|

|

|

|

|||||

|

|

NeuroOne Medical Technologies Corporation NMTC recently received FDA 510(k) clearance for its OneRF Trigeminal Nerve Ablation System, a minimally invasive solution for treating severe facial pain. The system delivers targeted radiofrequency energy to ablate trigeminal nerve fibers, offering an alternative to traditional medications or invasive surgical procedures. NMTC now targets a limited commercial launch in the fourth quarter of 2025.

The OneRF platform leverages proprietary multi-contact RF probe technology, allowing precise localization and tailored ablation under temperature-controlled conditions. This innovation aims to improve patient safety, reduce procedural time, and expand NMTC’s footprint in pain management. The FDA clearance also opens doors for future applications across other neurological and pain-related therapies, positioning the company for potential revenue growth as early as late 2025.

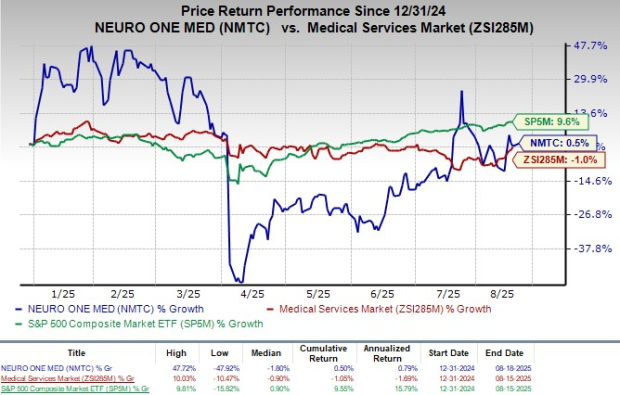

Following the announcement yesterday, the company's shares have gained 7% in today’s pre-market trading. Shares have gained 0.5% in the year-to-date period compared with the industry’s 1% growth. The S&P 500 has gained 9.6% in the same time frame.

The FDA clearance is a significant growth catalyst for NMTC, as it expands the company’s OneRF platform into the large pain management market. By offering a minimally invasive alternative to invasive surgeries, the system strengthens NMTC’s commercial pipeline and creates near-term revenue potential with a limited launch in late 2025. Longer term, the clearance validates the versatility of the OneRF platform, supporting expansion into broader neurological and pain therapy applications, which could accelerate adoption, attract strategic partnerships, and diversify revenue streams.

NMTC currently has a market capitalization of $40.9 million.

Trigeminal neuralgia is a chronic pain condition that impacts a significant number of people in the United States each year. The disorder arises from the trigeminal nerve, the primary sensory nerve of the face, and is associated with episodes of intense, debilitating pain. Traditional treatment options have typically centered on medications or invasive surgical approaches such as microvascular decompression, radiosurgery, and other percutaneous procedures, each carrying its own limitations and risks.

NeuroOne’s newly cleared OneRF Trigeminal Nerve Ablation System provides a minimally invasive alternative designed to interrupt pain signaling at its source. The system delivers targeted radiofrequency energy to ablate trigeminal nerve fibers and features a multi-contact RF probe that can both localize and ablate nerve tissue using the same instrument. With temperature-controlled functionality, the system enhances precision and safety while potentially reducing procedure time and improving overall patient comfort compared to conventional approaches.

The FDA clearance for this indication builds on the broader OneRF technology platform, which is already being applied in brain ablation procedures. By extending its use to facial pain, NeuroOne is taking its first step into pain management therapies. The platform’s adaptability offers further opportunities in additional areas such as lower back pain, while ongoing collaborations with existing users and potential strategic partners may support its clinical and commercial adoption.

Per a report by Straits Research, the global trigeminal neuralgia treatment market size was valued at $255.09 million in 2024 and is anticipated to reach $392.34 million by 2033, exhibiting a CAGR of 4.9% during the forecast period.

The market is primarily boosted by the surging incidence of trigeminal neuralgia worldwide. Additionally, the surge in the geriatric population is further increasing the burden of this disease, which is anticipated to expedite the market expansion.

Currently, NMTC carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank of 1 (Strong Buy), reported second-quarter 2025 EPS of $3.10, beating the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite