|

|

|

|

|||||

|

|

The past three months have been a roller-coaster ride for The Home Depot Inc. HD stock, yet the stock has climbed 8.8% in the period. This performance reflects a mix of challenges and resilience. While demand for big-ticket discretionary projects, like kitchen and bath remodels, has been soft due to elevated interest rates and tighter financing, Home Depot has held its ground. Strategic investments in technology, digital tools and supply-chain enhancements continue to reinforce its dominance in the home improvement space.

Recording growth of 8.8%, the company has marginally outperformed the Retail - Home Furnishings industry’s rally of 8.7% in the past three months. However, the HD stock has underperformed the Retail-Wholesale sector and the S&P 500’s growth of 17.7% and 23%, respectively, in the same period.

The HD stock’s performance is better than that of its arch rival, Lowe’s Companies Inc. LOW, which has risen 5.3% in the past three months. However, the stock has lagged peers, such as Williams-Sonoma WSM and Haverty Furniture Companies HVT, which have rallied 19.4% and 22.6%, respectively, in the same period.

At the current price of $371.68, the HD stock trades 15.4% below its 52-week high of $439.37. The current stock price also stands 13.9% above its 52-week low mark of $326.31.

HD trades above its 50-day moving average, signaling strong upward momentum and price stability. This technical strength indicates positive market sentiment and confidence in the company's financial health and prospects. However, the company trades below its 200-day SMA, showing long-term weakness.

Home Depot’s stock performance reflects mixed investor sentiment, with signals varying across broader industry comparisons and technical indicators. Let us break down the data to determine the best way to approach this stock.

HD remains a dominant player in the $1-trillion home improvement market, with a strategic position supported by scale, strong vendor relationships and a healthy balance sheet. Despite near-term pressures, its long-term investment case remains intact.

In first-quarter fiscal 2025, HD reported sales of $39.9 billion, up 9.4% year over year, driven largely by the SRS acquisition. However, comparable sales fell 0.3%, as higher interest rates continued to dampen demand for large, financing-dependent remodeling projects. Still, customer engagement in smaller, seasonal projects was encouraging, with six of 16 departments posting positive comps. Pro customer sales also outpaced DIY, reflecting strength in categories like siding, decking and gypsum.

From a strategic standpoint, HD is investing aggressively in its Pro ecosystem, digital capabilities and supply chain. The integration of SRS enhances its ability to serve complex Pros through trade credit programs and specialized distribution. Tools like Magic Apron and HD Phone aim to create a seamless omnichannel experience for consumers and store associates alike.

Fundamentally, HD benefits from long-term housing tailwinds — an aging housing stock, rising home equity and steady home price appreciation. Management cited an estimated $50 billion in deferred remodeling demand, positioning HD for an upside once macro conditions improve.

While the adjusted EPS is expected to be flat in fiscal 2025 and margin pressures remain due to the SRS mix and higher SG&A, HD’s pricing discipline, sourcing flexibility and strong cash returns make it a compelling long-term hold for investors seeking resilience and market leadership.

The Zacks Consensus Estimate for Home Depot’s fiscal 2025 earnings per share was unchanged in the last 30 days. For fiscal 2026, the Zacks Consensus Estimate for earnings per share moved down 0.1% in the last 30 days. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

For fiscal 2025, the Zacks Consensus Estimate for HD’s sales implies 3.1% year-over-year growth, while that for earnings per share suggests a decline of 1.3%. The consensus mark for fiscal 2026 sales and earnings indicates 4.4% and 9.1% year-over-year growth, respectively.

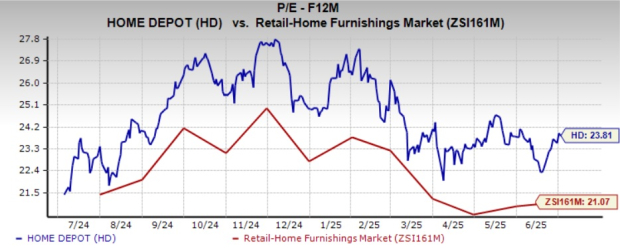

HD is currently trading at a forward 12-month P/E multiple of 23.81X, exceeding the industry average of 21.07X and the S&P 500’s average of 22.45X. At current levels, Home Depot’s stock valuation looks expensive.

At 23.81X forward 12-month P/E, HD is trading at a valuation much higher than its competitors. Its competitors, such as Lowe’s, Williams-Sonoma and Haverty Furniture, are trading at more reasonable multiples. Lowe’s, Williams-Sonoma and Haverty Furniture have forward 12-month P/E ratios of 17.89X, 19.84X and 11.91X — all lower than Home Depot. At such levels, the HD stock’s valuation seems out of step with its growth trajectory.

The premium valuation indicates that investors have high expectations for Home Depot’s performance and growth potential. However, the valuation premium may not be justified if the company fails to deliver on its long-term growth targets. Investors may be skeptical about buying the stock at these premium levels and may wait for a better entry point.

Home Depot’s fundamentals remain solid, supported by its growth initiatives, particularly the "One Home Depot" strategy, and strong Pro customer sales. Strategic investments in Pro capabilities, digital tools and supply-chain efficiency position the company to capture incremental market share over time, particularly when financing conditions improve.

The stock’s near-term upside may be tempered by macro headwinds and modest earnings growth expectations. With HD trading at a premium to historical averages on a forward P/E basis, much of the long-term optimism appears to be priced in. While not overvalued, the stock may lack near-term catalysts unless we see a material pickup in big-ticket remodel activity.

For existing shareholders, Home Depot remains a high-quality hold, offering reliable dividends, disciplined capital allocation and durable competitive advantages. For prospective investors, a more attractive entry point may emerge on market pullbacks or macro-driven dips. Home Depot has a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 44 min | |

| 9 hours | |

| 9 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite