|

|

|

|

|||||

|

|

NVIDIA Corp. NVDA — the undisputed global leader of the generative artificial intelligence (AI)-powered graphical processing units (GPUs) — saw a 4% jump in its stock price on July 15, after the company said in a statement that it is hopeful about resuming sales of H20 AI chips to China. At present, NVDA is the first and the sole publicly traded company with a market capitalization of more than $4 trillion.

The Trump administration restricted the shipment of H20 chips to China in April. However, the situation has changed after rigorous trade and tariff-related negotiations between the United States and China following the implementation of President Donald Trump’s reciprocal tariffs. In a recent statement, the company said, “the U.S. government has assured NVIDIA that licenses will be granted, and it hopes to start deliveries soon.”

Since May, the market has been ripe with speculation that NVIDIA is developing a less advanced variant of H20 chips — called RTX PRO. CEO Jensen Huang said that the new chip is a “fully compliant” GPU, ideal for smart factories and logistics. It is not clear whether Huang was talking about H20 or RTX PRO for a U.S. license to export in China.

NVIDIA lost $2.5 billion revenues in China in first-quarter fiscal 2026 and a $4.5 billion inventory write off. Management warned that it will lose $8 billion in revenues from China from second-quarter fiscal 2026. NVIDIA is no longer counting any sales from China.

Several investment banks have estimated that the resumption of sales in China could bring back around $10 to $20 billion in revenues in the rest of fiscal 2026. Financial researchers estimate that these additional revenues could translate into 25 cents to 50 cents in EPS upside in fiscal 2026. Consequently, it should act as a significant catalyst to NVDA stock’s upside potential.

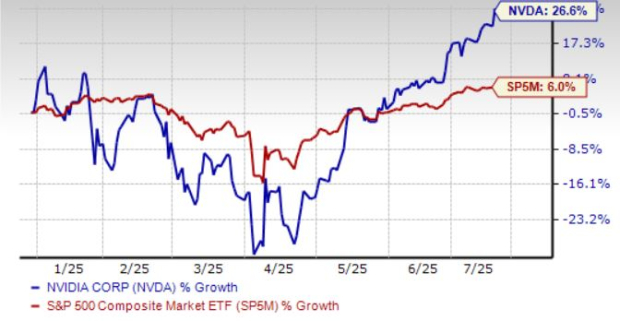

The stock price recorded its recent low in early April. From there, it surged nearly 97%, with a year-over-year gain of more than 26%.

NVIDIA reaffirmed its commitment to continued innovation, evolution and execution. After the successful execution of Hopper GPUs, NVDA’s Blackwell GPUs have already sold record-high units to cloud providers.

NVIDIA is expected to unveil Blackwell Ultra in the second half of 2025 and begin shipping Vera Rubin in 2026. In addition, the company has decided to announce its roadmap for Rubin Next, to be introduced in 2027, and Feynman AI chips in 2028.

The company is supported by an extremely bullish demand scenario. Four major clients of the company, namely, Microsoft Corp. MSFT, Alphabet Inc. GOOGL, Meta Platforms Inc. META and Amazon.com Inc. AMZN have decided to invest a massive $325 billion in 2025 as capital expenditure for AI-infrastructure development. This marks a significant 46% year-over-year increase in capital spending on the AI ecosystem. Research firm Oppenheimer estimated that the total addressable global sovereign AI market could be a massive $1.5 trillion.

The major innovation for NVDA’s new chipsets is a qualitative shift from pure-play generative AI models to reasoning AI models. NVIDIA’s CEO Jensen Huang said that contrary to the market’s belief that DeepSeek is a major threat to NVDA’s high-cost chips, it has actually opened a huge growth opportunity for his company.

According to Huang, “DeepSeek’s R1 AI model is the first open-sourced reasoning model. This reasoning AI consumes 100 times more compute than a non-reasoning AI.” OpenAI's o1 and Alphabet’s Gemini 2.0 Flash Thinking are also reasoning models.

Huang said that AI chips with faster speed will be the best option for companies that opt for reasoning AI-based infrastructure to save costs and maximize returns. In this regard, NVDA’s upcoming Blackwell Ultra chips are expected to provide data centers 50 times more revenues than its Hopper systems, buoyed by their superfast AI servicing capabilities to multiple users.

Apart from the robust business of data centers and gaming, the automobile industry, especially the self-driving and new energy vehicles, is turning out to be the next catalyst. In first-quarter fiscal 2026, automotive revenues jumped 72% year over year to $567 million. NVDA is expecting automotive segment revenue to cross $5 billion in fiscal 2026. Huang is highly optimistic as this business could become a multitrillion-dollar opportunity in the future.

NVIDIA is increasingly focusing on powering advanced driver-assistance systems, autonomous vehicles, and robotics. The company has started the production of its “full-stack” solutions for Mercedes-Benz, which combines its DRIVE AGX Orin AI chips with DriveOS software for next-generation vehicles.

In addition to Mercedes-Benz, other auto giants like Volvo and China’s BYD are using NVDA’s chips. Moreover, NVDA’s chips are also used in some of Tesla Inc.’s supercomputers. NVIDIA is also using its AI-enabled factory robots to upgrade and streamline the assembly line for auto makers like General Motors Co. and Hyundai.

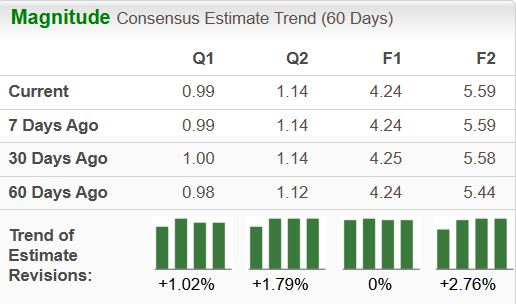

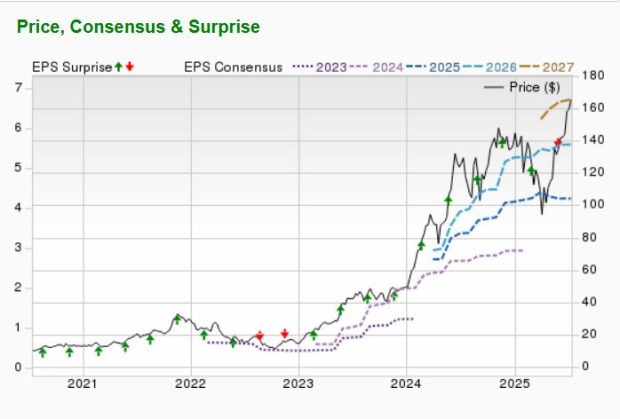

NVIDIA has an expected revenue and earnings growth rate of 51.4% and 41.8%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has remained flat over the past 60 days.

It has an expected revenue and earnings growth rate of 25.2% and 31.9%, respectively, for the next year (ending January 2027). The Zacks Consensus Estimate for next-year earnings has improved 0.2% over the past 30 days.

NVDA has a long-term (3-5 years) EPS growth rate of 28.2%, significantly above the S&P 500 Index’s 12.6% growth rate.

NVIDIA has a return on equity (ROE) of 105.1% compared with the S&P 500’s ROE of 17% and the industry’s ROE of a mere 5%. NVDA has a forward P/E (price/earnings) of 38.7% compared with the industry’s P/E of 39.1% and the S&P 500’s P/E of 19.6%.

NVIDIA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

However, the return of sales from China will have a significant positive impact on both the top and bottom lines of the company. As a result, the average target price of brokerage firms is expected to witness solid near-term upside.

NVIDIA represents a rare opportunity to invest in a company with proven execution and substantial unrealized potential in the AI revolution. At this stage, it will be prudent to buy NVDA on every dip. Hold this stock for the long term as the company’s strong execution of the last several quarters and robust future projections will generate more value.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Microsoft Gains On Hopes It Is Not AI's Lunch; But Is Microsoft A Buy Now?

MSFT

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow, Nasdaq End In Recovery Mode; AMD Jumps, Energy Name Powers Up (Live Coverage)

META

Investor's Business Daily

|

| 1 hour | |

| 1 hour |

Dow Jones Futures: Stock Market Bounces Before Trump Speech, Nvidia Earnings

NVDA

Investor's Business Daily

|

| 1 hour |

MercadoLibre Stock Climbs After Posting Mixed Q4 Results, Strong E-Commerce Growth

AMZN

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite