|

|

|

|

|||||

|

|

The fund provides exposure to the AI hardware and software supply chain while maintaining an ultra-low 0.09% expense ratio.

Top holdings, including Nvidia, Microsoft, and Apple, represent companies dominating different segments of the AI revolution.

The fund has nearly doubled the S&P 500's returns over the past 15 years.

Everyone's hunting for the next Nvidia (NASDAQ: NVDA), but they're looking in the wrong place. The real artificial intelligence (AI) opportunity lies in owning the companies supplying the chips, cloud platforms, and enterprise software powering today's AI gold rush.

With $300 billion in infrastructure spending from tech giants this year alone, modern prospectors are investing in computing and networking. The companies selling that infrastructure are the ones striking gold.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

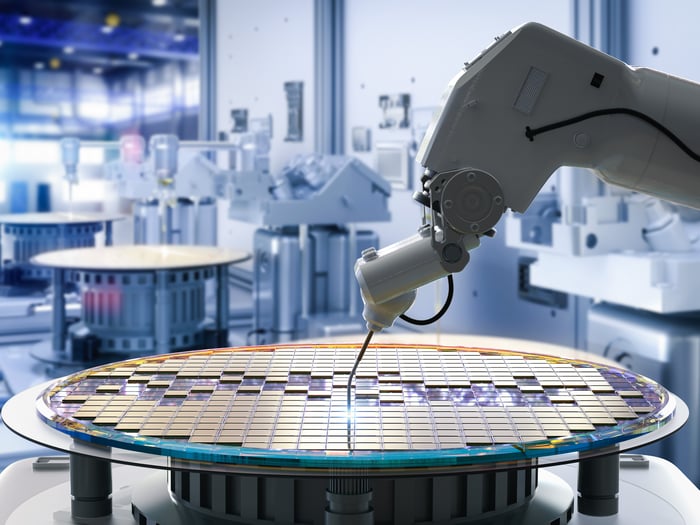

Image source: Getty Images.

For investors who prefer to avoid single-stock risk, the Vanguard Information Technology ETF (NYSEMKT: VGT) provides exposure to the AI technology supply chain. Read on to find out more about this top AI vehicle.

This exchange-traded fund (ETF) wasn't designed as an AI play when it was launched in 2004, years before deep learning went mainstream. But through market-cap weighting and technology's winner-take-all dynamics, it has become a strong proxy for the AI build-out.

Nvidia commands 16.7% of the fund, reflecting its stranglehold on the GPU market that powers AI training. Microsoft (NASDAQ: MSFT) represents 14.9%, with its Azure cloud platform hosting everything from OpenAI's ChatGPT to thousands of enterprise AI applications. Apple rounds out the top three at 13%, preparing to push AI features to over 2.35 billion active devices.

The concentration gets more interesting further down. Broadcom, at 4.6%, designs custom AI chips for hyperscalers and supplies the networking gear that keeps data flowing between thousands of processors. Oracle, at 2%, has reinvented itself as an AI cloud provider, winning customers with specialized infrastructure for training large models.

These aren't speculative bets. Microsoft's cloud revenue hit $40.9 billion last quarter, up 21% year over year. Nvidia's data center revenue reached $39.1 billion in its most recent quarter, up 73% relative to the same period a year ago. The AI gold rush is generating real revenue, and this fund captures the companies mining the most gold.

The ETF's reach extends beyond its mega-cap holdings, with 319 stocks providing AI exposure across the technology stack. Palantir Technologies (1.6%) delivers AI solutions to government agencies and Fortune 500 clients. Cisco Systems (1.6%) supplies the networking hardware that links together vast AI computing clusters. IBM (1.6%) deploys its Watson AI platform to help enterprises integrate advanced analytics and automation into their operations.

Over the past 15 years, the fund has delivered 19.7% annual total returns (including distributions), turning $10,000 into roughly $155,000. That's about 9 percentage points per year ahead of the benchmark S&P 500 over the same period. That's the power of owning the leaders in the most important technological innovation of our time.

VGT Total Return Level data by YCharts.

Analysts remain optimistic about the ETF's largest holdings, thanks to AI spending. Morgan Stanley estimates that Microsoft, Amazon, Alphabet, and Meta Platforms will invest about $300 billion in AI infrastructure in 2025. That level of investment should directly benefit the ETF's hardware and semiconductor holdings.

On the fee front, investors get this exposure for just $9 per year on a $10,000 investment -- a fraction of what most actively managed tech funds charge.

The ETF has some blind spots. As a fund in the information technology sector, it excludes Amazon and Alphabet entirely, leaving out Amazon Web Services and Google Cloud despite their dominant role in AI. It is also heavily weighted toward Apple, Microsoft, and Nvidia, so weakness in any of these companies could weigh on performance.

Moreover, technology-sector drawdowns can be severe. The fund declined more than 50% in 2008 and 30% in 2022. Even so, decades of compounding have more than offset the occasional sharp downturn.

The Vanguard Information Technology ETF doesn't need to guess the next AI breakthrough. It owns the companies with the capital, talent, and market dominance to adapt to whatever comes next. Periods of volatility are inevitable, but history shows that technology leaders often emerge from downturns even stronger.

For investors willing to ride out the drawdowns, the reward has been decades of market-beating compounding. So, with AI adoption accelerating and the sector's fundamentals in their best shape in years, this Vanguard ETF offers a low-cost way to capture the gains from this platform shift.

Before you buy stock in Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $660,783!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,122,682!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

George Budwell has positions in Apple, Microsoft, Nvidia, Palantir Technologies, and Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Cisco Systems, International Business Machines, Meta Platforms, Microsoft, Nvidia, Oracle, and Palantir Technologies. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 40 min | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite