|

|

|

|

|||||

|

|

OptimizeRx OPRX, a digital health platform that connects pharmaceutical companies with healthcare providers and patients, delivered a strong start to fiscal 2025 with first-quarter results that surpassed Wall Street expectations. This also got reflected in the robust performance of its share price in the past three months.

Amid ongoing shifts in pharma marketing strategies and a growing emphasis on digital outreach, the company demonstrated operational discipline, strategic agility, and an ability to monetize data-driven solutions. Revenue rose 11% year over year to $21.9 million, and positive operating cash flow of $3.9 million marked a notable turnaround from the prior year. Backed by increased visibility from contracted revenues and early success in transitioning to a subscription-based model, management raised its full-year guidance and reaffirmed its ambition to achieve Rule of 40 metrics.

As OPRX continues to scale its omnichannel platform and deepen client relationships, the company’s momentum underscores its potential to create sustained shareholder value in a rapidly evolving healthcare ecosystem.

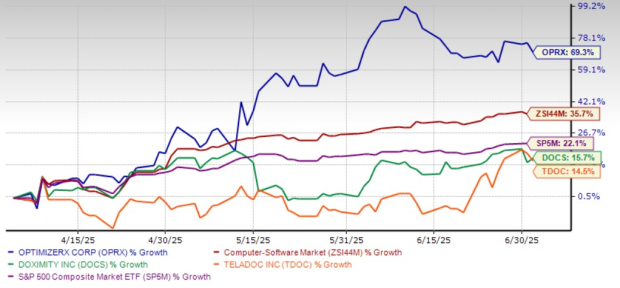

Shares of OptimizeRx have surged 69.3% in the past three months, most likely due to its strong revenue growth as well as rising volume of contracted revenues and early success in transitioning to a subscription-based model. This gain far outpaced the broader industry’s growth of 36.7%, while the S&P 500 has gained 22.1% during the same period.

Among its peers, Doximity DOCS has risen only 15.7%, and Teladoc TDOC has gained 14.5%, highlighting the uniquely steep improvements in OPRX’s stock.

Solid Financial Performance and Guidance Raise: OPRX kicked off the year with strong execution in what is traditionally its softest quarter. Gross margins remained steady at 60.9%, and operating expenses declined year over year due to reduced stock-based compensation and cost controls. The company generated a positive operating cash flow of $3.9 million and ended the quarter with $16.6 million in cash, up from $13.4 million at year-end 2024, despite repaying $6.2 million in debt. Encouraged by this trajectory, management raised full-year revenue guidance and reaffirmed its target to achieve Rule of 40 performance within the next several years such that OPRX’s combined annual revenue growth rate and EBITDA margin are 40% or higher.

Contracted Revenue and Pipeline Visibility: A key highlight of the quarter was the more than 25% year-over-year increase in committed contracted revenue, now exceeding $70 million. This accounts for over 80% of the mid-point of 2025 revenue guidance, providing high visibility for the rest of the year. Management cited improved conversion rates and a growing pipeline of opportunities, especially in high-value data and subscription services, as primary contributors to this confidence. Revenue per top 20 pharma customer stood at nearly $3 million, with these clients accounting for 63% of business in the first quarter.

Data Monetization and Subscription Model Transition: OPRX is making meaningful progress in converting parts of its business to a subscription-based revenue model, with over 5% of projected 2025 revenues already tied to recurring contracts. The shift is particularly focused on its DAAP (Dynamic Audience Activation Platform) and Medicx data businesses, which are expected to drive longer contract tenures and margin accretion. Though still early in the transition, the company views this model as accretive to gross margins and more resilient to budget fluctuations in pharma marketing.

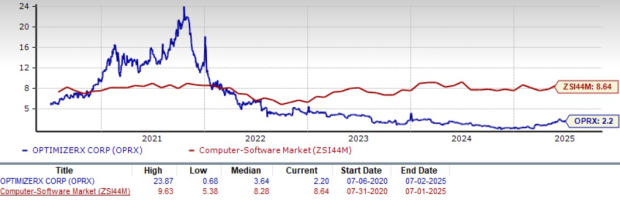

OptimizeRx seems to be attractively priced, trading at a forward P/S of 2.2X, well below its five-year median of 3.64X. The multiple also lies significantly below the industry average of 8.64X. In comparison, Doximity trades at 17.48X and Teladoc at 0.58X, placing OPRX somewhere in the middle of the pack despite its recent surge.

Competitive Landscape and Client Budget Pressures: Despite favorable demand signals, management remains cautious about potential macro and policy-related headwinds. While the company has not seen any client pullbacks to date, ongoing scrutiny around drug pricing and healthcare spending could eventually influence pharma marketing budgets. Management emphasized that digital solutions could become even more attractive in cost-cutting environments, but this dynamic remains fluid.

Execution Risk in Subscription Transition: Although early signs of the subscription pivot are encouraging, the transition still remains in its nascent stages. Management acknowledges there is “a lot of wood to chop” in terms of converting existing transactional business into recurring contracts. Moreover, pharma’s typical one-year marketing cycle presents structural challenges to locking in multi-year deals, potentially limiting near-term visibility on recurring revenue growth.

OptimizeRx’s first-quarter results and raised outlook for FY2025 reflect a company that is successfully executing on its strategy while navigating industry complexity. Its strong financial performance, growing contracted revenue base, and clear path toward a higher-margin, subscription-oriented model offer investors a compelling growth narrative. While margin variability and macro uncertainty warrant monitoring, OPRX’s differentiated platform, robust pipeline, and strong client engagement provide confidence in both its near-term execution and long-term potential. For investors seeking exposure to the convergence of data, digital engagement, and healthcare, OptimizeRx offers a unique value proposition with room for meaningful upside. Moreover, OPRX looks attractively placed based on its valuations compared to Doximity. Although Teladoc’s valuation is lower, its shares have been on a downtrend for the past couple of years.

OptimizeRx currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite