year over year to $23,846 million. Both figures missed the Zacks Consensus Estimate. In response, Target revised its full-year outlook, now expecting a low-single-digit sales decline. The adjusted EPS range was also lowered to $7.00-$9.00 from $8.80-$9.80. These revisions reflect ongoing concerns around profitability and demand softness heading into the rest of the fiscal year.

Target’s core retail performance is showing signs of strain, particularly within its physical stores, which remain central to its business model. During the first quarter, the company saw a 3.8% decline in comparable sales, driven largely by a 5.7% drop in comparable store sales. While digital channels offered some support with 4.7% growth in comparable digital sales, overall store traffic declined 2.4%, and the average transaction value slipped 1.4%. These trends point to ongoing challenges in sustaining customer engagement and sales momentum across its brick-and-mortar footprint.

The company’s gross margin also faced challenges, declining 60 basis points year over year to 28.2% in the first quarter. A key driver of this margin contraction was due to higher markdowns, along with about 80 basis points of pressure from digital fulfillment and supply chain. These challenges could continue as Target grapples with inventory issues and adjusts to slower-than-expected sales, making it difficult to sustain profitable growth in the short term.

The retail environment remains uncertain. Target's updated outlook reflects cautious consumer spending, ongoing inflation, and macroeconomic headwinds. Management now expects continued sales pressure through the first half of 2025. While Target is actively cutting costs and optimizing operations, external risks, including tariff shifts, rate volatility, and discretionary spending pullbacks, could further limit recovery potential in the near term.

Reflecting cautious sentiment around Target, the Zacks Consensus Estimate for EPS has seen downward revisions. Over the past 30 days, the consensus estimates for both the current and next fiscal year have declined by $1.12 to $7.51 and $1.13 to $8.07 per share, respectively. The revisions highlight lingering concerns about TGT’s near-term profitability outlook. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Target is capitalizing on its strong brand, broad product mix, and expanding e-commerce and store presence to reinforce its market position. The company is integrating AI and innovation to support long-term growth. A key part of this strategy is its third-party marketplace, Target Plus, which posted a 20% year-over-year increase in Gross Merchandise Value (GMV) in the first quarter of fiscal 2025, adding hundreds of new partners. Target aims to scale the platform to $5 billion in GMV by 2030, strengthening engagement in key categories like home and apparel.

The company’s investments in its membership program, Target Circle 360, have shown impressive results. The company reported that same-day delivery powered by Target Circle 360 grew by more than 35% in the first quarter. This highlights the success of TGT’s strategy to encourage customer loyalty through exclusive perks and benefits for members.

Target is actively investing in its physical store network, recognizing its strategic importance in supporting both in-store traffic and digital fulfillment. Beyond expansion, these efforts aim to boost operational efficiency and customer experience. In the first quarter, Target opened three new stores and plans to add approximately 20 more this year. The company is also prioritizing remodels of existing locations, which have delivered meaningful results. Completed remodels have driven comparable sales lifts of 2% to 4% in the first year and nearly 3% in the second year, reflecting strong customer response and sales momentum.

TGT is proactively addressing potential tariff headwinds through a range of strategic measures. These include negotiating with vendor partners, adjusting order timing, reevaluating product assortments, and shifting production to alternative countries where feasible. Notably, the company has significantly reduced its reliance on China, lowering its sourcing from 60% in 2017 to under 30% currently, to bring that below 25% by 2026. By diversifying its supplier base and leveraging long-standing vendor relationships, Target expects to offset the vast majority of incremental tariff exposure.

Target’s stock looks attractively valued, but much of that is due to its sharp price decline in 2025. While the company is making progress through store upgrades, e-commerce growth, and cost-saving efforts, it still faces near-term challenges like weak store traffic, margin pressure, and cautious consumer spending. Those already holding TGT may consider staying invested, especially if they have a long-term horizon, as the company’s strategic efforts could pay off over time. New investors might wait for clearer signs of stabilization or improvement in fundamentals before jumping in. At present, TGT carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 48 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours |

Krispy Kreme Revenue Falls as Chain Exits Underperforming Locations

TGT COST

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite