|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Alphabet's quantum computing efforts dovetail nicely with its AI development.

IBM is a quantum computing leader with an ambitious road map.

IonQ could be the best pure-play quantum computing pick.

What are the most important technological developments of all time? The wheel has to be high on the list. So do the printing press and the steam engine. Several advances over the last few decades should be included as well -- for example, personal computers, the internet, and artificial intelligence (AI).

We could soon need to add another huge development. Quantum computing holds the potential to transform AI model training, climate modeling, cybersecurity, drug discovery, financial analysis, logistics optimization, materials science, and more.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Want to invest in quantum computing? These three stocks are great buys right now.

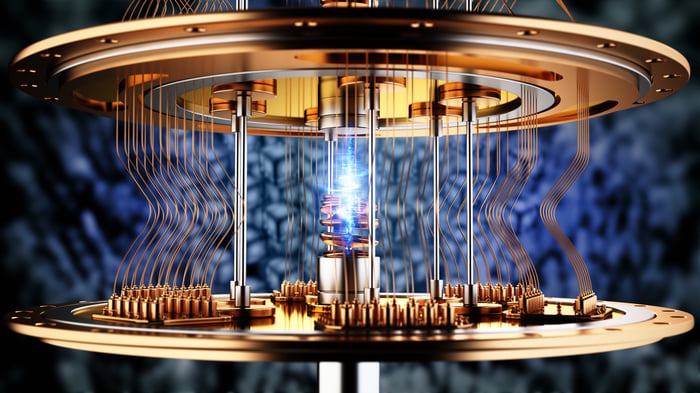

Image source: Getty Images.

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) ranks among the leaders in quantum computing development. The company's Google Quantum AI has already achieved two key milestones. The unit has four more milestones on its road map to building a large-scale error-corrected quantum computer, which it hopes to accomplish by the end of the decade.

Google Quantum AI's advances could also make Alphabet an even more formidable player in AI. It's no coincidence that "AI" is the unit's name. Hartmut Neven, the founder of Google Quantum AI, focused on AI research in the past before shifting to quantum computing. He wrote in a blog in late 2024 that both AI and quantum computing "will prove to be the most transformational technologies of our time, but advanced AI will significantly benefit from access to quantum computing."

For now, though, AI is a more important reason to invest in Alphabet than quantum computing is. Google Cloud continues to grow by leaps and bounds as organizations build and deploy AI models in the cloud. Google Search is incorporating generative AI in ways that are boosting search use. Google Gemini is one of the most powerful large language models (LLMs) available.

Alphabet's risk level has been reduced significantly now that a federal judge has decided the company won't have to divest its popular Chrome browser or its Android operating system. Google will also be able to continue paying Apple to be the default search engine on iPhones.

Although Alphabet is still appealing the federal court ruling against it, the latest decision makes the stock a more compelling pick than it's been in a while.

International Business Machines (NYSE: IBM) was founded in 1911, when a "computer" referred to a person who performed mathematical calculations by hand. This technology pioneer has changed with the times and today stands among the top developers of quantum computers.

Which company markets the world's most powerful quantum computing stack? IBM. It offers quantum computers that customers can pay for based on how much use is required. The company's Qiskit software development kit and its functions help customers build applications that can take advantage of quantum computing.

The company also has one of the most ambitious development road maps in the field. It expects to enable the first solid examples of quantum advantage (where a quantum computer performs processes more accurately, cheaply, and/or efficiently than a classical computer) by the end of next year. It plans to deliver a quantum computer that has 100 million gates and 200 logical qubits in 2029 (meaning it will be able to handle lots of parallel calculations).

In the meantime, IBM is making plenty of money helping customers develop AI applications. Its generative AI business is growing fast and has brought in more than $7.5 billion so far.

The stock also offers a relatively inexpensive way to invest in both AI and quantum computing, with its forward price-to-earnings ratio of 20.8 well below the valuations of most companies that are involved in both areas.

If you're looking for a pure-play quantum computing stock, though, IonQ (NYSE: IONQ) could be your best pick. The company's market cap of over $12 billion makes it the largest of the up-and-coming quantum computer developers.

IonQ already has hundreds of customers and partners, including Google Cloud and Hyundai. It makes the only quantum hardware available on all three major cloud platforms. Once its acquisition of Oxford Ionics closes, the company will have over 1,000 patents granted or pending.

Like Alphabet and IBM, IonQ has an aggressive timeline for advancing its technology. The company plans to unveil a quantum computer in 2026 that will potentially support 256 or more physical qubits and 12 logical qubits. By 2029, it hopes to have a system with 200,000 physical qubits, 8,000 logical qubits, and a super-low logical error rate.

The main knock against it is that it remains unprofitable. There is also no guarantee that it will emerge as a big winner in quantum computing. However, the company's technology offers multiple competitive advantages over its rivals.

IonQ has also made several key acquisitions that could position it well for the future. This stock is riskier than Alphabet or IBM, but it just might pay off more handsomely over time.

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $678,148!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,052,193!*

Now, it’s worth noting Stock Advisor’s total average return is 1,065% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Keith Speights has positions in Alphabet and Apple. The Motley Fool has positions in and recommends Alphabet, Apple, and International Business Machines. The Motley Fool has a disclosure policy.

| 26 min |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

GOOGL GOOG

Investor's Business Daily

|

| 1 hour | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 10 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite