|

|

|

|

|||||

|

|

IonQ. Inc. IONQ, a pioneer in quantum computing, is setting its sights far beyond Earth’s surface. With the recent acquisition of Capella Space, a satellite technology firm known for synthetic aperture radar (“SAR”) imaging, IonQ is accelerating its bold vision to build the first global space-based quantum key distribution (“QKD”) network. The deal positions IonQ to not only lead in quantum computing but also in quantum-secure communications—a sector expected to become increasingly vital for both commercial and defense applications.

The completed acquisition of Capella Space is not just a strategic expansion—it marks a foundational step toward realizing IonQ’s quantum Internet ambitions. By integrating Capella’s space-based infrastructure with its quantum hardware and software stack, IonQ is developing a QKD network that promises tamper-proof communication channels between satellites and ground stations. This could prove essential for national defense, cybersecurity, and even financial institutions where absolute data security is critical.

This space-based QKD architecture would also support new capabilities in Earth observation, enhancing SAR imaging with quantum encryption for ultra-secure data transmission. IonQ’s move effectively positions it as the first player in a new category: quantum-enabled geospatial intelligence. According to IonQ CEO Niccolo de Masi, the integration will not only enhance commercial applications but also expand the company’s role in global defense and intelligence operations.

Beyond Capella, IonQ has also forged key partnerships that reinforce its long-term vision. Its collaboration with ID Quantique, a leader in quantum-safe cryptography, and its quantum networking contracts with the U.S. Air Force Research Laboratory and the Applied Research Laboratory for Intelligence and Security highlight the growing demand for IonQ’s technology in national security and enterprise use cases.

These alliances help validate IonQ’s platform and increase the likelihood of recurring revenue through long-term government engagements. With security concerns escalating globally and government agencies seeking resilient communications infrastructure, IonQ’s offering stands to benefit from rising demand in the public sector.

IonQ shares have surged 61% over the past three months, outpacing the 45.1% gain in the Zacks Computer-Integrated Systems industry and the 30.1% rise in the broader Zacks Computer and Technology sector. Even the S&P 500’s robust 18.8% climb during the same period has lagged behind IonQ’s performance. This momentum reflects investor enthusiasm around IonQ’s strategic direction, particularly its leadership in quantum networking and government-backed projects.

IONQ 3-Month Share Price Performance

Yet with this rally comes a note of caution. The stock is currently trading at a lofty forward 12-month price-to-sales (P/S) ratio of 97.61, which is significantly higher than the industry average of 3.84. While IonQ operates in a highly specialized frontier market, the steep premium raises questions about whether the stock has already priced in too much of the company’s long-term potential.

IONQ Valuation

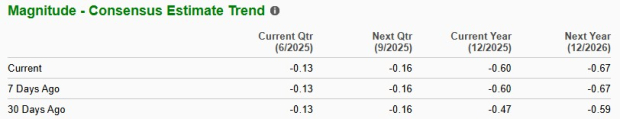

Despite the sky-high valuation, the company’s growth trajectory appears robust. For 2025, the Zacks Consensus Estimate for revenue implies a near doubling year over year, at 97.3% growth. That said, analysts have become slightly more conservative in their projections for profitability. The consensus estimate for 2025’s loss per share has widened over the past 30 days, although it still points to a much narrower loss than the $1.56 per share loss reported a year ago.

This mixed sentiment suggests that investors are optimistic about revenue expansion but remain cautious about when IonQ will turn the corner on profitability. The company continues to invest heavily in R&D and infrastructure, particularly in its quantum-as-a-service (QaaS) and networking initiatives, which may delay earnings upside but could secure a first-mover advantage.

While IonQ’s technological edge is compelling, the company is still in an early stage of commercial maturity. The quantum computing industry is years away from widespread enterprise adoption, and IonQ must demonstrate its ability to transition from R&D-driven partnerships to scalable, recurring commercial revenue. In the meantime, its burn rate and elevated valuation could limit investor patience if near-term milestones fall short.

Moreover, the intensifying competition from peers like International Business Machines Corporation IBM, Microsoft Corporation MSFT, and Rigetti Computing, Inc. RGTI could challenge IonQ’s leadership if those firms scale more quickly or secure broader ecosystems. IBM’s extensive hardware roadmap and global quantum network make it a key rival, while Microsoft’s Azure Quantum is gaining traction with hybrid solutions and cloud accessibility. Both IBM and Microsoft have broader platforms and deeper enterprise reach. Rigetti, though smaller, competes closely with IonQ in hardware innovation. While IonQ’s space-based QKD provides a differentiator, IBM and Microsoft, mentioned repeatedly in enterprise discussions, remain the more established players with vast resources and client ecosystems.

IonQ is making bold moves that reflect its ambition to shape the quantum future, from terrestrial computing to orbital communications. The Capella Space acquisition solidifies its leadership in quantum-secure networking and opens a new chapter in space-based infrastructure. With accelerating government interest, a clear roadmap toward the quantum Internet, and strong revenue prospects, IonQ offers a compelling growth narrative.

However, with its valuation already stretched and earnings still in the red, investors should remain cautious. IonQ currently carries a Zacks Rank #3 (Hold), which aligns with a prudent approach — hold the stock and monitor execution, especially as the company integrates Capella and ramps up commercial applications. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite