|

|

|

|

|||||

|

|

After the closing bell on Sept. 23, Micron Technology, Inc. MU is set to report its much-awaited fiscal fourth-quarter 2025 (ended on Aug. 31) results. Similar to the previous quarter, will Micron be able to provide an insightful update on its high-bandwidth memory (HBM), and is the stock a worthwhile investment now? Let’s analyze –

For the fiscal third quarter, Micron generated revenues of $9.3 billion, up 15% quarter over quarter and up 37% year over year. The majority of the revenues were generated by the compute and networking business segment, which included a nearly 50% sequential jump in HBM as well as growth in high-capacity DRAM.

Management believes that revenues also increased in the fiscal fourth quarter and expects total sales of $10.7 billion, a 38% rise year over year. Meanwhile, Micron’s earnings per share (EPS) for the third quarter were $1.91, a significant 208% increase from the previous year. However, the company anticipates EPS to improve further in the fiscal fourth quarter and reach $2.50, representing a 112% increase from the same period last year, citing investors.micron.com.

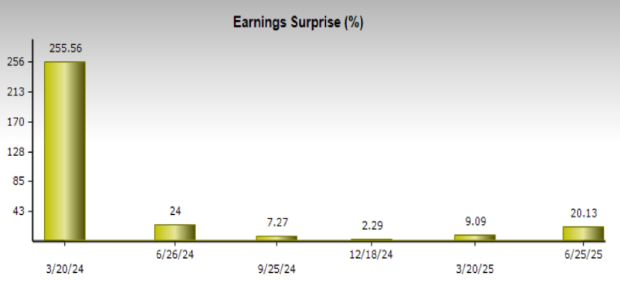

Management expects low inventory and significant demand for products to help the company improve pricing and strengthen product mix, thereby increasing revenues and operating margins in the fiscal fourth quarter. Additionally, on average, Micron’s trailing four-quarter earnings surprise is a positive 9.7%, signifying that the stock may deliver fiscal fourth-quarter growth.

Image Source: Zacks Investment Research

Tech behemoths have increased their capital expenditure (capex) on infrastructure to fulfill the growing demand for artificial intelligence (AI). This year, Alphabet Inc. GOOGL and Meta Platforms, Inc. META are expected to increase their capex on AI infrastructure from $75 billion to $85 billion, and from $64 billion to $66 billion, respectively. Amazon.com, Inc.’s AMZN capex, on the other hand, could top $118 billion in 2025.

Since NVIDIA Corporation’s NVDA graphics processing units (GPUs) are the most sought-after chips for AI workloads, the company is likely to capture a major share of the related spending. This should benefit Micron, as NVIDIA equips its GPUs with Micron’s HBM. Notably, NVIDIA has selected Micron’s HBM3E for its cutting-edge Blackwell chips. Looking forward, Micron plans to launch its newer HBM4 solution by next year.

Interestingly, Micron also supplies HBM solutions to NVIDIA’s rival, Advanced Micro Devices, Inc. AMD. This means the demand for Micron’s HBM solutions is unlikely to be affected even if NVIDIA loses its competitive advantage. AMD uses Micron’s HBM3E in its current MI350 series GPUs, which directly competes with NVIDIA’s Blackwell chips.

Currently, several AI-enabled smartphones require substantial memory and storage capacity, an obligation that Micron is well-positioned to meet, potentially driving revenues higher for the company. Moreover, Micron’s plan to increase chip manufacturing in the United States should shield its business from the potential ongoing tariff complications.

Beyond a probable strong fiscal fourth quarter, increasing demand for HBM solutions in both GPUs and smartphones bodes well for Micron in the long term. Manufacturing its chips in the United States also offers downside protection. Hence, astute investors should capitalize on these positives and buy Micron stock.

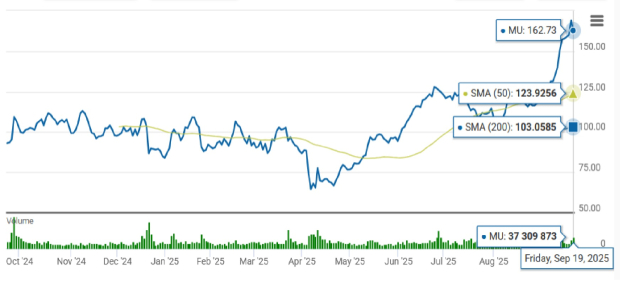

Technical chart patterns are also in favor of Micron. For instance, Micron’s shares are currently trading above both the short-term 50-day moving average (DMA) and the long-term 200 DMA, signaling an uptrend.

Image Source: Zacks Investment Research

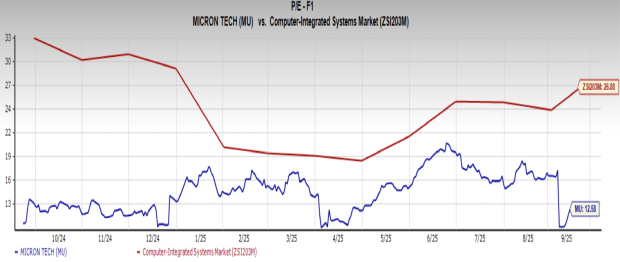

Additionally, investors can buy Micron at a more attractive valuation compared to its industry peers. Its forward price/earnings ratio is 12.58, lower than the Computer - Integrated Systems industry’s average of 26.88.

Image Source: Zacks Investment Research

Micron rightfully has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 min | |

| 12 min | |

| 21 min | |

| 24 min | |

| 29 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite