|

|

|

|

|||||

|

|

Supply-chain management plays a pivotal role in supporting The Home Depot, Inc.’s HD overall growth. The company has significantly invested in modernizing its supply chain to drive efficiency, speed and operational resilience. In the recent past, it has collaborated closely with its vendor partners to diversify its global supply-chain network.

As part of its supply-chain diversification efforts, Home Depot is reducing its reliance on non-U.S. markets for sourcing products. This is expected to be crucial for the company in navigating a complex and evolving trade landscape marked by rising tariffs on imported goods, especially from China. Though more than 50% of HD’s products are sourced from within the United States, about half still face varying tariffs, estimated between 10% and 30%. The company is proactively addressing this by diversifying its sourcing base, with a target to ensure that no single non-U.S. country accounts for more than 10% of total purchases within 12 months.

Despite this flexibility, management acknowledged that absorbing tariff-related costs without passing them to consumers may compress margins. Home Depot plans to use multiple levers, such as portfolio optimization, vendor partnerships and supply-chain efficiencies, to maintain pricing discipline.

HD’s supply-chain management is further amplified by the buildout of its One Supply Chain network, focused on strengthening distribution centers, market delivery operations and same-day delivery capabilities.

Home Depot is also strengthening its in-store and digital experiences, fulfillment and delivery improvements, interconnected retail strategy expansion and Pro ecosystem enhancements to reignite growth. Its strategic investments in downstream supply chain infrastructure have enhanced product availability at Distribution Fulfillment Centers, enabling quick deliveries. The company’s leveraged store network further offers flexible delivery options, enabling faster fulfillment and driving customer engagement.

In first-quarter fiscal 2025, supply-chain productivity has helped offset the gross margin decline. While macroeconomic uncertainties persist, Home Depot is making steady progress on its "One Home Depot" investment plan, aimed at supply-chain expansion, technology integration and digital enhancement. Such moves offer the company a competitive edge and position it for long-term success.

Lowe's Companies, Inc. LOW and Amazon.com, Inc. AMZN are the key companies competing with Home Depot in boosting their supply-chain activities.

Lowe's has been steadily advancing supply-chain transformation efforts, focused on building efficiency, optimizing inventory flow and offering a superior, reliable customer experience. The company aims to build a robust omnichannel supply chain that ensures product availability in the right quantities, at the right time and in the right locations. This strategy includes enhancing network capacity, improving flow management and driving overall operational efficiency through end-to-end optimization. Lowe’s supply chain serves as a crucial aspect of its Total Home strategy, and hence, it makes constant investments in modernizing its network to boost omnichannel capabilities. It also focuses on enhancing the speed of its delivery capabilities to better cater to the customers’ needs.

Amazon, with aggressive supply-chain upgradation efforts aimed at driving speed, efficiency and scalability to ramp up its e-commerce capabilities, leads the way. The company’s supply-chain efforts include regionalization of the fulfillment network, robotics, automation, innovations and technology integration. Amazon heavily focuses on strengthening its same-day and next-day delivery capabilities, thus elevating the overall shoppers’ experience. Amazon’s supply-chain modernization drives faster and reliable delivery, operational efficiency, lower costs and enhanced customer satisfaction. Continued investment in supply-chain innovation is pivotal to Amazon’s success, with quick delivery options and services and adaptability to meet customers’ evolving needs.

Shares of Home Depot have lost 6.2% year to date compared with the industry’s decline of 9.6%.

From a valuation standpoint, HD trades at a forward price-to-earnings ratio of 23.14X compared with the industry’s average of 20.38X.

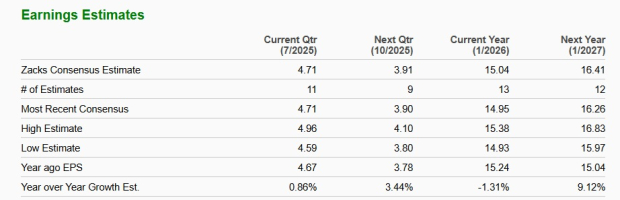

The Zacks Consensus Estimate for HD’s fiscal 2025 earnings implies a year-over-year decline of 1.3%, while that of fiscal 2026 shows growth of 9.1%. The company’s EPS estimate for fiscal 2025 and fiscal 2026 has moved down in the past 30 days.

Home Depot stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

AMZN

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite