|

|

|

|

|||||

|

|

Dollar Tree, Inc. DLTR is likely to register a decline in its top and bottom lines when it reports second-quarter fiscal 2025 results on Sept. 3, before the market opens. The Zacks Consensus Estimate for revenues is pegged at $4.5 billion, indicating a drop of 39.6% from the prior-year quarter’s figure.

The consensus estimate for earnings is pegged at 38 cents per share, indicating a decrease of 43.3% from the year-ago period’s figure. The consensus mark has increased 2 cents in the past 30 days.

DLTR has a trailing four-quarter negative earnings surprise of 6.9%, on average. In the last reported quarter, the Chesapeake, VA-based company’s earnings surpassed the Zacks Consensus Estimate by 5.9%.

Dollar Tree’s second-quarter fiscal 2025 is likely to be weighed down by near-term challenges despite a strong start to the year. The company expects continued pressure on discretionary demand in the quarter under discussion as the quarter traditionally lacks major seasonal sales drivers compared with the second halves of the year. Adverse foreign currency translations also continue to act as deterrents.

To mitigate these impacts, Dollar Tree is actively deploying its five levers of cost management, including supplier negotiations, product re-specifications, shifting sourcing to alternative countries, eliminating uneconomical items and leveraging its multi-price strategy. While these measures should offset much of the tariff impact over time, transitional inefficiencies and the lag in execution are likely to weigh on the fiscal second-quarter results.

Additionally, the company anticipates higher selling, general and administrative (SG&A) expenses in the quarter due to incremental labor and store investments aimed at supporting stronger execution and future growth. These combined headwinds, softer discretionary demand, tariff-driven cost pressures and elevated SG&A expenses are expected to result in a sharp year-over-year decline in earnings for the to-be-reported quarter.

On the last reported quarter’s earnings call, management expected comparable net sales growth toward the higher end of its full-year outlook of 3-5%. DLTR envisions second-quarter adjusted EPS from continuing operations to decline 45-50% year over year, before accelerating again in the third and fourth quarters to achieve the fiscal 2025 earnings outlook.

On the positive front, Dollar Tree is expected to have displayed continued progress on its expansion initiatives, marked by steady store openings and investments in distribution centers, which likely supported revenue momentum. The pending sale of Family Dollar also positions the company to sharpen its operational focus and improve cash flow, further strengthening its growth trajectory.

Our proven model conclusively predicts an earnings beat for Dollar Tree this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is exactly the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Dollar Tree has an Earnings ESP of +7.90% and currently carries a Zacks Rank of 3.

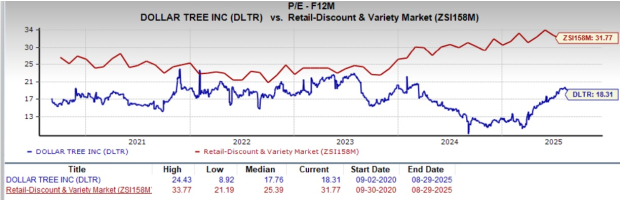

From a valuation perspective, Dollar Tree shares present an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 18.31X, above the five-year median of 17.76X and below the Retail-Discount Stores industry’s average of 31.77X, the company’s shares offer compelling value for investors seeking exposure to the sector.

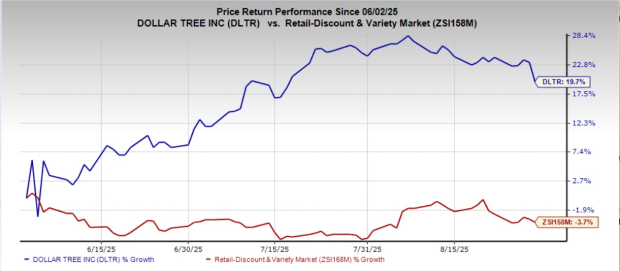

Recent market movements show that Dollar Tree’s shares have gained 19.7% in the past three months against the industry’s 3.7% decline.

American Eagle Outfitters AEO currently has an Earnings ESP of +7.69% and a Zacks Rank of 3. The Zacks Consensus Estimate for second-quarter fiscal 2025 EPS is pegged at 20 cents, which implies a 48.7% plunge year over year. The consensus mark has increased a penny in the past 30 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus mark for AEO’s quarterly revenues is pegged at $1.23 billion, which indicates a drop of 4.5% from the figure reported in the prior-year quarter. AEO delivered a negative trailing four-quarter earnings surprise of 0.3%, on average.

The Kroger Co. KR currently has an Earnings ESP of +0.29% and a Zacks Rank of 3. KR’s top line is anticipated to advance year over year when it reports second-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $34.12 billion, which indicates a 0.6% rise from the figure reported in the year-ago quarter.

The company is expected to register an increase in the bottom line. The consensus estimate for Kroger’s second-quarter earnings is pegged at $1.00 per share, up 7.5% from the year-ago quarter. KR delivered a trailing four-quarter earnings surprise of 3.5%, on average.

Torrid Holdings CURV presently has an Earnings ESP of +71.43% and a Zacks Rank of 2. The company is likely to register a decline in both top and bottom lines when it reports second-quarter fiscal 2025 results. The consensus mark for CURV’s quarterly revenues is pegged at $259.6 million, which indicates an 8.8% decline from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for second-quarter earnings per share is pegged at 3 cents, which indicates a decrease of 50% from the year-ago quarter’s actual. CURV has a negative trailing four-quarter earnings surprise of 10.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 14 hours | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite