|

|

|

|

|||||

|

|

Appaloosa Management’s David Tepper is a generational talent and one of the most successful investors of all time. Tepper has amassed a multi-billion-dollar fortune and accrued so much wealth that he was able to purchase the Carolina Panthers NFL team. How did Tepper become so wealthy? Tepper has made his fortune with an investing technique that bets against the crowd, takes high-conviction bets, and places large bets. For instance, in the fallout of the destruction of the Global Financial Crisis of 2008, Tepper bet big on beaten-down banks like Bank of America (BAC) in 2009, buying them when no one wanted them for pennies and selling them for multi-bag gains, leading to a $7 billion annual windfall for his fund.

In February, I wrote a piece titled "David Tepper’s Big Bets: China and AI" about Tepper’s newest, “all-in” high conviction bet: China. At the time, China had been recovering from one of the worst real estate collapses in history, a heavy-handed regulatory government, and a weak economy plagued with rampant inflation:

When I think of David Tepper’s success, I think of the quote “simplicity is the ultimate sophistication.” Unlike many prominent Wall Street firms, Tepper does not generate his returns through high-frequency trading or complex quant strategies. Instead, Tepper leverages a ‘first principles’ investing framework where he hyper-focuses on what might otherwise seem obvious to find high-probability, investment opportunities with asymmetric reward-to-risk.

David Tepper bought banks in 2009 for two simple, yet powerful reasons. Banks were criminally undervalued, and Tepper knew that the US government would not allow most major US banks to fail.

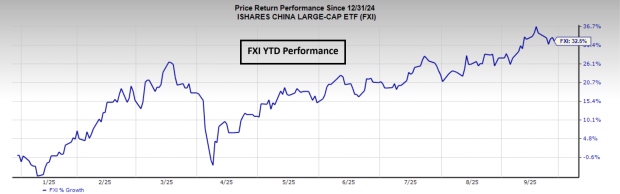

Fast-forward to February, and Tepper bought Chinese stocks for a similarly simple reason. Tepper realized that government officials in Beijing were intent on stimulating the market, saying, “When China wants to boost their stock market, the government will stop at nothing.” While it’s been a bumpy, headline-driven ride, the iShares China Large-Cap ETF (FXI) has gained a robust 35% year-to-date, again proving the power of straightforward thinking and high conviction bets.

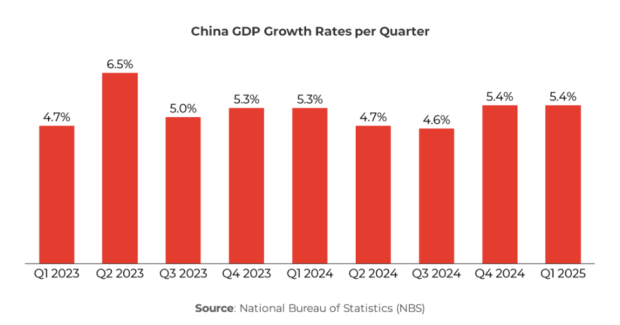

In the most wide-ranging action since the global financial crisis, the Chinese government continues to implement stimulus measures, like interest rate cuts, fiscal stimulus, and support for the real estate market. Remember, liquidity is the single most critical market-moving factor, and China currently enjoys a plethora of it. Additionally, the Chinese government has become more lenient with business regulations. Meanwhile, China is growing rapidly, with the first-half 2025 GDP growth clocking in at a robust 5.3%.

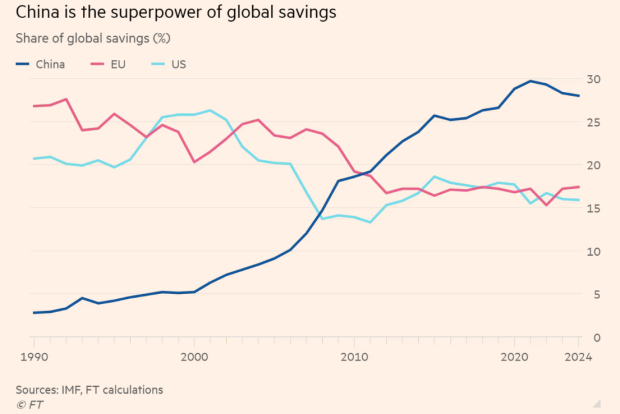

Stringent COVID-19 lockdowns and government-driven fear surrounding the virus have led to Chinese citizens saving a lot more money than most of the world. This excess savings should lead to a robust Chinese economy and a strong consumer.

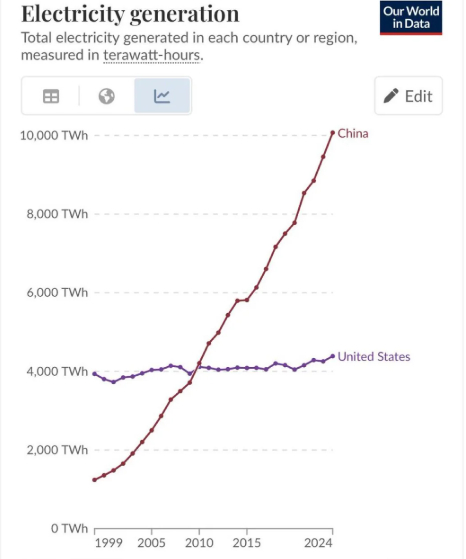

Although Wall Street thinks of the United States as the leader in the red-hot AI industry, China is hot on its heels and is leading the AI race in some critical areas. One such area is energy. AI training requires hundreds of energy-hungry data centers. Without sufficient energy, the AI race is lost. From this perspective, China is leading the AI energy race significantly. In fact, China produces more than twice the energy that the United States produces, and this gap is expected to widen over time.

Meanwhile, in a recent interview on the “All in Podcast,” former Google CEO Eric Schmidt pointed out that China is focusing more of its AI efforts on practical applications of AI (which will produce revenue) instead of aiming for artificial general intelligence (AGI) like many of America’s big tech juggernauts.

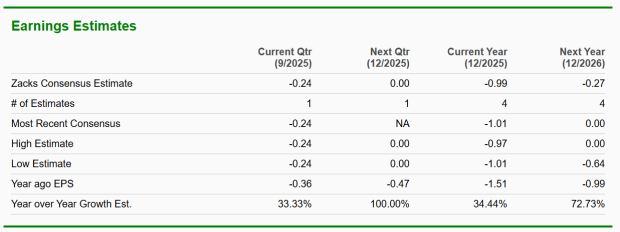

Wall Street analysts anticipate that Chinese companies such as Tencent Music (TME), Baidu (BIDU), and Nio (NIO) will generate robust earnings growth through 2026.

Despite significant price advances in 2025, Chinese tech juggernauts like Alibaba (BABA) remain cheap.

Bottom Line

David Tepper’s latest success with his China trade is a testament to his consistent, ‘first principles’ investment philosophy: bet against the crowd, focus on simple yet powerful fundamentals, and exude extreme conviction.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

BAC

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite