|

|

|

|

|||||

|

|

Walmart Inc. (WMT) reported second-quarter fiscal 2026 results, with the top line beating the Zacks Consensus Estimate while the bottom line missing the same. Both metrics showed year-over-year growth. Management raised its fiscal 2026 net sales and adjusted earnings per share (EPS) guidance.

The company continues to balance innovation with disciplined execution, showcasing resilience in an uncertain consumer environment. Notably, digital channels, advertising and membership income played pivotal roles in driving momentum, while strategic investments and one-time expenses weighed on operating profit.

WMT’s adjusted earnings of 68 cents per share inched up 1.5% from the year-ago period’s 67 cents. The metric missed the Zacks Consensus Estimate of 73 cents.

Walmart Inc. price-consensus-eps-surprise-chart | Walmart Inc. Quote

Walmart’s total revenues rose 4.8% year over year to $177.4 billion, which beat the consensus mark of $175.5 billion. On a constant-currency basis, revenues grew 5.6%, reflecting strong performance across all business segments.

Walmart’s Global e-commerce sales surged 25% as the digital mix increased across all segments. This upside can be attributed to store-fulfilled pickup and delivery services. The company witnessed a 15.3% increase in membership income globally. WMT’s global advertising business advanced 46%.

The consolidated gross profit margin expanded 4 bps to 24.5%, driven by Walmart U.S. Margin growth. The upside was backed by strong inventory management in the United States and improved business mix, though partially impacted by unfavorable merchandise category mix.

Operating expenses deleveraged 64 bps, caused by higher self-insured liability claims in the United States, along with technology investments and wage increases at Sam’s Club across the United States, Canada and Mexico. This was partially offset by improved international leverage. On an adjusted basis, operating expenses deleveraged 35 bps, excluding discrete legal and reorganization charges.

The company’s operating income decreased 8.2% year over year to $7.3 billion, affected by discrete legal & restructuring costs. Adjusted operating income (cc) is up 0.4%.

Walmart U.S.: The segment’s net sales grew 4.8% year over year to $120.9 billion. Strong sales performance was driven by growth in grocery and health & wellness, along with low single-digit gains in general merchandise. U.S. comp sales, excluding fuel, were up 4.6%, fueled by transaction growth of 1.5%, an average ticket increase of 3.1%, as well as strong e-commerce growth. E-commerce sales rose 26%, driven by strong performance in store-fulfilled delivery, marketplace growth and advertising.

The operating income of the Walmart U.S. segment jumped 2% to $6.7 billion, reflecting solid inventory management and improved e-commerce economics, partly offset by elevated claims expenses.

Walmart International: The segment’s net sales inched up 5.5% to $31.2 billion. Foreign currency fluctuations negatively impacted sales by $1.5 billion. On a cc basis, net sales jumped 10.5%, driven by strong performance in China, Flipkart and Walmex, supported by higher transaction counts and increased unit volumes. Sales strength continued across food and consumables, alongside growth in general merchandise.

E-commerce sales increased 22%, driven by strong growth in store-fulfilled pickup and delivery services and marketplace performance, with a higher digital sales mix across markets. The operating income, on a cc basis, fell 2.8% to $1.3 billion, impacted by strategic investments in India, Canada and Mexico, along with unfavorable currency translation.

Sam’s Club U.S.: The segment, which comprises membership warehouse clubs, witnessed a net sales increase of 6% to $21.2 billion (excluding fuel). Sam’s Club’s comp sales, excluding fuel, grew 5.9%. While transactions grew 3.9%, the average ticket climbed 2%. Sales growth was driven by strong performance in grocery and health & wellness.

E-commerce net sales jumped 26% at Sam’s Club U.S. Membership income increased 7.6%, supported by consistent growth in member count, strong renewal rates and higher penetration of Plus members. The segment’s operating income totaled $0.5 billion, down 15.8% year over year.

The Zacks Rank #2 (Buy) company ended the quarter with cash and cash equivalents of $9.4 billion and total debt of $50.3 billion.

For the six months ended July 31, 2025, WMT generated an operating cash flow of $18.4 billion and a free cash flow of $6.9 billion. In fiscal 2026, capital expenditure is likely to account for 3-3.5% of net sales.

Year to date, Walmart repurchased 67.4 million shares for $6.2 billion, with $5.9 billion remaining under its $20 billion authorization.

For the third quarter of fiscal 2026, WMT expects consolidated net sales growth of 3.75-4.75% (at cc). The guidance includes almost 20 bps benefit from the VIZIO acquisition. The operating income is expected to grow 3-6% (cc), with adjusted EPS in the range of 58-60 cents.

For fiscal 2026, WMT now expects consolidated net sales growth of 3.75-4.75% (at cc) compared with prior guidance of 3-4%. The adjusted operating income is expected to increase 3.5-5.5% at cc for the year. Net interest expenses are likely to escalate $100-$200 million.

Walmart now expects adjusted EPS for fiscal 2026 to be in the $2.52-$2.62 range compared with prior guidance of $2.50-$2.60. The company recorded an adjusted EPS of $2.51 in fiscal 2025.

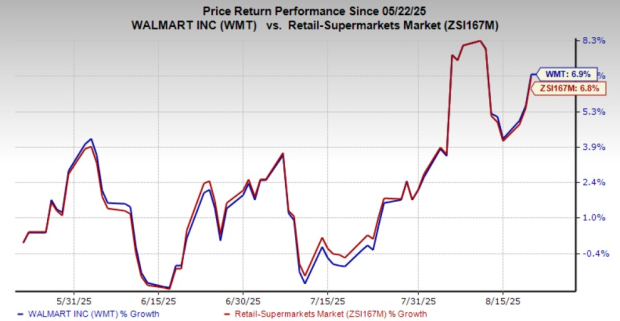

WMT’s shares have gained 6.9% in the past three months compared with the industry’s growth of 6.8%.

The Kroger Co. (KR) operates as a food and drug retailer in the United States, and currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kroger’s current fiscal-year sales and earnings implies growth of 1.1% and 6.7%, respectively, from the year-ago reported numbers. KR delivered a trailing four-quarter earnings surprise of 1.4%, on average.

Grocery Outlet Holding Corp. (GO) operates as a retailer of consumables and fresh products sold through independently operated stores in the United States. It carries a Zacks Rank #2 at present. GO delivered a trailing four-quarter earnings surprise of 28.2%, on average.

The Zacks Consensus Estimate for Grocery Outlet’s current financial-year sales indicates growth of around 8.2% from the year-ago reported numbers.

Ollie's Bargain Outlet Holdings, Inc. (OLLI) operates as a retailer of closeout merchandise and excess inventory in the United States and currently carries a Zacks Rank #2. OLLI delivered a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Ollie's current fiscal-year sales and earnings implies growth of 14.3% and 14%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite