|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As Walmart Inc. WMT is slated to report second-quarter fiscal 2026 earnings on Aug. 21 before market open, investors face an important decision on whether they should buy the stock now or hold their current positions.

With earnings expectations and market conditions in mind, it is crucial to evaluate key factors influencing Walmart’s performance and whether the stock offers an attractive entry point ahead of its earnings report.

WMT has established a strong position in global retail by leveraging its diversified business model and omnichannel strategy. Backed by steady traffic growth across stores and digital platforms, as well as expanding high-margin businesses like advertising and membership, Walmart is well-positioned to deliver consistent growth.

The Zacks Consensus Estimate for fiscal second-quarter revenues is pegged at $175.5 billion, indicating 3.7% growth from the year-ago reported level. Also, the consensus mark for quarterly earnings has moved up a penny in the past seven days to 73 cents per share, indicating 9% growth from the year-ago quarter’s reported figure.

Walmart has a trailing four-quarter average earnings surprise of 5.3%. In the last reported quarter, the company’s bottom line surpassed the Zacks Consensus Estimate by a margin of 7%.

Walmart Inc. price-consensus-eps-surprise-chart | Walmart Inc. Quote

As investors prepare for Walmart’s fiscal second-quarter announcement, the question looms regarding earnings beat or miss. Our proven model conclusively predicts that an earnings beat is likely for WMT this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Walmart has an Earnings ESP of +1.26% and a Zacks Rank #2 at present. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

WMT continues to strengthen its position as a resilient and growth-oriented retailer, supported by consistent sales momentum across Walmart U.S., Sam’s Club, and its international businesses. Comparable sales (comps) trends highlight broad-based demand, particularly in grocery and health & wellness, wherein the company has expanded its market share.

With its ability to attract customers across income groups and blend physical stores with digital platforms, Walmart’s omnichannel strategy remains a key competitive advantage, driving customer loyalty and traffic growth. The Zacks Consensus Estimate points to a 4% increase in U.S. comps and a 4.9% rise in Sam's Club U.S. comps for the fiscal second quarter.

E-commerce is likely to have been a major catalyst in the fiscal second quarter. Walmart is enhancing convenience with faster delivery capabilities, targeting 95% of the U.S. population with three-hour delivery options. Its marketplace expansion, coupled with improvements in last-mile efficiency, continues to build scale and efficiency, reinforcing Walmart’s digital edge. These advancements are contributing to stronger profitability and setting the stage for further margin expansion as digital adoption accelerates.

High-margin businesses are also playing a greater role in Walmart’s outlook. Membership income has grown at a double-digit pace in the fiscal first quarter, with Walmart+ and Sam’s Club both benefiting from strong renewal rates and increased penetration of premium tiers. Advertising has become another growth pillar, with Walmart Connect and international platforms such as Flipkart scaling rapidly. These businesses are likely to have diversified the company’s revenue streams and provided earnings stability by reducing the reliance on traditional lower-margin retail sales.

International markets have added another dimension to Walmart’s growth story. Strong performances in China, Flipkart and Walmex in the recent past highlight the company’s ability to tap into high-potential regions and diversify geographic risks. Alongside disciplined inventory management and strategic capital returns, Walmart’s healthy balance sheet enables it to invest in growth while rewarding shareholders.

On its last reported quarter’s earnings call, Walmart expected year-over-year sales growth of 3.5% to 4.5% at constant currency in the fiscal second quarter, supported by ongoing momentum in grocery, membership and e-commerce. However, currency headwinds are likely to have reduced reported sales growth by 120 basis points. While tariff-related cost pressures may create variability in quarterly results, Walmart’s scale, sourcing flexibility, and diversified profit streams provide it with the tools to manage through this environment effectively.

From a valuation standpoint, Walmart stock is currently trading at a premium compared with the Zacks Retail - Supermarkets industry. With a forward 12-month price-to-earnings (P/E) ratio of 36.56, Walmart stands above the industry average of 33.34, suggesting that the stock may be relatively expensive at current levels.

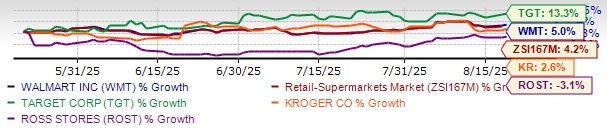

When compared with other retail giants, including The Kroger Co. KR, Target Corporation TGT and Ross Stores, Inc. ROST, the company’s valuation looks even more stretched. Kroger trades at a forward P/E of 14.11, Target at 13.51 and Ross Stores at 22.66 — all significantly lower than Walmart’s valuation multiple. Currently, Walmart has a Value Score of B.

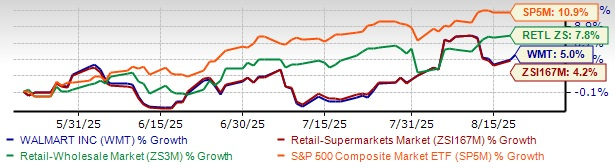

Over the past three months, Walmart’s stock has gained 5% compared with the industry’s growth of 4.2%. In the same period, the Retail-Wholesale sector and the S&P 500 have risen 7.8% and 10.9%, respectively.

The company underperformed some key peers, including Target, which has gained 13.3%. Kroger’s stock has rallied 2.6%, while Ross Stores has declined 3.1% over the same period.

Walmart’s stock is strengthened by its broad retail reach, seamless integration of physical and digital channels, and expanding profit streams from areas such as marketplace services, advertising, and memberships. The company’s ability to capture share in essential categories while investing in faster delivery and international growth provides durable competitive advantages.

With earnings estimates trending upward, a strong track record of surprises and favorable indicators for another beat, WMT presents a solid buying opportunity before its fiscal second-quarter earnings release, even at a premium valuation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 45 min | |

| 1 hour | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite