|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The beverage industry is brimming with competition, but a few rivalries are as compelling as PepsiCo, Inc. PEP versus Monster Beverage Corporation MNST. On one side stands PepsiCo, a global titan with a sprawling portfolio spanning carbonated drinks, snacks and ready-to-drink innovations. Meanwhile, Monster Beverage is a pure-play energy drink powerhouse that has carved a niche with bold branding and rapid growth.

As these big-wigs battle for market share and dominance in evolving consumer preferences, the clash highlights not just scale versus specialization, but also stability versus high-octane momentum.

PepsiCo’s investment appeal rests heavily on its ability to adapt and innovate across both beverages and foods. The company has consistently evolved its portfolio to align with consumer shifts toward health, functionality and value. Its beverage strategy highlights growth areas like zero-sugar, functional hydration and sports nutrition, while acquisitions such as poppi add modern, health-forward sodas that resonate with younger demographics.

On the food side, PepsiCo is refreshing legacy brands like Lay’s and Tostitos with clean-label credentials, while scaling permissible offerings like Simply, Sun Chips and Sabra. By weaving avocado oil, whole grains and protein into product extensions, the company is broadening its reach into the fast-growing “better-for-you” snack segment.

At the strategic level, PepsiCo is pursuing operational integration through its “One North America” initiative, which blends food and beverage distribution, merchandising and back-office support into a more efficient model. This unlocks savings that are reinvested in digital transformation and brand competitiveness.

From automation in plants and warehouses to digital consumer engagement and demand forecasting, PepsiCo is embedding data-driven capabilities across its operations. Global partnerships, such as its Formula 1 sponsorship featuring Sting, Gatorade and Doritos, further demonstrate its ability to tap into premium consumer experiences and reinforce brand strength worldwide.

Innovation at PepsiCo is not only about product pipelines but also about positioning. Its strategy combines affordability with premiumization, ensuring relevance across income levels and geographies. The company is strengthening its away-from-home channels through collaborations with Subway and activating high-visibility campaigns like “Food Deserves Pepsi.” Digital tools are sharpening trade promotion and in-store execution, allowing PepsiCo to connect with consumers more directly and effectively.

While tariff dynamics and global trade frictions continue to pressure supply chains, the company’s agility in sourcing and revenue management provides a buffer against volatility. Collectively, these strategies position PepsiCo as a consumer staples leader that blends scale, innovation and resilience into a durable long-term growth story.

Monster Beverage has established itself as a global energy drink powerhouse with strong market share momentum. In the United States, its Ultra line is the third-largest stand-alone energy drink brand, trailing only Red Bull and the core Monster label.

Internationally, Monster Beverage is now the number one energy drink in markets like Norway and has broadened its footprint across EMEA, APAC, and Latin America, with more than 40% of sales generated outside the United States. The company does not participate in the avocado industry but continues to diversify its portfolio around functional, lifestyle-oriented beverages that align with shifting consumer needs.

Monster Beverage’s strategy is anchored in aggressive innovation and brand differentiation. Recent launches include Zero Sugar collaborations, such as the Lando Norris edition, Juice Monster Rio Punch, and new Ultra flavors. The Ultra line’s refreshed visual identity, supported by dedicated in-store merchandising, enhances visibility, while sponsorships in Formula 1, UFC and music festivals ensure cultural relevance. These initiatives reinforce MNST’s positioning as both aspirational and accessible, with strong appeal among younger demographics seeking energy and performance.

Monster Beverage combines double-digit revenue growth with disciplined cost management and selective pricing. While tariffs, especially on aluminum, pose modest headwinds, supply-chain optimization, hedging and planned pricing actions mitigate risks. With its innovation engine, youth-driven branding and expanding global presence, Monster Beverage offers investors a resilient and growth-focused opportunity in consumer staples.

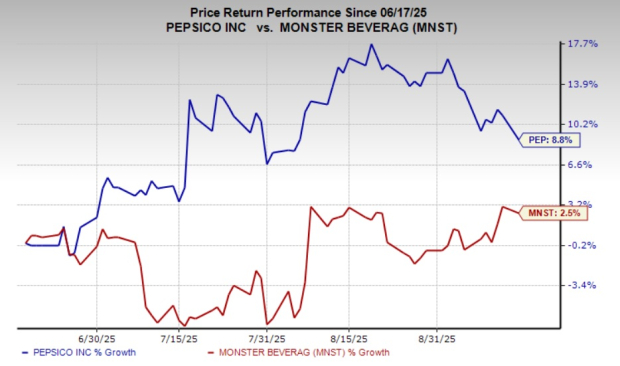

Shares of PepsiCo and Monster Beverage both show an improving trend in the past three months. PEP shares have risen 8.8% in the past three months, whereas the MNST stock has grown 2.5%.

From a valuation perspective, PepsiCo currently trades at a more modest forward price-to-earnings (P/E) multiple of 16.82X, significantly lower than Monster Beverage’s 31.03X. On the surface, this may suggest that PepsiCo is more attractively priced.

PEP’s lower multiple reflects its maturity, slower growth and defensive appeal, ideal for income-focused investors seeking dividends and stability. MNST’s premium valuation highlights its stronger growth trajectory, higher margins and global category momentum, but it also carries higher expectations and greater downside risk if performance slows.

In short, PepsiCo offers value and predictability at a discount, while Monster Beverage justifies its richer multiple through innovation, brand power and growth potential in the energy drink market. However, MNST’s lofty valuation brings heightened expectations. Any slowdown in innovation or market share momentum can pressure MNST’s multiples far more than PepsiCo’s.

PepsiCo’s EPS estimates for 2025 and 2026 moved up 0.1% and 0.7%, respectively, in the last 30 days. PEP’s 2025 revenues are projected to rise 1.3% year over year to $93.1 billion, and EPS is expected to decline 1.6% year over year to $8.03.

Monster Beverage’s EPS estimates for 2025 and 2026 have been unchanged in the past 30 days. MNST’s 2025 revenues and EPS are expected to increase 7.7% and 17.3% year over year, respectively, to $8.1 billion and $1.90 per share.

Between PepsiCo and Monster Beverage, the balance of appeal currently leans toward PepsiCo. The company not only demonstrates stronger share price momentum but also trades at a valuation that makes it more accessible for investors seeking both stability and growth. PepsiCo’s broad portfolio, global scale and steady dividend stream reinforce its defensive strength, while recent upward estimate revisions signal improving earnings potential.

In contrast, Monster Beverage thrives on rapid innovation, bold branding and category momentum, but its premium valuation leaves it more vulnerable should growth moderate or consumer trends shift.

PepsiCo offers resilience, affordability and consistent adaptability, making it a more attractive investment case for those who value predictable performance alongside incremental growth. Monster Beverage still represents a high-octane growth story with strong cultural status, but PepsiCo’s combination of value, momentum and earnings visibility positions it as the steadier and more compelling choice in this face-off.

Monster Beverage currently carries a Zacks Rank #3 (Hold), whereas PepsiCo has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite