|

|

|

|

|||||

|

|

Big Data refers to a vast and diverse collection of structured, unstructured and semi-structured data that inundates businesses on a day-to-day basis. The big data space focuses on companies that process, store and analyze data, and provide tools for data mining, transformation, visualization, and predictive analytics.

Market Data Forecast estimated that the global big data market size was $199.63 billion in 2024, and will be $224.46 billion in 2025 and $573.47 billion by 2033, witnessing a CAGR of 12.44%. MarketsAndMarkets projected the big data market size of $220.2 billion in 2024 to reach $401.2 billion in 2028 at a CAGR of 12.7%.

According to straits research, the global big data analytics market size, which was valued at $277.14 billion in 2024 is expected to be $303.71 billion in 2025 and reach $1,045.26 billion by 2033, at a CAGR of 13.7%.

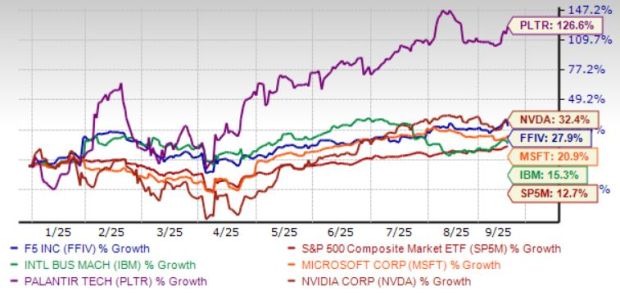

Here, we have selected five big data companies — NVIDIA Corp. NVDA, Palantir Technologies Inc. PLTR, Microsoft Corp. MSFT, International Business Machines Corp. IBM and F5 Inc. FFIV. These stocks show strong potential for the last quarter of this year. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The chart below shows the price performance of our five picks year to date.

NVIDIA — the undisputed global leader of generative artificial intelligence (AI)-powered graphical processing units (GPUs) — reported strong second-quarter fiscal 2026 earnings results. NVDA’s H20 chip sales in China are currently in jeopardy due to an impasse in the U.S. Government decision. Moreover, the decision of the Chinese authority is encouraging the use of indigenously developed AI chips instead of NVDA’s GPUs.

As a result, NVDA did not count H20 chip sales to China while issuing its fiscal third-quarter guidance. Despite this headwind, management said that quarterly sales will reach $54 billion, +/- 2%. Management said that the resumption of H20 sales in China could add another $2 to $5 billion in the third quarter.

NVIDIA reaffirmed its commitment to continued innovation, evolution and execution. After the successful execution of Hopper GPUs, NVDA’s Blackwell GPUs have already sold record-high units to cloud providers. Management said that Blackwell sales rose 17% sequentially in the fiscal second quarter.

NVIDIA is expected to unveil Blackwell Ultra — in the second half of 2025 and begin shipping Vera Rubin — in 2026. In addition, the company has decided to announce its roadmap for Rubin Next, to be introduced in 2027, and Feynman AI chips to be launched in 2028. NVIDIA is supported by an extremely bullish demand scenario. The company expects between $3 trillion and $4 trillion in AI infrastructure spending by the end of the decade.

NVIDIA has an expected revenue and earnings growth rate of 56.3% and 48.5%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has improved 4.2% over the last 30 days.

AI-powered data mining and analytics company Palantir Technologies has reported blockbuster second-quarter earnings results. The top line surpassed $1 billion for the first time in its history, exceeding all estimates.

Palantir Technologies’ commercial business has gathered pace in addition to its traditional government contracts. This is primarily due to PLTR’s aggressive venture in the AI space. In 2023, PLTR launched its Artificial Intelligence Platform (“AIP”), an AI-powered system that helps customers quickly concentrate and analyze data and discover how it can help advance their business goals.

AIP provides unified access to open-source, self-hosted, and commercial large language models (LLMs) that can transform structured and unstructured data into LLM-understandable objects and turn organizations' actions and processes into tools for humans and LLM-driven agents. This shift in revenue structure has enabled the company to no longer depend on government defense agencies.

Palantir increased its full-year guidance, now expecting revenues between $4.142 billion and $4.150 billion, up from the previous forecast of $3.89 billion to $3.90 billion. CEO, Alex Karp, expressed enthusiasm about the company's prospects, stating in the quarterly letter to shareholders that “this is still only the beginning of something much larger and, we believe, even more significant.”

Palantir Technologies has an expected revenue and earnings growth rate of 45.6% and 58.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 12.1% over the last 60 days.

Microsoft has been capitalizing on artificial intelligence (AI) business momentum and Copilot adoption alongside the acceleration of Azure cloud infrastructure expansion. Strong Office 365 Commercial demand has been propelling Productivity and Business Processes revenue growth. ARPU (average revenue per user) is increasing through E5 and M365 Copilot uptake across key segments.

MSFT delivered exceptional fourth-quarter fiscal 2025 results, which exceeded the Zacks Consensus Estimate across all key metrics, demonstrating the company's dominant position in the rapidly expanding cloud and AI markets. These robust results underscore Microsoft's successful execution of its cloud-first, AI-powered strategy and present a compelling investment opportunity for the rest of 2025.

Microsoft delivered exceptional growth across its Azure, AI, and Copilot platforms, demonstrating its leadership in the AI transformation. Despite stiff competition in the AI-powered cloud space, Azure holds approximately 20-24% of the global cloud market share, second only to Amazon.com Inc.’s (AMZN) around 31% hold.

Azure achieved remarkable scale, surpassing $75 billion in annual revenues with 34% growth, while expanding its global infrastructure to more than 400 datacenters across 70 regions. MSFT added more than two gigawatts of new capacity and made every Azure region AI-first, with all locations now supporting liquid cooling for enhanced performance and flexibility.

Microsoft has an expected revenue and earnings growth rate of 14% and 12.5%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

International Business Machines has been witnessing healthy demand trends for hybrid cloud and AI solutions with a client-focused portfolio and broad-based growth. The acquisition of Hakkoda has strengthened IBM’s data expertise and augmented its capability to support clients’ AI transformation initiatives.

IBM’s growth is expected to be aided by analytics, cloud computing and security over the long term. With a surge in traditional cloud-native workloads and associated applications, along with a rise in generative AI deployment, there is a radical expansion in the number of cloud workloads that enterprises are currently managing.

This enterprise-ready AI and data platform comprises three products to help organizations accelerate and scale AI — the watsonx.ai studio for new foundation models, generative AI and machine learning, the watsonx.data fit-for-purpose data store built on an open lake house architecture and the watsonx.governance toolkit to help enable AI workflows to be built with responsibility and transparency.

International Business Machines has an expected revenue and earnings growth rate of 6.4% and 7.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

F5 is gaining traction from strong software growth, backed by a solid uptick in public cloud and security offerings. FFIV is benefiting from the growing demand for application security across multi-cloud environments. Acceleration in BIG-IP, NGINX, ELA and Virtual Edition subscription software deals is an upside.

FFIV has resorted to acquisitions to boost its network security capabilities and tap the solid growth prospects in the market. Over the past five years, it has acquired six businesses. The buyouts have helped it enhance its security capabilities, enabling it to pick up market share.

FFIV is uniquely positioned in the application networking market due to its strong presence in Layer 4-7 content switching, critical for managing the increasing capacity and security demands of modern applications. Unlike its competitors, F5 has established itself as a leader in the data center space, offering tailored solutions that seamlessly integrate with data applications.

F5 has an expected revenue and earnings growth rate of 3.9% and 4%, respectively, for next year (ending September 2026). The Zacks Consensus Estimate for next-year’s earnings has improved 0.4% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| 28 min | |

| 31 min | |

| 32 min | |

| 49 min | |

| 50 min | |

| 54 min | |

| 55 min | |

| 56 min | |

| 57 min | |

| 58 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite