|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Meta Platforms META has been taking initiatives to boost its presence in the social commerce domain, which is a subset of e-commerce, and essentially means using social media platforms to promote and sell products or services. META offers a social commerce experience to its users through Facebook, Instagram, and WhatsApp.

According to Shopify, which cited Statista data, 89% of social media marketers prefer Facebook to drive social commerce sales, while one-third of social commerce buyers prefer to buy through Facebook. Instagram, on the other hand, is used by roughly 26% of the global population over the age of 13. Shopping tags and shop tab helps users discover products and purchase them over the Instagram platform. For WhatsApp, META has introduced AI tools that help businesses on WhatsApp assist their customers and help them discover new products. Integrated AI helps businesses on WhatsApp create ads on Facebook and Instagram more easily.

Meta Verified on Instagram, Facebook and WhatsApp is a popular initiative under which the company offers four subscription plans to help businesses build credibility. All plans include the verified badge, account support and impersonation protection. This boosts consumer trust and attracts new businesses to the platforms.

In first-quarter 2025, WhatsApp Business Platform, as well as Meta Verified subscriptions, contributed to deliver 34% year-over-year growth in Family of Apps other revenues, reaching $510 million.

The company recently announced features to the Ads Manager that enable businesses to manage their marketing strategy across WhatsApp, Facebook and Instagram. Businesses can now upload their subscriber list and either manually select marketing messages as an additional placement or use Advantage+. META’s AI system will then optimize budgets across placements to maximize performance. Ads Manager will help businesses in creating ads in Status once the feature is available.

Meta Platforms is planning to introduce Business AI that can make personalized product recommendations and facilitate sales on any business’ website. Over a WhatsApp chat, the Business AI can also follow up with customers to answer questions and provide updates. Moreover, Meta Platforms plans to launch calling and voice options for large businesses that use the WhatsApp Business Platform, thereby strengthening the relationship between businesses and customers.

In June, Meta Platforms introduced channel subscriptions, promoted channels and ads in WhatsApp’s Status tab in Updates, which is currently used by 1.5 billion people per day globally. This is expected to further attract advertisers, thereby driving META’s ad revenues, which accounted for 98% of total revenues in the first quarter of 2025.

Meta Platforms’ focus on integrating AI into its platforms — Facebook, WhatsApp, Instagram, Messenger and Threads — is driving user engagement to boost ad revenues. AI is heavily dependent on data, of which META has a trove, driven by its more than 3.43 billion daily users. Meta AI usage continues to increase, with roughly one billion monthly users globally. The company’s initiative to add updates that will help Meta AI deliver more personalized and relevant responses is expected to boost engagement.

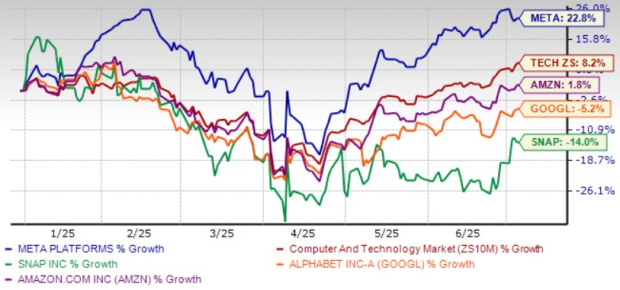

META’s shares have appreciated 22.8% year to date (YTD), outperforming the broader Zacks Computer & Technology sector, as well as its advertising peers, including Alphabet GOOGL, Amazon AMZN and Snap SNAP. Meta Platforms, Alphabet and Amazon are expected to absorb roughly 50% of the projected global ad spending by 2028.

Shares of Alphabet and Snap have dropped 5.2% and 14%, respectively, on a YTD basis. The broader sector and Amazon have climbed 8.2% and 1.8%, respectively, over the same timeframe.

META shares are trading above the 50-day and 200-day moving averages, indicating a bullish trend.

The Zacks Consensus Estimate for second-quarter 2025 earnings is pegged at $5.73 per share, up by a penny over the past 30 days, indicating a 11.05% year-over-year increase.

Meta Platforms, Inc. price-consensus-chart | Meta Platforms, Inc. Quote

The consensus mark for 2025 earnings is pegged at $25.31 per share, up 0.6% over the past 30 days, indicating a 6.08% increase over 2024’s reported figure.

META shares are overvalued as suggested by the Value Score of D. In terms of the forward 12-month Price/Sales (P/S), META is trading at 9.11X, a premium compared with the broader sector’s 6.65X.

Meta Platforms shares are trading at a premium compared to Alphabet, Amazon and Snap. In terms of the forward 12-month P/S, Alphabet shares are trading at 6.32X, while Amazon is trading at 3.25X and Snap at 2.52X.

Meta Platforms is spending heavily on expanding AI infrastructure. For 2025, capital expenditure is expected to be between $64 billion and $72 billion, driven by META’s Gen AI initiatives and core business.

Operating expenses are expected in the $114-$119 billion range, with headcount expected to increase within infrastructure, monetization, Reality Labs, Generative AI, regulations and compliance. Regulatory concerns in the United States and Europe, along with tariffs and premium valuation, make the stock a risky bet.

Although these investments bode well for the company’s longer-term prospects, we believe the lack of monetization of new platforms, such as Threads and Meta AI, is a concern. Meta Platforms plans to focus on scaling and deepening engagements for Meta AI over the next few years. Ad revenues are expected to suffer from uncertainty related to higher tariffs and challenging macroeconomic conditions.

META currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 44 min | |

| 55 min |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

GOOGL

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite