|

|

|

|

|||||

|

|

The artificial intelligence (AI)-driven astonishing bull run of 2023 and 2024 has suffered major hurdles in 2025. The tariff and trade policies of the Trump administration, the Fed’s ambiguity over further rate cuts this year, fears of a near-term recession and the availability of a low-cost Chinese AI platform have unnerved investors.

However, the technology sector has lately returned to its northward trajectory. Expectations of a U.S.-China trade deal and the ongoing negotiations with several other major trading partners of the United States boosted market participants’ confidence.

Despite these positives, several large-cap AI stocks provided negative returns in the past month. Surprisingly, a handful of these stocks with a favorable Zacks Rank currently offer strong price upside potential in the short term.

Five such stocks are: Arista Networks Inc. ANET, HubSpot Inc. HUBS, Twilio Inc. TWLO, Adobe Inc. ADBE and Okta Inc. OKTA. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

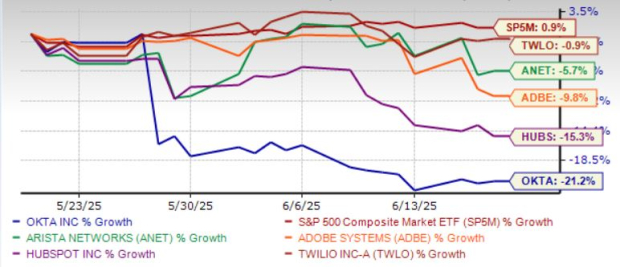

The chart below shows the price performance of our five picks in the past month.

Zacks Rank #2 Arista Networks is well-positioned with the right network architecture for client-to-campus data center cloud and AI networking backed by three guiding principles. These include the best-in-class, highly proactive products with resilience, zero-touch automation and telemetry with predictive client-to-cloud one-click operations with granular visibility and prescriptive insights for deeper AI algorithms.

ANET’s EOS Smart AI Suite and Arista AVA (Autonomous Virtual Assist) enhance AI job monitoring, deep-dive analytics, and proactive performance issue resolution. Its AI suite also focuses on network security and optimization.

ANET’s AI-powered cloud networking solutions provide predictable performance and programmability, enabling seamless integration with third-party applications for network management, automation and orchestration.

Arista AVA offers augmentation of pervasive visibility, continuous threat detection, and enforcement. The growing demand for 200- and 400-gig high-performance switching products augurs well for ANET’s long-term growth.

Arista Networks has an expected revenue and earnings growth rate of 18.7% and 12.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.6% in the last 60 days.

The short-term average price target of brokerage firms for the stock represents an increase of 23.4% from the last closing price of $90.24. The brokerage target price is currently in the range of $87-$130. This indicates a maximum upside of 44% and a downside of 3.6%.

Zacks Rank #2 HubSpot provides a cloud-based customer relationship management platform for businesses in the Americas, Europe, and the Asia Pacific. HUBS is witnessing steady multi-hub adoption from enterprise customers in the premium market. Pricing optimization in HUBS’ starter edition is leading to solid client additions in the lower end of the market.

The integration of HubSpot AI, which includes state-of-the-art features, such as AI assistance, AI agents, AI insights and ChatSpot, is driving more value to customers. HUBS’ seat pricing model lowers the barrier for customers to get started with its business and mitigates pricing friction for upgrades. The growing adoption of inbound applications is a tailwind.

HubSpot has an expected revenue and earnings growth rate of 15.4% and 15%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% in the last 30 days.

The short-term average price target of brokerage firms for the stock represents an increase of 37.5% from the last closing price of $544.46. The brokerage target price is currently in the range of $645-$930. This indicates a maximum upside of 70.8% and no downside.

Zacks Rank #1 Twilio is a leading provider of cloud communications Platform-as-a-Service in the United States and internationally. TWLO is focusing on generative AI offerings to tap the growing opportunities in this space.

In this regard, TWLO launched Customer AI technology in June 2023, which powerfully combines customer engagement platform data, generative and predictive AI, and large language models (LLMs) to unlock stronger customer relationships for brands.

TWLO is integrating generative AI capabilities across its platform and every customer touchpoint. The company believes that by training LLMs for customers with their data inside its Segment customer data platform, Twilio will be able to help customers enter the AI race multiple steps ahead of their peers.

TWLO has also partnered with Alphabet Inc. (GOOGL) for Google Cloud to integrate generative AI into the Twilio Flex customer engagement platform. Twilio’s initiative to integrate generative and predictive AI technology across its platform is likely to boost its revenue growth over the long run.

Twilio enables companies to create personalized, customer-aware experiences powered by OpenAI. Through this integration, Twilio customers will be able to use OpenAI’s GPT-4 model to power new generative capabilities in Twilio Engage, its multichannel marketing solution built on the Segment Customer Data Platform.

Twilio has an expected revenue and earnings growth rate of 7.9% and 22.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.9% in the last 60 days.

The short-term average price target of brokerage firms for the stock represents an increase of 10.8% from the last closing price of $116.68. The brokerage target price is currently in the range of $75-$170. This indicates a maximum upside of 45.7% and a downside of 35.7%.

Zacks Rank #2 Adobe has extensively implemented AI applications across its flagship products, such as Photoshop, Illustrator, Lightroom, and Premiere. Earlier this year, ADBE introduced generative AI-driven Adobe Firefly. Moreover, Adobe Acrobat and Reader AI Assistant help users summarize documents and answer questions, saving time and helping users accomplish tasks faster.

Using its new AI-driven cloud-based platform, ADBE is also diversifying into digital marketing services, offering data mining services that help businesses measure page views, purchases and social media sites. Adobe Marketing Cloud enables marketers to deliver personalized web experiences across multiple devices, manage multichannel campaigns and optimize media monetization.

ADBE has launched Adobe Express, an application for quick editing effects. Leveraging generative AI, this tool is useful for short-form video content like Instagram Reels. Adobe also launched an AI-based Express app for iOS and Android.

Adobe has an expected revenue and earnings growth rate of 9.5% and 11.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% in the last seven days.

The average short-term price target of brokerage firms represents an increase of 29.7% from the last closing price of $378.04. The brokerage target price is currently in the range of $380-$605. This indicates a maximum upside of 60.1% and no downside.

Zacks Rank #2 Okta operates as an identity partner in the United States and internationally. OKTA offers a suite of products and services used to manage and secure identities, such as Single Sign-On, which enables users to access applications in the cloud or on-premises from various devices.

OKTA leverages AI through its Okta AI platform, which enhances security while improving user experience and simplifying administration. Key applications include Identity Threat Protection, Log Investigator, and Auth for GenAI. This AI-enabled platform is integrated with OKTA’s Workforce Identity and Customer Identity Clouds.

OKTA’s Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications and data, while API Access Management enables organizations to secure APIs. Access Gateway enables organizations to extend Workforce Identity Cloud, and Okta Device Access enables end users to securely log in to devices with Okta credentials.

OKTA has expected revenue and earnings growth rates of 9.4% and 16.7%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has improved 2.8% over the last 30 days.

The average short-term price target of brokerage firms represents an increase of 26.2% from the last closing price of $99. The brokerage target price is currently in the range of $75-$142. This indicates a maximum upside of 43.4% and a downside of 24.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite