|

|

|

|

|||||

|

|

Smith + Nephew SNN recently announced a strategic partnership with Standard Health to establish the United Kingdom’s first dedicated Orthopaedic Ambulatory Surgery Centre (ASC), located in Poole, Dorset. This pioneering facility is likely to provide both National Health Service (“NHS”) and private patients with access to advanced joint repair and replacement technologies, aiming to transform outpatient orthopedic care across the region. The center will focus on delivering minimally invasive procedures such as rotator cuff repairs, Anterior Cruciate Ligament (ACL) reconstructions, knee and hip replacements, and foot, ankle, hand, and wrist surgeries.

By combining Smith+Nephew’s innovative surgical solutions with Standard Health’s clinical expertise, the collaboration aims to enhance patient outcomes, reduce surgical wait times, and promote a more efficient, patient-centric model of care.

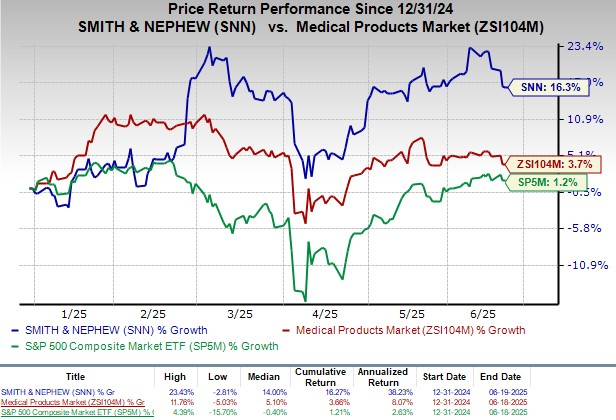

Shares of the company closed flat at $28.58 yesterday following the announcement. In the year-to-date period, SNN shares have gained 16.3% compared with the industry’s 3.7% growth. The S&P 500 increased 1.2% in the same time frame.

This partnership positions Smith+Nephew to capitalize on the growing shift toward outpatient orthopedic procedures, especially as healthcare systems prioritize efficiency and reduced hospital stays. By leading the development of the United Kingdom's first Orthopaedic Ambulatory Surgery Centre, SNN strengthens its presence in the high-growth ASC market, drives adoption of its surgical technologies, and builds deeper ties with both public and private healthcare providers—factors that can boost recurring revenue, expand market share, and support long-term growth.

Meanwhile, SNN currently has a market capitalization of $12.52 billion. The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $6.12 billion, which indicates 10.3% growth from the fiscal 2023 reported number.

As part of its latest strategic move, Smith+Nephew is likely to supply its cutting-edge medical technologies to Standard Health’s newly developed Orthopaedic ASC in Poole, set to open this year. While Standard Health will oversee site development and operations, SNN’s contribution ensures the integration of advanced surgical tools across procedures like ACL reconstruction, hip and knee replacements, and upper/lower extremity repairs.

The facility is likely to handle both day and short overnight-stay cases, mirroring the successful ASC model in the United States, where SNN already has a strong footprint. Notably, U.S.-based ASCs have demonstrated greater procedural efficiency, 92% patient satisfaction, and up to 40% lower costs for outpatient joint replacements compared to hospitals, making them an ideal model to address similar pressures in the United Kingdom system.

The significance of this partnership extends far beyond a single location. Standard Health plans to open 10 more sites over the next three years and 20 in total by 2030, signaling a scalable opportunity for Smith+Nephew to deepen its United Kingdom presence. With over 850,000 patients currently awaiting orthopedic surgeries in the United Kingdom, the NHS increasingly relies on independent providers to reduce backlogs. The centers are expected to serve thousands of patients annually, with the majority being NHS referrals. For Smith+Nephew, this collaboration not only drives product adoption across multiple sites but also reinforces its reputation as a key enabler in transforming orthopedic care delivery across outpatient settings.

Per a report by Grand View Research, the global ambulatory surgery centers market size was estimated at USD 134.9 billion in 2023 and is projected to reach $205.5 billion by 2030, registering a CAGR of 6.2% from 2024 to 2030.

The market is expected to grow substantially, driven by an increase in the number of ASCs and the rise in a shift of surgical procedures from hospitals to ambulatory centers, which requires cost-effective and efficient treatment.

SNN carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are CVS Health Corporation CVS, Integer Holdings Corporation ITGR and AngioDynamics ANGO.

CVS Health, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2025 adjusted earnings per share (EPS) of $2.25, beating the Zacks Consensus Estimate by 31.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $94.59 billion outpaced the consensus mark by 1.8%. CVS Health has a long-term estimated growth rate of 11.4%. Its earnings surpassed estimates in each of the trailing four quarters, with an average surprise of 18.1%.

Integer Holdings reported first-quarter 2025 adjusted EPS of $1.31, beating the Zacks Consensus Estimate by 3.2%. Revenues of $437.4 million surpassed the Zacks Consensus Estimate by 1.3%. It currently sports a Zacks Rank of 1.

Integer Holdings has a long-term estimated growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

AngioDynamics, currently sporting a Zacks Rank #1, reported a third-quarter fiscal 2025 adjusted EPS of 3 cents against the Zacks Consensus Estimate of a 13-cent loss. Revenues of $72 million beat the Zacks Consensus Estimate by 2%.

ANGO has an estimated fiscal 2026 earnings growth rate of 27.8% compared with the S&P 500 Composite’s 10.5% growth. AngioDynamics’ earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 70.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 5 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite