|

|

|

|

|||||

|

|

Comfort Systems USA FIX has seen a spectacular run in recent months. Shares have surged more than 73.3% in the past three months alone, eclipsing the broader Zacks Building Products - Air Conditioner and Heating industry’s 37.1% gain and leaving broader Construction sector benchmarks far behind. As this national leader in mechanical, electrical, and plumbing (MEP) services hovers just 2.2% below its 52-week high of $553.09, investors are right to ask: Is there still room to run?

FIX Share Price Performance

Against competitors like AAON AAON, Watsco WSO, and EMCOR Group EME, FIX’s recent outperformance stands out. Over the past three months, while AAON has gained just 3.1%, Watsco has declined slightly by 1.2%, and EMCOR—its closest peer in terms of MEP breadth—has gained a still-impressive 54.4%. Comfort Systems’ national scale, deep industrial and tech-sector exposure, and large-scale project capacity give it a distinct edge, especially as demand shifts toward more complex and integrated mechanical and electrical solutions.

FIX Stock Performance Vs EME, AAON, WSO Stock

Comfort Systems ended the first quarter with a record $6.9 billion backlog, up 16% year over year and 14% sequentially on a same-store basis. Bookings were broad-based, led by advanced technology projects—data centers and semiconductor fabs now account for 37% of total revenues, up from 30% last year. With this strong backlog, management confirmed that visibility into 2026 is already higher than ever. Even as macro risks loom, this backlog depth provides a cushion and supports sustained revenue and earnings growth.

Comfort Systems’ modular business accounted for 19% of total revenues in first-quarter 2025, aided by more than 2.5 million square feet of production and storage space. Modular projects are typically large, repeatable, and margin-accretive, and their expansion helps reduce seasonality and drive better capital efficiency. The recent acquisition of Century Contractors, a mechanical contractor in North Carolina, further enhances Comfort Systems’ geographic reach and earnings power. The company expects to generate $90 million in revenues from Century Contractors this year. The company also returned $92 million to shareholders via share repurchases, while maintaining over $130 million in net cash, reinforcing its disciplined capital allocation.

FIX’s revenue mix is increasingly tilted toward high-growth, high-complexity sectors. Advanced tech leads the way, but institutional demand from healthcare, education, and government (now accounting for 24% of total revenues) also remains resilient. Management has noted a rise in healthcare bookings, which now account for about 10% of business, driven by aging demographics. Meanwhile, manufacturing activity and onshoring trends continue to offer new bidding opportunities. With 85% of revenue tied to construction, including 58% from new buildings and 27% from existing retrofits, FIX is positioned for secular growth even as pockets of commercial softness emerge.

While the latest tariff headlines raise concerns across the construction sector, Comfort Systems appears better insulated than many of its peers. Management emphasized that most pricing is locked in early—particularly for large equipment and long-lead items—and customers often share the risk of inflation. In addition, FIX’s size allows for aggressive early procurement and price hedging across its network. The company’s experience navigating COVID-era disruptions—with minimal margin erosion—gives confidence that it can manage future volatility. As of the first quarter, supply chain pressures and pricing pass-throughs remain manageable, with no sign of customer sticker shock.

Despite a remarkable rally, FIX’s valuation remains under control. The stock currently trades at a forward 12-month price/earnings (P/E) ratio of 27.24—below the industry average of 29.11 and comfortably below its five-year peak of 32.52. That’s especially notable given the company’s 82% gain from its 52-week low and its substantial outperformance relative to peers. For context, AAON is currently trading at 30.71X, Watsco at 30.72, and EMCOR—another large MEP player—at 22.27. FIX’s scale, diversified customer base, and robust backlog make its premium more justifiable than most.

FIX Stock Valuation

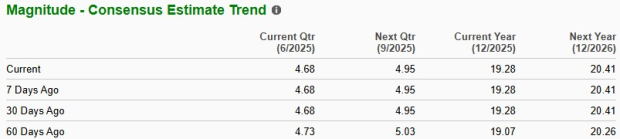

Comfort Systems’ earnings estimates for 2025 and 2026 have trended upward in the past 60 days to $19.28 per share and $20.41, respectively. The estimated figures for 2025 and 2026 indicate 32.1% and 5.8% year-over-year growth, respectively.

FIX is not simply benefiting from cyclical momentum. The company is executing exceptionally well in structurally advantaged markets, such as tech infrastructure and institutional construction. While macroeconomic risks, such as tariffs and inflation, warrant caution, management’s track record suggests that these challenges are unlikely to derail its long-term growth story. With a record backlog, strong margin visibility, and a balanced capital strategy, FIX offers more staying power than many of its industrial peers. Comfort Systems currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite