|

|

|

|

|||||

|

|

The dynamic world of athletic apparel is marked by two titans vying for dominance: NIKE Inc. NKE, the undisputed global sportswear giant, and lululemon athletica inc. LULU, the sleek disruptor redefining performance and lifestyle wear. While NIKE commands a massive share of the global market with its broad-based portfolio spanning footwear, apparel and equipment, lululemon has carved out a powerful niche with its premium, direct-to-consumer model and cult-like brand following, particularly in women’s athleisure.

This face-off goes beyond brand popularity; it is a strategic battle between legacy and innovation, mass appeal and targeted lifestyle curation. As shifting consumer preferences, digital engagement, and global expansion reshape the activewear landscape, NIKE and lululemon are rewriting the rules of competition.

Who has the edge in market share? Who is best-positioned to lead the next chapter in performance wear? Let us dive into the fundamentals of these bigwigs.

NIKE stands as a global powerhouse in athleticwear, commanding a dominant share of the consumer discretionary sector with its vast portfolio spanning NIKE, Jordan and Converse. The brand caters to a wide range of demographics, from elite athletes to Gen Z consumers, with deep penetration across key performance categories like running, basketball and sportswear. Despite macroeconomic pressures and internal challenges, NKE maintains unmatched visibility and influence across global retail and wholesale channels.

In fiscal 2025, NIKE launched its “Win Now” strategy, aimed at revitalizing growth by refocusing on sport-led innovation, streamlining leadership and rebalancing its product mix. Key franchises like the Air Force 1 and Dunk are being right-sized, while performance-driven launches such as the Vomero 18 and A’ja Wilson’s A-ONE have seen rapid sell-through.

The company is reorganizing teams by sport rather than gender to deepen athlete relationships and create more relevant, high-impact product assortments. This shift, along with partnerships with Amazon, JD Sports and Aritzia, is already showing signs of marketplace traction.

However, there are certain near-term headwinds. Fiscal 2025 revenues declined 10% year over year, with fourth-quarter EPS at 14 cents, reflecting the financial impacts of repositioning efforts and elevated promotional activities. NIKE faces ongoing softness in China, continued pressure from new U.S. tariffs (estimated at $1 billion), and a pullback in digital traffic as the brand transitions to a full-price model. Elevated inventory levels and reduced demand in classic franchises like Dunk also weigh on the performance, with management expecting these pressures to persist through the first half of fiscal 2026.

Despite these challenges, NIKE’s holiday order book is improving, and the repositioning of NIKE Digital is expected to lift margins. As it heads into fiscal 2026 with an energized brand, cleaner inventory and a powerful sports-led product pipeline, NKE is well-positioned for long-term, sustainable growth.

LULU continues to outperform in the premium activewear segment, commanding a growing market share in men’s and women’s categories. In first-quarter fiscal 2025, revenues rose 7% year over year to $2.4 billion, with the gross margin expanding 60 basis points (bps) to 58.3% and EPS of $2.60. The brand’s distinct positioning, blending performance, comfort and style, resonates with its target demographic of high-income, wellness-focused consumers.

With 770 stores worldwide and 41% of sales from its digital channel, lululemon is building a powerful omnichannel engine. Growth remains well-balanced, led by a 22% constant-currency increase in China and 17% in the Rest of World segment, while store productivity and digital engagement stay strong.

Strategically, lululemon is leaning into innovation and global expansion. Its product pipeline is gaining traction with launches like the Daydrift trouser, No Line Align leggings and the Glow Up performance line, all aimed at establishing new core franchises. lululemon’s marketing engine, rooted in grassroots activations and social storytelling, continues to elevate brand equity and deepen customer loyalty.

The company remains focused on its “Power of Three X2” strategy, growing product categories, expanding internationally and doubling digital revenues, while maintaining premium price positioning and high full-price sell-throughs.

However, near-term headwinds loom. U.S. traffic trends remain soft, leading to cautious markdown assumptions for the second half of fiscal 2025. Elevated tariffs are also expected to pressure the gross margin, with a projected 110-bps decline for the year. Despite these challenges, lululemon’s strong balance sheet ($1.3 billion in cash, no debt), disciplined cost management and resilient brand positioning support its long-term growth outlook.

The Zacks Consensus Estimate for NIKE’s fiscal 2026 sales and EPS implies year-over-year declines of 1.5% and 21.8%, respectively. The EPS estimate has moved down by a penny in the past seven days.

The Zacks Consensus Estimate for lululemon’s fiscal 2025 sales suggests year-over-year growth of 5.7%, while that for EPS indicates a decline of 1%. The EPS estimate has edged down 2.1% in the past 30 days.

This clearly illustrates that both NIKE and lululemon have witnessed downward estimate revision trends in the past 30 days. Moreover, estimates for both NKE and LULU indicate year-over-year declines in earnings for the current year.

Shares of both NIKE and lululemon have shown soft year-to-date trends due to the ongoing troubles in their businesses and the rising tariff imposition-related concerns. Year to date, NIKE shares have inched up 1.2%, while lululemon stock has lost 37.9%.

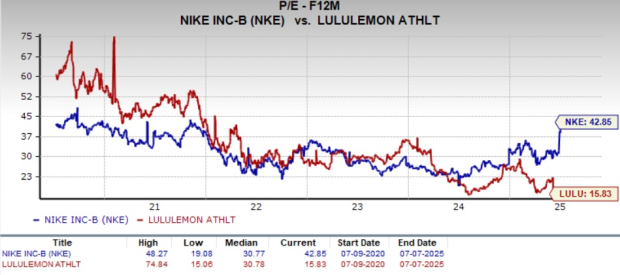

NIKE is trading at a forward price-to-earnings (P/E) multiple of 42.85X, above its median of 30.77X in the last five years. lululemon’s forward P/E multiple sits at 15.83X, below its median of 30.78X in the last five years.

lululemon’s stock looks cheap from a valuation perspective. Moreover, investments in product innovation, guest experience and market expansion, as part of the Power of Three X2 growth plan, highlight its growth prospects.

NIKE does seem pricey. However, its valuations reflect its focus on repositioning itself to be more competitive and drive sustainable, profitable long-term growth. If the company sustains its execution, the premium can be warranted.

As the activewear industry transforms, both NIKE and lululemon present compelling, yet contrasting, investment narratives. NKE, despite recent challenges, is showing signs of a rebound. The stock has regained ground year to date, underpinned by improving wholesale momentum, a more disciplined digital strategy and an invigorated focus on performance products. While earnings estimates have been revised downward, the adjustment has been relatively modest, suggesting investor confidence in NIKE’s execution of its “Win Now” strategy and its ability to navigate headwinds without losing long-term footing.

lululemon remains a growth-driven disruptor, but near-term sentiment is cautious. The stock has corrected meaningfully as concerns around U.S. consumer softness, elevated tariffs and markdown pressures weigh on forecasts. However, LULU’s long-term strategy, anchored in product innovation, brand intimacy and international expansion, remains intact. Investors may need to weather short-term volatility, but the brand’s lean operating model and global runway position it for future outperformance.

NIKE offers defensive stability with potential upside as it sharpens execution, while lululemon presents a high-quality growth opportunity at a more attractive valuation. Investors must weigh near-term volatility against long-term brand strength; both companies remain central players in the future of activewear.

NIKE and lululemon currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 8 hours | |

| 10 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

LULU

The Wall Street Journal

|

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite