|

|

|

|

|||||

|

|

Eli Lilly’s LLY extraordinary revenue expansion remains anchored in its cardiometabolic franchise, where blockbuster GLP-1 drugs Mounjaro and Zepbound powered $20.6 billion in sales during the first half of 2025, up 58% over the prior-year period. Oncology, while not the primary growth driver, contributed $4.4 billion in revenues, representing a 10% year-over-year increase and constituted roughly 15% of Lilly’s top line. This steady growth — led by Verzenio — offers investors an important diversification buffer against potential concentration risks in the diabetes and obesity segments.

Lilly’s oncology portfolio is a mix of long-established therapies and newer targeted agents, providing breadth across tumor types. Its older drugs include Alimta (for lung cancer and malignant pleural mesothelioma) and Erbitux (for head and neck as well as metastatic colorectal cancer), both on the market since 2004. Cyramza, launched in 2014, extends Lilly’s reach into gastric, lung, colorectal, and liver cancers, while Verzenio, approved in 2017, has become the backbone of its breast cancer franchise. More recent additions, such as Retevmo (in 2020) for RET-altered tumors and Jaypirca (in 2023) for mantle cell lymphoma (MCL) and chronic lymphocytic leukemia (CLL), underscore Lilly’s shift toward precision oncology and hematologic cancers. Together, these assets form a diversified portfolio that continues to add meaningful revenues and strategic optionality to Lilly’s growth trajectory.

Eli Lilly is actively working to expand Jaypirca’s commercial potential by advancing it into earlier lines of therapy for CLL and MCL. LLY recently reported positive topline data from a third phase III study of Jaypirca showing a significant improvement in progression-free survival compared to chemoimmunotherapy in treatment-naive CLL patients. Such encouraging data support upcoming global filings and potential label expansion.

Lilly’s oncology pipeline momentum is set to continue with imlunestrant, an oral selective estrogen receptor degrader for ER+/HER2- metastatic breast cancer, which is currently under regulatory review in the United States and the EU and could soon add a fresh growth driver to its oncology franchise. The company is also evaluating several other candidates across various stages of clinical development for a range of cancer indications.

Other bigger players in the oncology space are AstraZeneca AZN, Merck MRK, Bristol-Myers and Pfizer PFE.

For AstraZeneca, oncology sales now comprise around 43% of total revenues. Sales in its oncology segment rose 16% in the first half of 2025. AstraZeneca’s strong oncology performance was driven by medicines, such as Tagrisso, Lynparza, Imfinzi, Calquence and Enhertu (in partnership with Daiichi Sankyo).

Merck’s key oncology medicines are PD-L1 inhibitor Keytruda and PARP inhibitor Lynparza, which it markets in partnership with AstraZeneca. Keytruda, approved for several types of cancer, alone accounts for around 50% of Merck’s pharmaceutical sales. Keytruda’s sales rose 6.6% to $15.1 billion in the first half of 2025.

Bristol-Myers’ key cancer drug is PD-L1 inhibitor, Opdivo, which accounts for around 20% of its total revenues. Opdivo’s sales rose 9% to $4.82 billion in the first half of 2025.

Oncology sales comprise more than 25% of Pfizer’s total revenues. Its oncology revenues grew 9% in the first half of 2025, driven by drugs like Xtandi, Lorbrena, the Braftovi-Mektovi combination and Padcev, which made up for declining sales of drugs like Ibrance. Pfizer has also ventured into the oncology biosimilars space and markets six biosimilars for cancer. Pfizer also advanced its oncology clinical pipeline with several candidates entering late-stage development, like sasanlimab, vepdegestrant and sigvotatug vedotin.

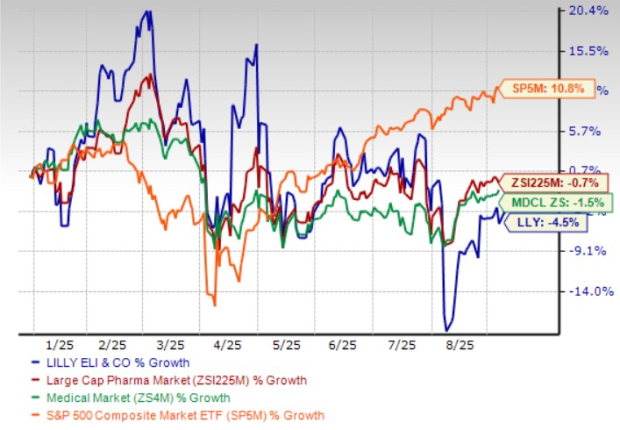

Shares of Eli Lilly have lost 4.5% so far this year compared with the industry’s decline of 0.7%. The stock has also underperformed the sector and the S&P 500 index during the same time frame, as seen in the chart below.

From a valuation standpoint, Lilly’s stock is expensive. Going by the price/earnings ratio, the company’s shares currently trade at 25.92 forward earnings, higher than 14.74 for the industry. However, the stock is trading much below its five-year mean of 34.54.

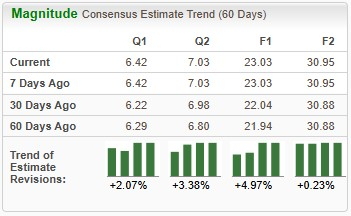

Estimates for Eli Lilly’s 2025 earnings have improved from $21.94 to $23.03 per share in the past 60 days, and estimates for 2026 earnings have improved from $30.88 to $30.95 over the same time frame.

Eli Lilly currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

MRK

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 12 hours | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite