|

|

|

|

|||||

|

|

“I think he has extraordinary skills. A lot of it has to do with what I call the signal-to-noise ratio, and I learned from Steve Jobs back in the early ‘90s. 80% of his day was focused on getting three to four things done in that 18-hour cycle, and anything else was noise. You get a mandate, you get it done, you move on to the next thing you get the mandate done. That’s how he got stuff done 80:20. I believe Elon Musk is 100% signal. I think he tolerates zero noise, and it makes it very uncomfortable. I’ve never seen an entrepreneur like him.” ~ Kevin O’Leary

Before we cover the nuts and bolts of Tesla’s (TSLA) earnings, future products, and outlook, it is important to talk about it’s CEO Elon Musk. Though controversial, Elon Musk is the entrepreneur of this generation. That said, any time he has stepped away for Tesla, whether it was for X or Doge, the company has suffered. After a few side quests it appears that Musk is back and more focused than ever. In a recent interview, Musk acknowledged that the government is “unfixable” and that he is 100% focused on his companies. Additionally, the Tesla board has proposed a mind-boggling $1 trillion pay package to ensure that Musk remains focused. For Musk reap the reward, him and his team will need to attain lofty targets, including a market cap of $8.6 trillion in 10 years (TSLA’s market cap is currently ~$1.12 trillion). While Wall Street doubters are creeping in again after a few years of underperformance, Musk has a long history of meeting what seem like outlandish performance goals.

The AI revolution is alive and well currently. For instance, Elon Musk’s friend Larry Ellison briefly surpassed Musk as the world’s richest man after Oracle (ORCL) announced that it has a backlog nearing a half trillion dollars for its cloud and AI contracts. Meanwhile, earlier this week Nvidia (NVDA) backed Nebius (NBIS) soared nearly 50% after it scored a $17.4 billion deal to provide AI infrastructure to Microsoft (MSFT). While these recent announcements mean that the AI data center buildout will last for years, the biggest question remains how will they be powered.

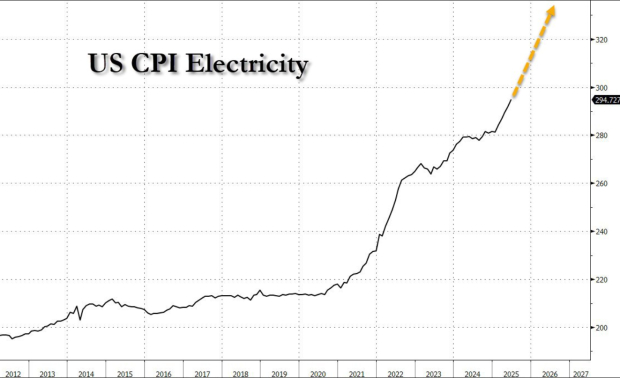

Data centers are extremely energy intensive and US consumers are already feeling it in their pocket books.

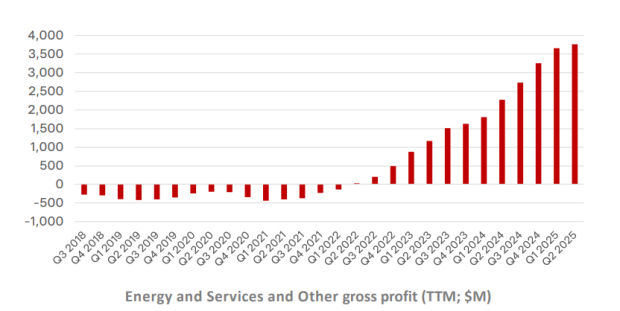

Bloom Energy (BE), a renewable energy producer and supplier, is evidence that Wall Street is finally catching onto this reality. Shares are up eight straight weeks and have more than doubled. While many investors have caught onto companies like Bloom, many underestimate Tesla’s booming energy business. Tesla Energy allows utilities to increase their reliance on intermittent solar and wind power through its mega pack. As US power grid gets more strained, utility companies are investing in Tesla’s Megapack to supplement the grid. Tesla Energy became profitable in mid-2022 and has produced more profits in 13 consecutive quarters since.

Meanwhile, year-over-year energy deployments soared by 113% in 2024 alone. The energy theme is one of the most predictable trends on Wall Street, and Tesla is set to be a main beneficiary.

Tesla’s legacy EV business has been on a downward spiral the past few years. However, early reports show that the refreshed Model Y is selling well, including selling out in China. Next week, Tesla will release its latest delivery numbers. My view is that if Tesla can show that it has simply stopped the bleeding, shares will rally knowing that the energy business can pick up the slack.

Tesla’s Optimus humanoid robot is set to hit mass production early next year. Tesla has the best real-world AI on Earth, and Optimus is already completing tasks in Tesla factories. Elon Musk has said that he believes Optimus will be Tesla’s most successful product ever.

Though Tesla is behind Waymo and other lidar-based robotaxis in the autonomous space, it’s catching up rapidly. The company has finally launched its test period in Austin and the Bay Area. While human supervision is necessary at this juncture, Tesla will be able to catchup quickly. Once approved by regulators Tesla Robotaxis will not need geofenced areas like lidar-based competitors. Additionally, Tesla robotaxis are far cheaper and faster to produce than the competition. In other words, Tesla will be able to scale rapidly.

Throughout its history, Tesla shares have traded at a premium versus the general market and its competitors. There are two reasons for the premium:

1. Tesla is a “Cult Stock”: Tesla and its CEO Elon Musk have curated a massive following among investors and customers. In fact, though the company spends very little on marketing, it has the best-selling vehicle in the United States. Additionally, investors are intensely loyal to the company. Because of this unwavering loyalty shares trade at a premium.

2. Tesla is a Serial Innovator: Elon Musk and his team rarely rest on their laurels and always seek to innovate. This obsessions with constant innovation mean that investors expect massive growth in the future. For instance, when Tesla struck success with the Model S, it immediately began work on the cheaper mass market Model 3.

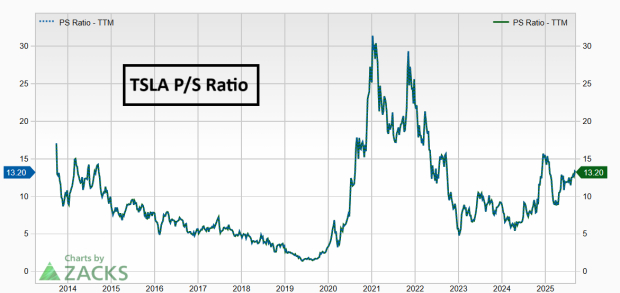

For a tech innovator like Tesla, it’s best to focus on its valuation in relation to its history. Though its core business has slowed, Tesla shares have chopped around for months. Historically speaking, the price-to-sales ratio of 13.2x is right in line with its average as a public company.

Should Musk’s master plan work with either the robotaxi or Optimus Humanoid robot, its valuation should expand.

TSLA shares are breaking out of a multi-month price congestion. Should the breakout stick, the Fibonacci levels suggest that the stock could reach the mid-$400s in a hurry.

Bottom Line

While a slowing EV market has created some short-term investor doubts, Tesla remains a compelling investment. Tesla’s underrated energy division is on fire, its robotaxi business will scale quickly, and its Optimus robot will move to production next year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 min | |

| 32 min | |

| 36 min | |

| 44 min | |

| 55 min | |

| 59 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite