|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The quantum computing chip that Alphabet unveiled in December raised the bar in the space.

IonQ's unusual approach to quantum computing technology sets it apart from the competition.

Nvidia is bridging the gap between traditional and quantum computing.

Quantum computing stocks are starting to pick up steam again. After a summer largely spent moving sideways, many of the tech niche's pure plays have been putting up noteworthy gains in September. However, all of these stocks are still quite risky as investments, as there's no guarantee that their approaches to quantum computing will pan out commercially.

With that in mind, if you're looking to invest in quantum computing technology, I'd suggest taking a balanced approach, picking some established tech players that are pursuing it to extend their offerings as well as some pure plays that offer greater potential rewards to go with their higher risks. Adding these three companies to your portfolio would exemplify this balanced approach, and I think that, as a group, this trio will beat the market over the next five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

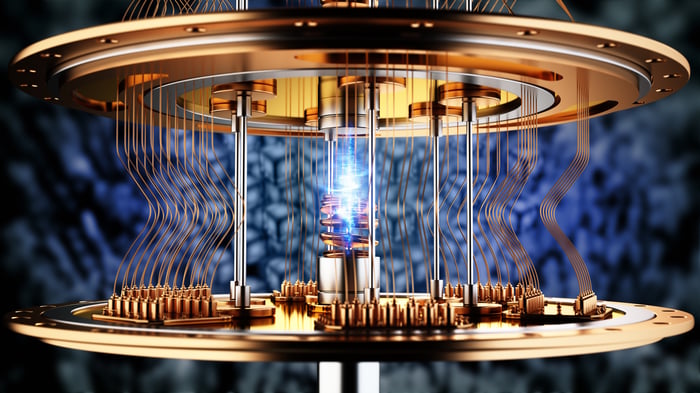

Image source: Getty Images.

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) may not be the most flashy quantum computing company on the market, but it is heavily investing in the technology. In December, Alphabet unveiled its Willow quantum computing chip, touting its impressive early achievements. That helped kick off a massive investment rush in the quantum computing sector.

If Alphabet can develop a commercially viable quantum computing approach, it could have significant implications for its business. Right now, when Alphabet needs more processing power to support its internal artificial intelligence models or to rent out via its cloud computing arm, it must buy enormous quantities of chips from companies like Nvidia (NASDAQ: NVDA). This is quite expensive, and a large fraction of the money Alphabet pays for this hardware is the sellers' profit.

If Alphabet can develop a viable quantum computer in-house to boost its AI capabilities and rent out via Google Cloud, its profit margins will soar. Most companies that choose to make use of quantum computing will likely access it primarily via a cloud service, likely through a hybrid approach that combines traditional computing methods with quantum technology. In addition to boosting Alphabet's own margins, if it can bring commercially viable quantum computing to the masses, it could attain first-mover advantage and win numerous contracts to run workloads on its servers.

However, even if Alphabet's quantum computing technology flops, it will still have its dominant digital ad business to fall back on. This makes Alphabet a much safer investment in the quantum computing industry, at least compared to some of the start-ups.

IonQ (NYSE: IONQ) isn't a safe stock. It must achieve relevancy with its quantum computing product, or the stock could go to $0. That's a huge amount of risk, but the stock also has immense upside potential if its technology pans out.

IonQ is taking a different approach to quantum computing than most of its competition. Its trapped ion technology trades speed for accuracy. Currently, IonQ's quantum computers hold the world record for one-qubit (99.999%) and two-qubit (99.97%) gate fidelity. This is a common metric that quantum computing companies use to measure the number of errors their machines make in the course of processing data. If it can deliver the most accurate technology, IonQ may be able to carve out a durable niche for itself before others can bring rival products to market.

Time will tell if IonQ will be a successful quantum computing investment, but it's taking an unusual approach that offers massive advantages, so I like its chances.

Nvidia (NASDAQ: NVDA) may not seem like a quantum computing investment at first glance. It's largely focused on traditional computing with its high-end graphics processing units (GPUs). However, Nvidia isn't blind to the future and is working on facilitating a hybrid computing approach. That will likely be how most quantum computers are eventually deployed.

When the AI trend kicked off, many onlookers focused on the fact that Nvidia had the best hardware to support AI workloads. But a less obvious advantage for the company was that its software platform for programming its chips was undoubtedly the best available, too. The popularity of its CUDA platform with developers helped Nvidia to capture massive market share in the AI processor space -- a lead that it has maintained to this day. Now, with quantum computing on the horizon, Nvidia has adopted its platform with a version designed for quantum computing: CUDA-Q.

By offering a version of its already popular software that helps developers integrate quantum computers into their existing infrastructure, Nvidia will secure its place in another major computing trend. Furthermore, there's still huge demand for AI processing power, so Nvidia will likely remain a highly profitable company well into the future based on that alone. This makes Nvidia a great stock to buy and hold, as it bridges the gap between traditional and quantum computing methods. Even if its quantum computing efforts fail to deliver, its established strengths mean decreased risk for its shareholders.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,280!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,084,802!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

| 59 min | |

| 6 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite