|

|

|

|

|||||

|

|

Subscribers to Chart of the Week received this commentary on Sunday, August 2.

Last week ushered in a handful of Magnificent 7 earnings that brought the halo lift to broader tech that everyone expected. The Roundhill Magnificent Seven ETF (MAGS) hit a record high of $59.77 on Thursday, on the backs of outperformers Meta Platforms (META) and Microsoft (MSFT). What investors didn’t expect though, was Friday’s sharp tariff-infused selloff to take the wind out of Big Tech’s sales, winds that had propped up the Nasdaq-100 Index (NDX) to a record high on Thursday.

If you adhere to – and past is precedent, in this case – the ‘Trump Always Chickens Out’ TACO trade, then Friday’s selloff is just part of some necessary short-term pain before a robust buying opportunity. For Nvidia Corp (NASDAQ:NVDA), the last Mag 7 name to report earnings this quarter, now may be the time to strike.

Nvidia won’t step into the second-quarter earnings confessional until after the market closes on Wednesday, Aug. 27. That may mean the company stays out of the news for the last few months, but make no mistake, Nvidia remains the king of the tech titans. MSFT briefly joined Club $4 Trillion earlier this week, before moving back below this market cap level on Friday. NVDA blew past the $4 trillion earlier in July and never looked back -- or even came close to stalling out at this psychologically significant level. Even during Friday’s selloff, NVDA never once breached its 20-day moving average, a trendline that hasn’t been breached on a closing basis since late April.

Bears might point to the trendline connecting NVDA’s current peak with the shares’ late 2024 highs. Especially as tariff rhetoric remains unresolved with China, this is understandably a daunting technical hurdle. However, there are seasonal and historical trends in the next month that can help the stock clear it.

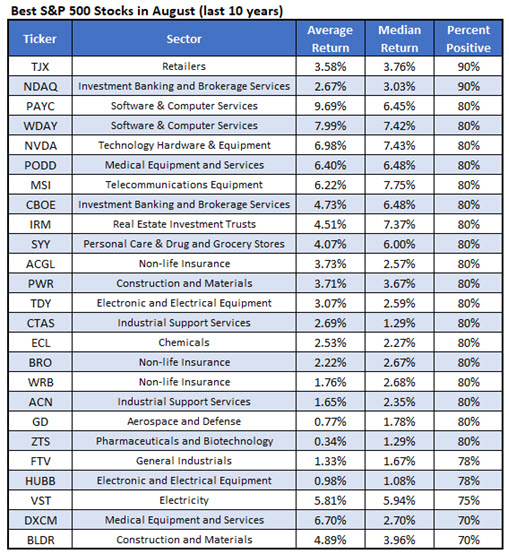

August is historically a bullish month for Nvidia, per Senior Quantitative Analyst Rocky White. Going back 10 years, NVDA averages a monthly gain of 7%, with eight out of 10 returns positive. That’s the third best stock by averages on the list below, and the only megacap name present. NVDA has a rather upbeat post-earnings history as well. The stock has moved higher the day after five of its last eight reports, including a 3.2% gain back in May. Overall, NVDA averages a post-earnings move of 5.9%, regardless of direction, in the last two years.

Aug. 27 is a long way away, and a lot can change, but options trends are revealing some actionable insights. Short-term options traders are leaning toward puts, per NVDA’s Schaeffer's put/call open interest ratio (SOIR) of 0.94 stands in the 76th percentile of readings from the past 12 months. Volume remains subdued though; call and put open interest (OI) both sit in the 10th percentile of their annual range, well off their highs from August 2024.

Its clear from Trade-Alert that premium buyers are not doing much pre-earnings positioning at the moment, seemingly more content to play out weekly and nearer-term contracts. The weekly 8/1 180-strike call is the top open interest position at the moment, followed closely by the standard expiration August 160 call, the latter seemingly part of some spread activity with the August 160 put. The upside to the report being so far away is that premium is affordably priced at the moment, per the equity’s Schaeffers Volatility Index (SVI) of 35%, sitting in the low 3rd percentile of its annual range.

In the weeks leading up to Aug. 27, there are macro storylines to monitor. Data center spending seems to be on the upswing, per Alphabet’s (GOOGL) report on Tuesday. Nvidia CEO Jensen Huang has been vocal about data center demand, anticipating over $1 trillion in spending by 2028 to help the massive computing power used for large language models. Alphabet is hardly the only data center game in town, so keep an eye on earnings reports from Nebius Group (NBIS), CoreWeave (CRWV), and Arista Network (ANET), all major players due to report earnings in the next 10 trading days.

Huang has also been a vocal proponent of quantum computing. IonQ (IONQ) reports earnings next Wednesday, Aug. 6. Upbeat quantum rhetoric could embolden Nvidia to double down on the speculative technology when it’s their turn. And for investors, quantum doesn’t have to work right now or be profitable to companies. It just has to be exciting enough to move the stock.

Imagine this: IONQ gaps higher on Thursday after the company’s fundamentals look solid, or a major Qubit breakthrough is announced. Investors buy the rumor, and quantum becomes the next buzzword that piques investor interest -- just as artificial intelligence (AI) did a few years ago -- in corporate reports. Huang has therefore positioned Nvidia to capitalize on the current strengths (AI, data centers), while also keeping an eye on the future. And given all of the slowly building technical factors supporting NVDA, the bullish seasonality, and the currently bargain bin options prices, now may be the last time in a while to take a flier on such a giant.

| 2 min | |

| 53 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite