|

|

|

|

|||||

|

|

The United States’ home-furnishing market is currently facing a setback due to reduced consumer confidence fueled by a still-high mortgage rate scenario, lingering inflation risks and rising concerns regarding the implementation of the new tariff regime. However, amid such an uncertain external scenario, renowned home-furnishing firms like RH RH and Williams-Sonoma, Inc. WSM are navigating the headwinds and sustaining their business growth through diversified in-house strategies.

RH is a leading luxury retailer in the home furnishing space, offering dominant merchandise assortments across a growing number of categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, tableware and child and teen furnishings. On the other hand, Williams-Sonoma is a multi-channel specialty retailer of premium quality home products spread across five reportable brands.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

This California-based company, with a market cap of approximately $3.88 billion, is notably gaining from its global expansion efforts, alongside product transformation and platform enhancement activities. Across Europe, RH’s market is going robust thanks to its several openings. During the first quarter of fiscal 2025, the company witnessed 60% demand growth across RH Munich and RH Dusseldorf. Besides, the company continues to witness demand acceleration in its noncomparable galleries, RH Brussels and RH Madrid. Given the strong demand trends, RH remains optimistic about its upcoming opening in Paris, the gallery on the Champs Élysées, alongside the other two openings in London and Milan.

Besides global expansion, RH’s focus on production elevation or transformation and retail platform expansion is commendable. Its recent 2025 RH Outdoor Sourcebook, the new RH Interior Sourcebook and the RH Modern Sourcebook launches are garnering positive response. Considering retail expansion, already into 2025, for the remainder of the year, RH expects to open seven Design galleries. In the long term, the company’s platform expansion plans include opening seven-nine new galleries annually, with two to three Design Studios or Outdoor galleries, or new concept galleries per year.

However, business being directly related to housing demand patterns, the current market scenario is against RH, with softness in housing demand weakening renovation and home furnishing demand. Moreover, the ambiguity surrounding the implementation of tariffs is adding to its concerns. Nonetheless, to counter the tariff-related uncertainties, RH is mainly focusing on shifting its sourcing out of China with the expectation of receipts reducing from 16% in the first quarter of fiscal 2025 to 2% in the fourth quarter of the same year. By the end of 2025, it projects 52% of its upholstered furniture to be produced in the United States and 21% in Italy.

This California-based company, having a market cap of about $21.3 billion, is gaining from global expansion efforts, focus on B2B and strengthening its retail and e-commerce channels. WSM is considered one of the largest e-commerce retailers in the United States. Currently, the company is witnessing increased e-commerce penetration, buoyed by its in-house tech platform, rapid experimentation program, content-rich online experience and marketing strategies. In the first quarter of fiscal 2025, its retail and e-commerce comps rose 6.2% and 2.1%, respectively, year over year. Looking at the long-term perspective, WSM anticipates the industry will continue to transition from retail to online. Holding onto this view, Williams-Sonoma expects to incur between $250 million and $275 million in capital expenditures in fiscal 2025, with 85% of this investment being dedicated to driving its e-commerce leadership, retail optimization and supply-chain efficiency.

Besides, WSM’s B2B strategy is proving successful, allowing it to capture significant market share by utilizing its portfolio brands, internal design team and global sourcing capabilities. In the first quarter of fiscal 2025, the company reported 8% year-over-year growth in the B2B segment thanks to the diversified commercial product offerings and design capabilities. In the long term, it believes the B2B division has the opportunity to realize benefits of $2 billion.

Notably, Williams-Sonoma’s global presence is expanding, despite the ongoing macroeconomic pressures, thanks to the effective execution of its strategic initiatives. It is delivering positive results across its key strategic markets, including Canada, Mexico and India. During the first quarter of fiscal 2025 earnings call, the company highlighted increasing geographical presence in Mexico with four new stores. Moreover, in the United Kingdom, the trade segment showed progress and WSM announced plans to launch the Pottery Barn brand online in 2025 fall.

However, macroeconomic pressures continue to impact WSM’s global business. For fiscal 2025, the company foresees ongoing macroeconomic uncertainty and a somewhat adverse impact from the new tariff regulations in Mexico, Canada and China. It also expects that a pause on the interest rate declines due to lingering inflationary pressures is expected to keep the housing market unstable for some time.

As witnessed from the chart below, in the past three months, RH’s share price performance stands above Williams-Sonoma’s. Besides, both stocks are riding quite above the Hoya Capital Housing ETF’s (HOMZ) 13.4% growth during the same time frame. HOMZ is an exchange-traded fund that offers a diversified glimpse of the U.S. residential housing industry through 100 companies across homebuilding, rental operators, home improvement, furnishings, mortgage services and real estate tech, to name a few.

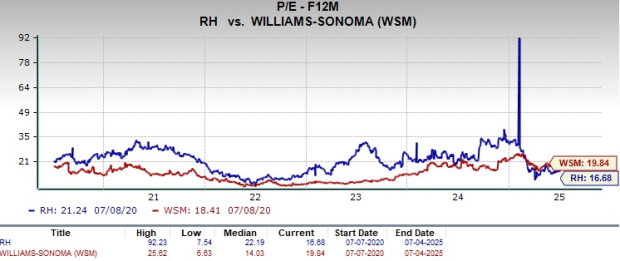

Considering valuation, over the last five years, RH stock is trading below WSM stock on a forward 12-month price-to-earnings (P/E) ratio basis. The discounted valuation of RH stock compared with WSM stock advocates for a comparatively attractive entry point for investors in favor of the former.

The Zacks Consensus Estimate for RH’s fiscal 2025 and 2026 earnings has trended downward in the past 30 days by 0.8% to $10.76 per share and 4.1% to $14.61, respectively. However, the estimated figures for fiscal 2025 and 2026 imply 99.6% and 5.8% year-over-year growth, respectively.

RH's EPS Trend

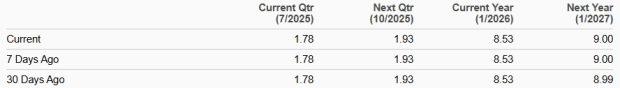

The Zacks Consensus Estimate for WSM’s fiscal 2025 earnings remained unchanged in the past 30 days at $8.53 per share, while the fiscal 2026 estimate has inched up 0.1% to $9.00 per share. The estimated figure for fiscal 2025 indicates 3% year-over-year decline, while the same for fiscal 2026 indicates 5.4% growth.

WSM's EPS Trend

Per the discussion above, it can be deduced that RH stock offers comparatively high growth rate at a discounted valuation, making it a good fit for investors looking for a high-growth option amid a risky market scenario with bright long-term prospects. In the long term, the valuation could move toward a premium, given the benefits realized from the in-house capabilities amid favorable demand trends backing the company’s revenue visibility and profitability.

On the other hand, while discussing WSM stock, it can be concluded that the market uncertainties are taking a toll on its growth visibility despite its diversified in-house efforts in driving its business trends. The stock is reflecting long-term growth trends. However, when compared with RH, the intensity is dim. Also, the current premium valuation is a concern, making it difficult for investors to figure out a suitable entry point from a short-term perspective.

While both stocks currently carry a Zacks Rank #3 (Hold), RH appears to comparatively offer the better upside potential for investors seeking growth at a reasonable price. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite